Summary: Numerous events converge in the middle of March. We still lean toward a May hike rate than March. Wilders may garner a plurality of the vote in the Netherlands, but is unlikely to form a government for want of coalition partners. How will the Republican US Congress and President deal with the debt ceiling? T.S. Eliot tells us that April is the cruelest month. A great poet he was, but a trader he was...

Read More »Some Notes On GDP Past And Present

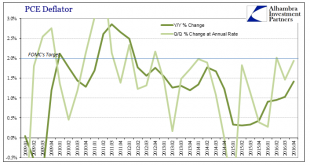

The second estimate for GDP was so similar to the first as to be in all likelihood statistically insignificant. The preliminary estimate for real GDP was given as $16,804.8 billion. The updated figure is now $16,804.1 billion. In nominal terms there was more variation, where the preliminary estimate of $18,860.8 billion is now replaced by one for $18,855.5 billion. Therefore, to net out with no change in real terms a...

Read More »Bank drops plan to loosen Swiss mortgage restrictions

Source: Raiffeisen - Click to enlarge The bank Raiffeisen has dropped its attempt to reduce minimum deposit requirements for home loans, according to RTS. Last autumn, it unveiled plans to reduce loan deposit requirements. However, last week, the bank announced that FINMA, Switzerland’s financial regulator, was opposed to the idea. FINMA sets guidelines for mortgage lending in Switzerland which banks follow. Anyone...

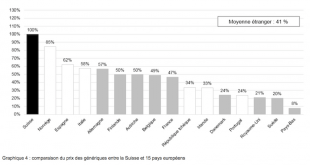

Read More »Swiss drug prices more than double european average – “Mr Price” takes aim

Switzerland’s public price watchdog chief, Stefan Meierhans, also know as “Mr Price”, has taken aim at high Swiss drug prices. A report published last week shows prices of generic drugs are nearly 2.4 times more expensive in Switzerland compared to the average price across 15 european countries. Generic drugs in the Netherlands cost 8% of what they cost in Switzerland. Anyone arriving in Switzerland from the UK will be...

Read More »Art Market Bubble Bursting? Gauguin Priced At $85 Million Collapses 74 percent

– Art Market Bubble Bursting?– Russian Billionaire Takes 74% Loss On “Investment”– $85 Million Gauguin Bought By Dmitry Rybolovlev in 2008– Christie’s auctioned the work at its evening sale in London– Global art sales plummet, but China rises as ‘art superpower’– China soon to dominates global art and gold market– Art price volumes doubled since 2009– As currencies debase super rich seek out stores of value– Gold...

Read More »FX Daily, February 28: Markets Little Changed as Breakout is Awaited

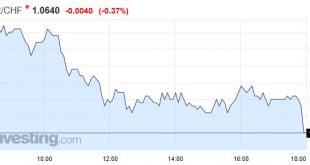

Swiss Franc EUR/CHF - Euro Swiss Franc, February 28(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF GBH CHF continues to see a volatile period with the general global uncertainty which has seen investors favour the safe haven currency. GBP CHF currently sits at 1.25 for this pair and there is resistance at these levels which is preventing the pound from driving higher. Brexit is now...

Read More »The Misplaced Animosity toward Imports

Summary: Pity imports, they are misunderstood. Imports create jobs directly and indirectly. Restricting US imports would likely also curb exports. The mercantilist inclination by the Trump Administration makes it seem as if exports are good and create jobs and imports are bad and cost jobs. This is simply not true. This assessment is not based on newfangled thinking about trade. Rather Adam Smith argued...

Read More »The Gold-Silver Ratio Curiously Failed to Fall – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Gold Scarcity Intensifies Further Last week (a holiday-shortened week, as Monday was President’s Day in the US), the price of the dollar fell. In gold, it fell almost half a milligram to 24.75mg, and prices in silver it dropped 30mg, to 1.7 grams of the white monetary metal. Looks good… and since last week, costs...

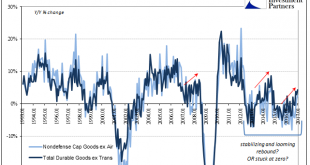

Read More »Durable Goods Groundhog

If the economy is repeating the after-effects of the latest “dollar” events, and it does seem more and more to be that case, then analysis starts with identifying a range for where it might be in the repetition. New orders for durable goods (ex transportation) rose 4.3% year-over-year in January 2017 (NSA, only 2.4% SA), the highest growth rate since September 2014 (though not meaningfully faster than the 3.9% rate in...

Read More »Virtue-Signaling the Decline of the Empire

Virtue-signaling doesn’t signal virtue–it signals decline and collapse. There are many reasons why Imperial Rome declined, but two primary causes that get relatively little attention are moral decay and soaring wealth inequality. The two are of course intimately connected: once the morals of the ruling Elites degrade, the status quo seeks to mask its self-serving rot behind high-minded “virtue-signaling” appeals to...

Read More » SNB & CHF

SNB & CHF