By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to buy outright assets without any formal authority, no checks and balances whatsoever, and have since destroyed the entire financial market system globally. In short, Financial Markets are broken, any sense of properly pricing risk has been completely removed from the market, as such, risk has been distorted to such a degree, the future ramifications for financial markets, and financial market participants is profound. Expect the VIX, to blow past the elevated levels that occurred during the financial crisis of 2008 in the 60 range, to well over 100, and even 200 is possible, maybe even 1,000. The Central Banks have no clue to what degree they have distorted financial asset prices, I can tell you my model stops at a 20 Sigma Event over the next decade.

Topics:

EconMatters considers the following as important: Asia Pacific, Bailout, Bond, Business, Business cycle, Central Banks, default, Economic bubbles, economy, European Union, Fail, Featured, Financial crises, Financial crisis, Financial crisis of 2007–2008, Great Recession, Market Crash, Market liquidity, newslettersent, Real estate, SNB, Swiss National Bank, Systemic risk, too big to fail, Twitter, VIX, Zerohedge on SNB

This could be interesting, too:

investrends.ch writes Schweizer Firmen ziehen wieder Investitionen aus dem Ausland ab

investrends.ch writes Die Zurückhaltung der SNB wird mehrheitlich begrüsst

investrends.ch writes Schweizer Inflation fällt etwas stärker als gedacht

investrends.ch writes SNB erzielt nach 9 Monaten einen Gewinn von 12,6 Milliarden Franken

By EconMatters

We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory!

We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to buy outright assets without any formal authority, no checks and balances whatsoever, and have since destroyed the entire financial market system globally.

In short, Financial Markets are broken, any sense of properly pricing risk has been completely removed from the market, as such, risk has been distorted to such a degree, the future ramifications for financial markets, and financial market participants is profound.

Expect the VIX, to blow past the elevated levels that occurred during the financial crisis of 2008 in the 60 range, to well over 100, and even 200 is possible, maybe even 1,000. The Central Banks have no clue to what degree they have distorted financial asset prices, I can tell you my model stops at a 20 Sigma Event over the next decade. I put the 20 sigma event as high as a 35% probability over the next 10 years, 35 percent, that is just how much asset price distortion has occurred in financial markets by more than 10 major Central Banks around the Financial System since the 2008 Financial Crisis, which was a bubble then.

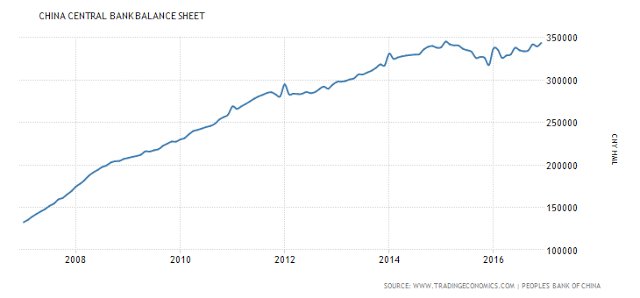

If we think of China`s massive credit bubble and real estate crash implications for the Asia Pacific Rim Region alone, or the complete dissolution of the European Union (remember the debt crisis of 2012) debt has gotten worse in the European Union since then, to the massive stock market and bond market bubbles in the United States one will start to realize that I am not being alarmist, but that this is a real possibility, and poses a substantial threat to the entire global financial system.

In essence to modern civilization as we know it. Central Banks are so worried about this potential Bubble popping, that they just are afraid to take any responsible action to try and reduce the impact of the ultimate asset unwind.

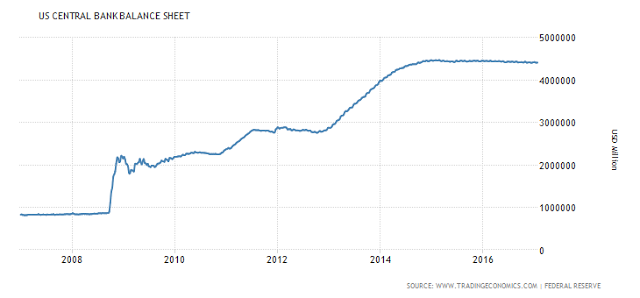

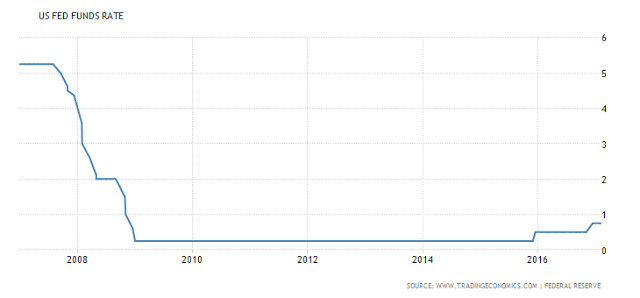

The problem with this strategy is that the bubble gets substantially bigger every additional month they wait to either raise interest rates, sell assets on their massive balance sheets, or withdraw additional liquidity from the market through other available monetary tools. Moreover, the subsequent risks become exponentially greater as well the more asset prices get distorted from previous historical norm valuation levels through never before attempted artificial Central Bank Balance Sheet Purchases.

We have now blown past Too Big To Fail Territory, risk is not able to be modeled correctly, there isn`t enough money in the system to cover the losses. Whether we are talking taxpayer bailout, gold reserves, currency devaluation, partial haircuts; there are no measures available to cover the losses on a 20 sigma risk event, let alone if the VIX goes to 1,000!

We are facing the massive unilateral complete global financial default that only the tin foil hat crowd has envisioned. How can a responsible Central Bank even let it get to this point where the Extremist Market Crash Scenario is a legitimate possibility, and something that now has to be modeled by financial market participants?

This is the reason we are starting to experience tail risk buying out there in various asset curves. I cannot believe Economists can be this stupid, irresponsible and absolutely ignorant of the risks now brewing to financial markets, and not be scurrying like hell to remedy these alarming financial system risks. Everywhere I look in Financial Markets there are giant massive asset bubbles, and just look below at the Central Bank policies as a group as to the reason why, and the real culprit for the next financial Armageddon. In short, Central Banks have set the entire financial system on a collision course with a Risk level that cannot be properly assessed, and through no formal powers authorizing them this Power.

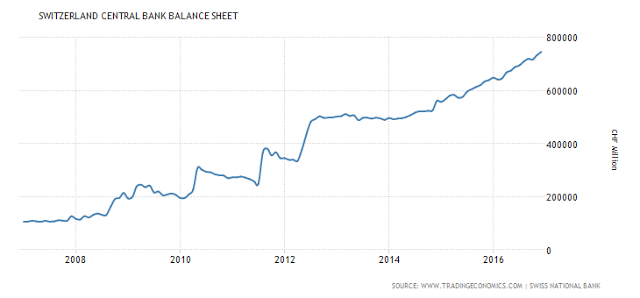

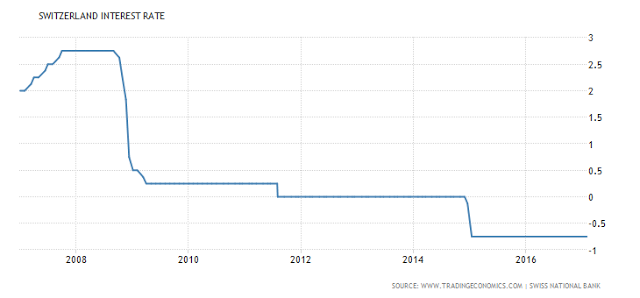

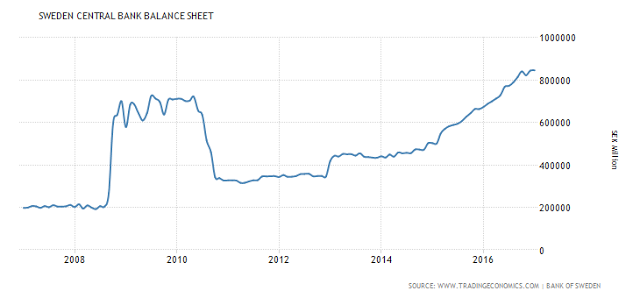

Just look at all those charts below by Central Banks, and tell me I am wrong to the risks facing the entire global financial system!

Switzerland |

Switzerland Central Bank Balance Sheet |

Switzerland Interest Rate |

|

Sweden |

Sweden Central Bank Balance Sheet |

Sweden Interest Rate |

|

China |

China Central Bank Balance Sheet |

China Interest Rate |

|

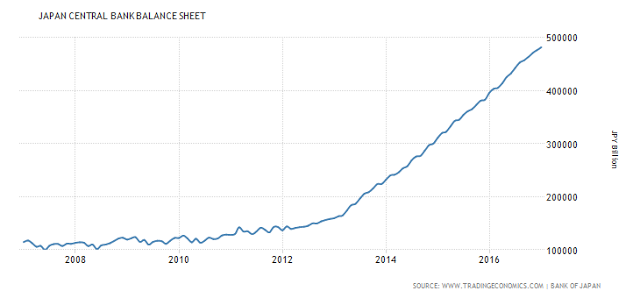

Japan |

Japan Central Bank Balance Sheet |

Japan Interest Rate |

|

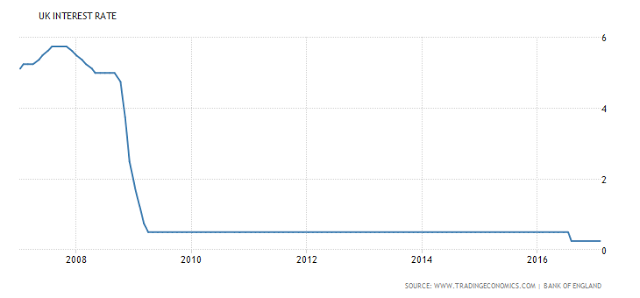

United Kingdom |

United Kingdom Central Bank Balance Sheet |

United Kingdom Interest Rate |

|

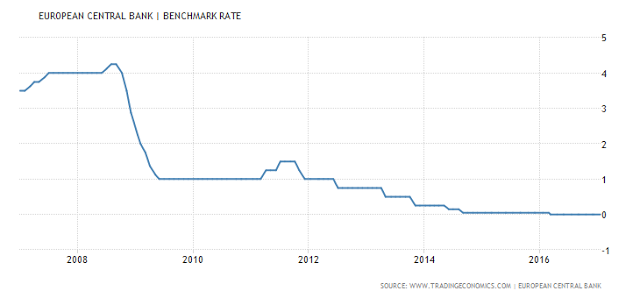

Europe |

Euro Area Central Bank Balance Sheet |

European Central Bank and Benchmark Rate |

|

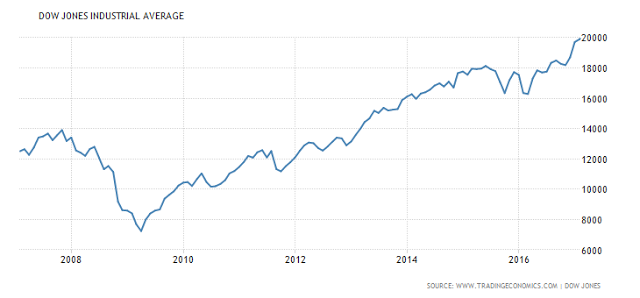

United States |

Dow Jones Industrial Average |

United States Central Bank Balance Sheet |

|

United States Interest Rate |

© EconMatters All Rights Reserved | Facebook | Twitter | YouTube | Email Digest | Kindle

Tags: Asia Pacific,Bailout,Bond,Business,Business Cycle,central banks,default,Economic bubbles,economy,European Union,Fail,Featured,Financial crises,Financial crisis,Financial crisis of 2007–2008,Great Recession,Market Crash,Market liquidity,newslettersent,Real Estate,Swiss National Bank,Systemic risk,Too Big To Fail,Twitter,VIX