It has been a rough week in most markets with both equities and bonds declining sharply. Tech stocks have been pummeled with many ‘big names’ plunging more than 50% (from their 52-week high). Some of the bigger names include Zoom Video -75%, PayPal -73%, Netflix -72%, Meta Platforms (Facebook), -53%. . The equity market decline is coupled with announced layoffs. Robinhood, the popular online trading platform, announced a 9% reduction in full-time staff this week for...

Read More »The Fed Has No Idea What’s Coming Next!

We will let you know what we are doing once we know what we are doing was the message from the Federal Reserve statement and Chair Powell’s press conference that followed. The Fed, as widely expected did raise their short-term rate, known as the fed funds rate, by .25% to a range of 0.25% to 0.50%. This was the first increase since 2018. Along with the statement FOMC (Federal Open Market Committee) participants also released their Summary of Economic Projections....

Read More »Gold Gives You Personal Sovereignty

Dave Lukas of Misfit Entrepreneur invites Stephen Flood, CEO of GoldCore, to the show. Dave and Stephen talk about what people should know before investing in gold and silver, the present state of inflation, central banking, and the monetary system. Further, he explains why gold is still your safe-haven asset and how it provides you with personal sovereignty. They also talk about cryptocurrencies and their future. Stephen also discusses some of the lessons he’s...

Read More »The Black Friday Stock Market Crash – Gareth Soloway

Black Friday 2021 saw the largest stock market sell-off since 1931. Is this the start of a bigger crash, has the trend changed or is this just a one-time blip? We ask Gareth Soloway of InTheMoneyStocks.com what his charts are suggesting and why he is so bullish on gold [embedded content] Make sure you don’t miss a single episode… Subscribe to our YouTube channel [embedded content] You Might Also Like...

Read More »U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There

U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There US Treasury Secretary Steve Mnuchin visits Fort Knox Gold Later tweeted ‘Glad gold is safe!’ Only the third Treasury Secretary to visit the fortified vault, last visit was 1948 Last Congressional visit was 1974 Speculation over existence of gold in Fort Knox is rife Concerns over Federal Reserves lack of interest in carrying to an audit on gold Gold was last counted in 1953, nine years before Mnuchin was born Mnuchin may be...

Read More »“Time To Position In Gold Is Right Now” – Rickards

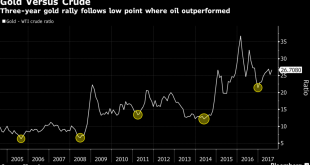

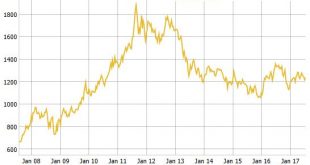

“Time To Position In Gold Is Right Now” – Rickards - "Time to position in gold is right now” - James Rickards- Fed has hit the ‘pause’ button; No more rate hikes for foreseeable future- Fed’s theories "bear no relation to reality" and has "blundered by raising rates"- Growth is weak, inflation is weak, retail sales and real incomes are weak- Tight money, weak economy & stock bubble classic recipe for market crash- Reduce allocations to stocks and reallocate to...

Read More »Sornette’s Supercomputer Is Betting On A Market Crash

Via FinancialSense.com, One of the world's most powerful supercomputers, retrofitted for trading the stock market, appears to be betting on a crash in the months ahead. The Financial Crisis Observatory (FCO) at ETH Zurich released its latest Global Bubble Status Report on July 1st. As we discussed with FCO’s director, Didier Sornette, on our podcast in May, they use one of the world’s leading supercomputers to monitor global markets each day for two distinct bubble-like...

Read More »“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

Authored by Kevin Muir via The Macro Tourist blog, After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side,...

Read More »Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

The following article by David Haggith was first published on The Great Recession Blog: We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a...

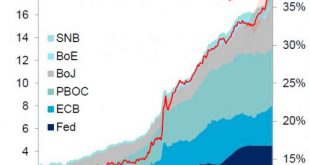

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org