James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

Authored by Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels and...

Read More »For The First Time Ever, The “1%” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank’s infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past year, suggests that the lower...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

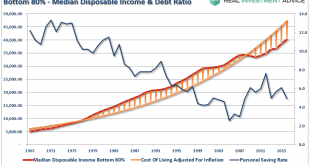

Read More »The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth. What’s not to love? I just have one question. If things are so good, then why is America’s saving rate posting such a sharp decline? The answer is not...

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

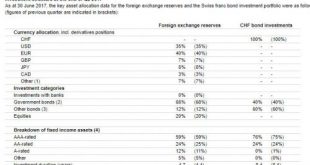

Read More »Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and “other bonds”, at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable –...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org