See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Gold and Silver Divergence – Precious Metals Supply and Demand Last week, the prices of the metals went up, with the gold price rising every day and the silver price stalling out after rising 42 cents on Tuesday. The gold-silver ratio went up a bit this week, an unusual occurrence when prices are rising. Everyone knows that the price of silver is supposed to outperform — the way Pavlov’s Dogs know that food comes after the bell. Speculators usually make it so. This will be a brief Report this week, as we are busy working on something new and big. Stalin regarded Pavlov’s psychological theories as compatible with Marxism and “dialectic materialism”. Soviet psychologists who championed competing concepts were reportedly often declared insane and involuntarily committed to a booby hatch. Pavlov meanwhile kept a secret stash of silver bars under the table in his lab, which his dog had conditioned him to buy (see photographic evidence of this counter-revolutionary activity above). - Click to enlarge Fundamental Developments – Gold Scarcity Still Rising in Tandem with Prices Below, we will show the only true picture of the gold and silver supply and demand fundamentals.

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newslettersent, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

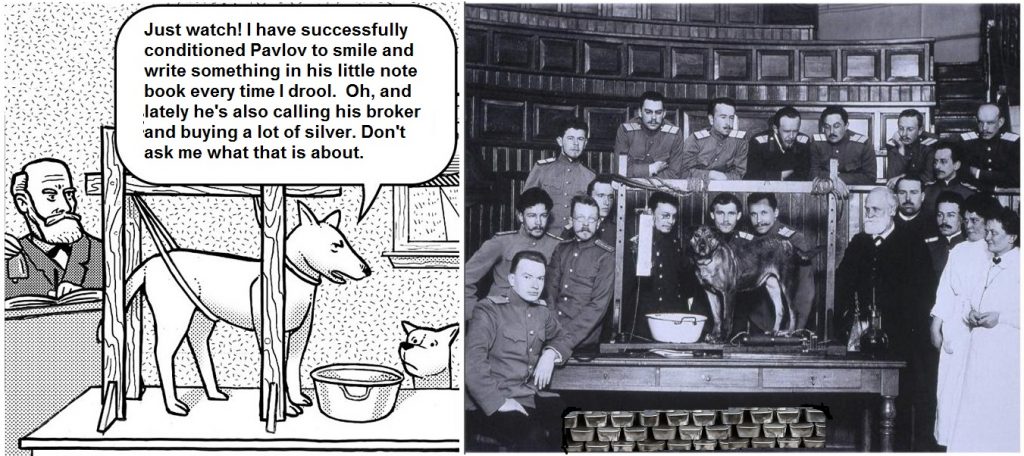

Gold and Silver Divergence – Precious Metals Supply and DemandLast week, the prices of the metals went up, with the gold price rising every day and the silver price stalling out after rising 42 cents on Tuesday. The gold-silver ratio went up a bit this week, an unusual occurrence when prices are rising. Everyone knows that the price of silver is supposed to outperform — the way Pavlov’s Dogs know that food comes after the bell. Speculators usually make it so. This will be a brief Report this week, as we are busy working on something new and big. |

Stalin regarded Pavlov’s psychological theories as compatible with Marxism and “dialectic materialism”. Soviet psychologists who championed competing concepts were reportedly often declared insane and involuntarily committed to a booby hatch. Pavlov meanwhile kept a secret stash of silver bars under the table in his lab, which his dog had conditioned him to buy (see photographic evidence of this counter-revolutionary activity above). - Click to enlarge |

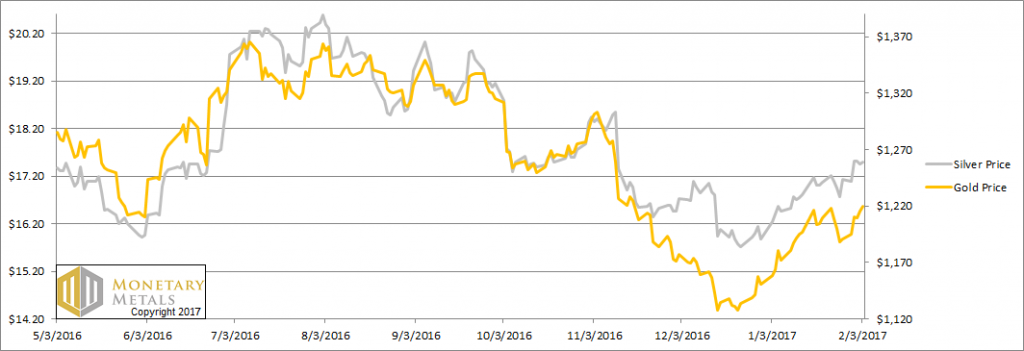

Fundamental Developments – Gold Scarcity Still Rising in Tandem with PricesBelow, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

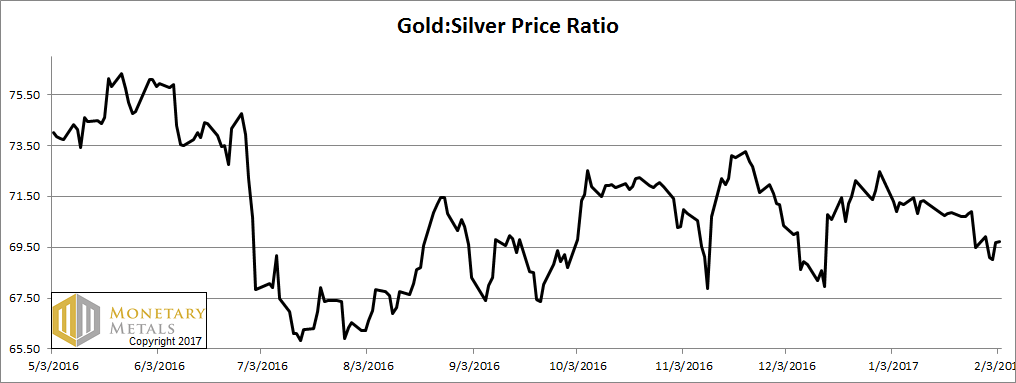

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose slightly this week.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

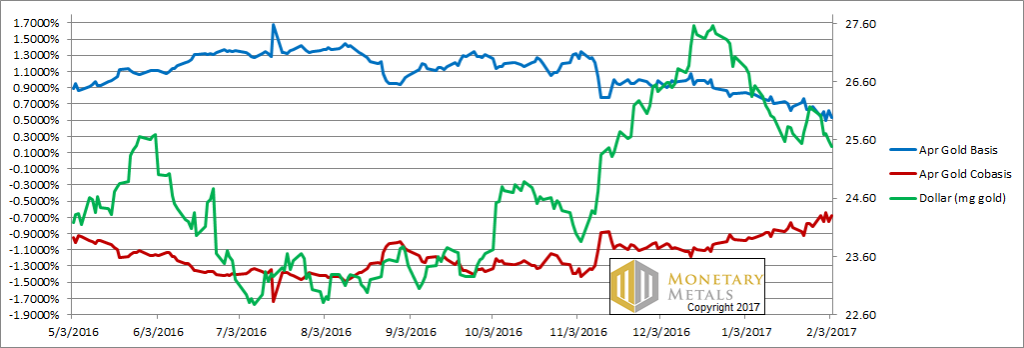

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph. Do we have rising price of gold, up $25 (i.e. falling dollar, from 26mg to 25.5mg gold)? Yes. Do we have rising scarcity of gold (i.e. the co-basis, our measure of scarcity)? Why yes, we do. This resumes the pattern that began the last week of December. The price of gold made a low of $1,127 (i.e. the dollar made a high of 27.6mg). Since then, the price of gold has been rising (i.e. the dollar has been falling) while the scarcity of gold has been rising. Not a lot. Not Defcon 5, gold is going to spike to $10,000 (i.e. the dollar is going to crash to 3mg gold). Not a big obvious crisis-type sort of move. Just a gradual move from -100bps to -68bps. What makes it significant is that it occurred while prices were rising. Gold is becoming scarcer as its price rises. So far, this move has been driven by buyers of physical metal. Our calculated fundamental price is up $40 to stay about $100 above the market price. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

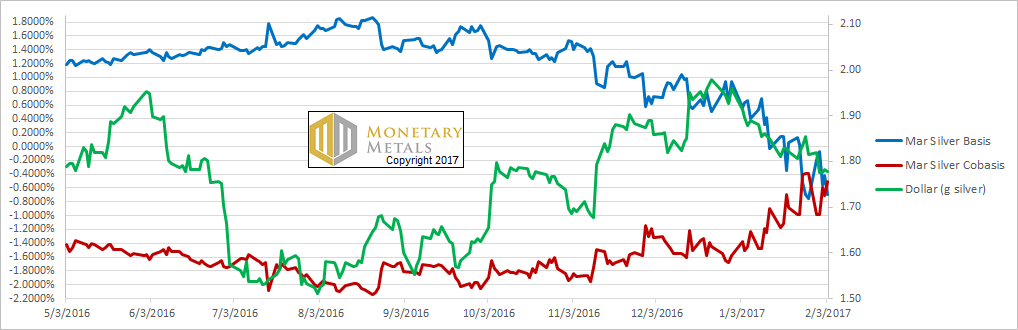

Silver Basis and Co-basis and The Dollar PriceNow let’s look at silver. In silver, there is quite a bit more volatility in the basis. And although the March co-basis is up, more distant contracts do not show the same move. Our calculated fundamental price did move up a bit, by 15 cents. However, it did not keep up with the market move. So now it is basically even with the market price. It turns out speculators did think that silver ought to outperform gold, and they tried. They caught up to and passed the buyers of physical metal. We note that in the futures market, open interest in gold turned down sharply starting last week. However, silver open interest diverged, and continued to skyrocket. |

Silver Basis and Co-basis and The Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Charts by: Monetary Metals

Image caption by PT

Tags: dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis,silver price