Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank’s infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past year, suggests that the lower...

Read More »Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

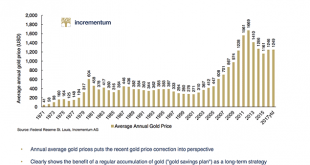

by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of some of the best...

Read More »Accelerating Child Literacy with New Libraries

Helman Sitohang, CEO Asia Pacific, was presented with the Friends of Global Literacy Award by John Wood, founder of the non-profit organization Room to Read at its annual gala event in Singapore. Room to Read, an NGO focused on children's literacy and girls' education, firmly believes that "world...

Read More »“I’m making Asia smaller”

Cautious First Steps in Further Development of Financial Markets

Asian countries have high savings rates, but investments are predominantly short-term. However, they have embarked on the path to longer investment horizons and deeper capital market integration. Asia's investment needs are enormous and will likely continue to grow over the coming years....

Read More »Pioneers of Swiss Trade: How to Do Business Successfully in Asia

Despite all of the differences and current challenges, Asian expansion is worthwhile – now more than ever. There is no question that Asia will play a prominent role in the 21st century. In 1863, it took Switzerland's Caspar Brennwald a full 122 days, or four months, to travel to Japan. Brennwald,...

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

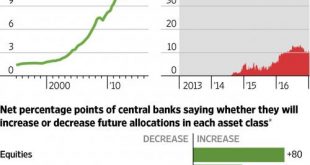

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past few months suggests that the lower ‘levels’...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org