Overview: The markets are calmer after yesterday's post-US election drama. A consolidative tone has emerged in the foreign exchange market, and the dollar is softer against all the G10 currencies, led the 1% gain in the Norwegian krone, after the central bank left rates on hold. Sweden's Riksbank delivered the expected half-point cut and the krona is up 0.5%. Japanese officials warned against excessive moves, and the PBOC set the dollar's reference rate almost 1%...

Read More »Macro: Tell Us Something We Don’t Already Know

As September winds down, three sets of economic reports will draw the most attention. We will review them and then offer a snapshot of the emerging market central bank meetings. As we have seen in the UK and Norway, several emerging market countries raised rates early (beginning in the middle of last year) but still experienced an acceleration of inflation. It obviously begs the unanswerable question about the impact on US inflation if the Fed had taken its foot off...

Read More »FX Daily, October 11: Rate Expectation Adjustment Continues

Swiss Franc The Euro has fallen by 0.07% to 1.0717 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are softer and yields higher to start the new week. The dollar is mixed. Oil and industrial metals are higher. There are several developments over the weekend, but the focus seems to be on central bank action, inflation reports by the US and China, and the start of the Q3...

Read More »What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%. Taiwan got tagged for 2%, and Japan's Topix was off 1%. Hong Kong and South Korean markets were closed. Europe's Dow Jones Stoxx 600 is firmer for the second day but is still lower for the week. US indices...

Read More »FX Daily, June 22: Turn Around Tuesday or Dollar Rally Resumes?

Swiss Franc The Euro has risen by 0.10% to 1.0944 EUR/CHF and USD/CHF, June 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Firming long-term US yields have lent the dollar support after trading heavily yesterday. The greenback is around 0.15%-0.50% higher against the major currencies. The Japanese yen and Canadian dollar are among the more resilient, and the Australian dollar and sterling among the...

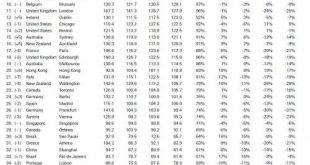

Read More »These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive – and in this year’s edition, best – cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of “cheap dates” in the world’s top cities. The index consists of...

Read More »These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive - and in this year's edition, best - cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of "cheap dates" in the world's top cities. The index consists of i) cab rides, ii) dinner/lunch for two at a pub or diner, iii) soft...

Read More »End of EUR/CZK peg: Czech National Bank

The Czech National Bank (CNB) ended the EUR/CZK floor today. Timing was a little earlier than expected, but rising inflation and a robust economy warranted it. We think it’s too soon to talk about a rate hike, as we expect the koruna to overshoot to the strong side. Policy Outlook Price pressures are rising, with CPI accelerating to 2.5% y/y in February. March data will be reported April 10, with consensus at 2.6%...

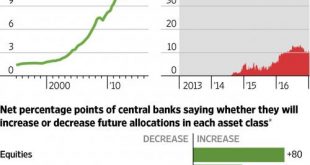

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Will The ECB Buy Stocks?

Authored by Nick Kounis and Kim Liu via ABN AMRO, Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility We think the ECB could legally buy ETFs that fit its requirements… … but it would be controversial and we question the benefits An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme …and assuming a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org