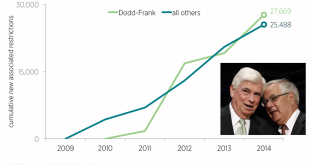

Debunking a Lie Don Watkins of the Ayn Rand Institute wrote an article, The Myth of Banking Deregulation, to debunk a lie. The lie is that bank regulation is good. That it helped stabilize the economy in the 1930’s. And that deregulation at the end of the century destabilized the economy and caused the crisis of 2008. As of early 2015, Dodd-Frank had imposed altogether 27,670 new restrictions, more than all other laws...

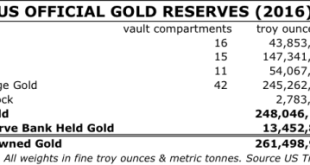

Read More »US Mint Releases New Fort Knox “Audit Documentation” The First Critical Observations.

In response to a FOIA request the US Mint has finally released reports drafted from 1993 through 2008 related to the physical audits of the US official gold reserves. However, the documents released are incomplete and reveal the audit procedures have not been executed proficiently. Moreover, because the Mint could not honor its promises in full the costs ($3,144.96 US dollars) of the FOIA request have been refunded....

Read More »Each Week the Same: Another SNB Intervention Record

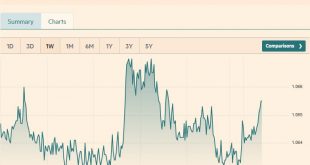

Headlines Week February 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand Speculators increase their dollar shorts against Euro and reduce them against CHF. FX week until February 27 The EUR/CHF fell to new lows. The average rate in the week was 1.0648. The SNB is apparently ready to let the...

Read More »Weekly Speculative Position: More EUR Shorts, Less CHF Shorts .. Again

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

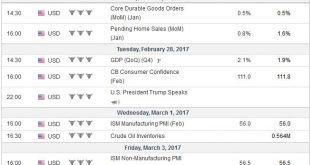

Read More »FX Weekly Preview: Macroeconomics and Psychology

United States There is a broad consensus around the macroeconomic picture. The headwinds slowing the US economy in H1 16 have eased, and above trend growth in H2 16 appears to be carrying into 2017. Q4 16 GDP is expected to be revised to 2.1% up from 1.8%. Many economists appear to accept that a good part, though not all, of the decline in the estimated trend growth in the US, is a function of demographic...

Read More »Emerging Markets: Preview of the Week Ahead

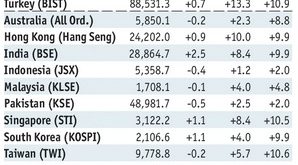

Stock Markets EM FX ended last week on a soft note despite lower US rates. The dollar regained some traction that it lost over the course of the week, when markets pushed out Fed tightening beyond March. Treasury Secretary Mnuchin also seemed to push out fiscal stimulus. There is a full slate of Fed speakers this week, and Wednesday sees the release of the Fed’s Beige book that was prepared for the March 15 FOMC...

Read More »Video: The Swiss National Bank Is Acting Like A Hedge Fund

By EconMatters In this Video, we discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy? Central Banks have really...

Read More »FX Weekly Review, February 20 – 25: Ranges in FX: Respect the Price Action

Swiss Franc Currency Index After a certain recovery in the last month, the Swiss Franc index lost ground again in this month. It is down one percent for this month, while the dollar index is up one percent. Trade-weighted index Swiss Franc, February 25(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the...

Read More »Gold Sector Update – What Stance is Appropriate?

The Technical Picture – a Comparison of Antecedents We wanted to post an update to our late December post on the gold sector for some time now (see “Gold – Ready to Spring Another Surprise?” for the details). Perhaps it was a good thing that some time has passed, as the current juncture seems particularly interesting. We received quite a few mails from friends and readers recently, expressing concern about the...

Read More »Farewell, Welfare State

Impossible Bills BALTIMORE – The tweet was never sent and never received: “Lying Otto von Bismarck set us up for bankruptcy! What was he thinking? Sad!!” Instead, Mr. Trump said last weekend that, far from trying to curb the promises and cut the costs of the welfare state, he was nearly ready to unveil a plan to replace Obamacare with something better: a plan that would provide “insurance for everybody.” The “iron...

Read More » SNB & CHF

SNB & CHF