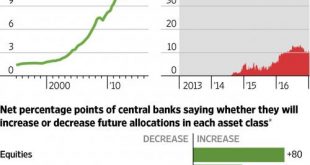

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

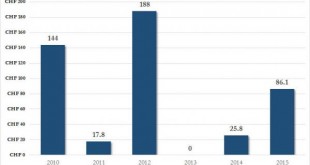

Read More »Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woefully investments in Valeant and the spike in its buying of AAPL stock at its all time high. But while the SNB's stock holdings are updated every quarter courtesy of its informative SEC-filed 13F (we wish the Fed would also disclose the equities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org