“Trade Cheaters” It is worse than “voodoo economics,” says former Treasury Secretary Larry Summers. It is the “economic equivalent of creationism.” Wait a minute – Larry Summers is wrong about almost everything. Could he be right about this? Summers is referring to the paper written by two members of Trump’s trade team: his pick for secretary of commerce, billionaire investor Wilbur Ross, and the director of Trump’s...

Read More »Dear Self-Proclaimed “Progressives”: as Apologists for the Neocon-Neoliberal Empire, You Are as Evil as the Empire You’ve Enabled

Sorry, pal, you’re evil. Self-righteous indignation counts for nothing in the strict accounting of real progressivism. Dear Self-Proclaimed “Progressive”: I love you, man, but it has become necessary to intervene in your self-destruction. Your ideological blinders and apologies for the Establishment’s Neocon-Neoliberal Empire are not just destroying your credibility, they’re destroying the nation and everywhere the...

Read More »The Difference of an A and BBB for Italy

Summary: DBRS cut Italy’s rating to BBB from A. It will increase the haircut on Italy’s sovereign bonds used for collateral by Italian banks. It is not a mortal blow or a significant hit, but is not helpful, except to add pressure on Italy and further reduce its ability to respond to another shock. The ECB takes the best credit rating of four agencies to set the haircut on collateral provided by banks for loans....

Read More »Emerging Markets: What has Changed

Summary China’s government has asked banks to balance their yuan inflows and outflows. Indonesia partially lifted a ban on exports of nickel ore and bauxite. Czech President Zeman picked two new central bankers as the end of the koruna cap looms. Turkish central bank is taking limited measures to support the lira. Turkey’s parliament voted 338-134 to discuss proposed constitutional changes that would increase the power...

Read More »Trump’s Plan to Close the Trade Deficit with China

Rags to Riches Jack Ma is an amiable fellow. Back in 1994, while visiting the United States he decided to give that newfangled internet thing a whirl. At a moment of peak inspiration, he executed his first search engine request by typing in the word beer. The search results had such a profound impact on Ma that he returned home to China and immediately started his first internet business. After several tries he hit...

Read More »What’s Truly Progressive?

What’s progressive? Pushing power, agency, skills, capital and solutions down to the individual, household, community, enterprise, town and city levels and focusing on doing more with much less. We know what fake-Progressives support: neocon-neoliberal policies and narratives that enable elite privilege, power and Imperial pretensions. So what’s truly progressive? We can start with four things: 1. Focus on developing...

Read More »How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract: The removal of the floor led to extreme price moves in the forwards market, similar to those...

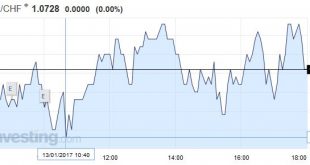

Read More »FX Daily, January 13: Corrective Forces Persist

Swiss Franc EUR/CHF - Euro Swiss Franc, January 13(see more posts on EUR/CHF, ) - Click to enlarge Supreme Court Judgement expected imminently The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have...

Read More »Saudis Cut More than Commitment, Lifts Prices

Summary: US refinery demand for oil is near a 30-year high. Demand growth will help catch up to supply. Saudi Arabia (and Kuwait) appear to have cut more output than promised. - Click to enlarge Oil prices rallied yesterday following the EIA weekly data and are up further today. Despite the rise in US inventories (4.1 mln barrels) more than four times greater than expected, participants focused on other details. ...

Read More »Regime Change: The Effect of Trump’s Victory on Stock Prices

A Soaring Market On January 20 2017 Donald Trump will be sworn in as the new president of the United States. On the stock market his victory has triggered a lot of advance cheer already: the Dow Jones Industrial Average rose by a sizable 7.80 percent between the election and the turn of the year. Many investors are now wondering what effect the change in government will have on stock prices in the new...

Read More » SNB & CHF

SNB & CHF