[unable to retrieve full-text content]New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version.

Read More »Gold ETFs or Physical Gold? Dangers In Exchange Traded Funds

Gold ETFs or gold bars? Bars including one kilo gold bar at bullion dealers Goldcore, in London, U.K. (March 11, 2010). Photographer: Chris Ratcliffe/Bloomberg Considering the public’s waning trust in the banking system, many investors find themselves wondering how GLD stacks up to owning the real thing. When you look at both assets more closely, it’s clear that gold ETFs and gold bullion are very different...

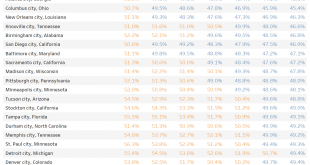

Read More »Renters Now Rule Half of U.S. Cities

The American Dream increasingly involves a lease, not a mortgage. [embedded content] Sam Zell Sees Surge in Supply of NYC Real Estate Detroit was once known as a city where a working-class family could afford to own a home. Now it’s a city of renters. Just 49 percent of Motor City households were homeowners in 2015, down from 55 percent in 2009 and the lowest percentage in more than 50 years. Detroit isn’t alone, of...

Read More »Emerging Markets: What has Changed

[unable to retrieve full-text content]Reserve Bank of India will introduce a new monetary policy tool. Moody’s raised the outlook on Russia’s Ba1 rating from stable to positive. Fitch cut Saudi Arabia’s rating a notch to A+. Moody’s cut the outlook on Turkey’s Ba1 rating from stable to negative. China has temporarily suspended beef imports from Brazil.

Read More »March to Default

Style Over Substance “May you live in interesting times,” says the ancient Chinese curse. No doubt about it, we live in interesting times. Hardly a day goes by that we’re not aghast and astounded by a series of grotesque caricatures of the world as at devolves towards vulgarity. Just this week, for instance, U.S. Representative Maxine Waters tweeted, “Get ready for impeachment.” [embedded content] Well, Maxine...

Read More »The Inverse of Keynes

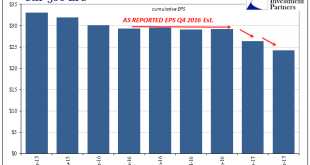

With nearly all of the S&P 500 companies having reported their Q4 numbers, we can safely claim that it was a very bad earnings season. It may seem incredulous to categorize the quarter that way given that EPS growth (as reported) was +29%, but even that rate tells us something significant about how there is, actually, a relationship between economy and at least corporate profits. Keynes famously said that we should...

Read More »Swiss balance of payments and international investment position: Current Account Surplus Up 22%

[unable to retrieve full-text content]Switzerland extended its current account and trade surplus in Q4/2016 by 22%, helped by strong interventions by the Swiss National Bank.

Read More »The real reason Swiss drugs are so expensive

24 Heures. In Switzerland, a 16-pack of 500mg Dafalgan Odis (Paracetamol) costs CHF 8.60. A comparable French product, Doliprane, costs 1.12 euros for a box of 12 tablets the same size. 12 tablets of 500 mg of Algifor (Ibuprofen) costs CHF 9.90 compared to 2.50 euros for a similar box of Advil in France. © Ginasanders | Dreamstime.com - Click to enlarge Another product, Nivea Baby Serum physiologique (24 x 5 ml), an...

Read More »Results of the new pensions statistics 2015: Large differences between genders and age groups in pillar 2 and 3a old-age benefits

Neuchâtel, 24.03.2017 (FSO) – In 2015 approximately 33,000 persons obtained an old-age pension for the first time from the occupational pension fund (2nd pillar), while some 41,000 persons received a lump-sum withdrawal from their 2nd pillar retirement savings. Men received far higher benefits from the 2nd pillar than women. Pensions obtained before the legal retirement age were on average the highest. These are some of...

Read More »FX Daily, March 24: Dollar Trying to Stabilize Ahead of the Weekend

Swiss Franc EUR/CHF - Euro Swiss Franc, March 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF With just a few days to go before Article 50 is triggered the currency markets are waiting with baited breath for what may happen to the value of the Pound against all major currencies including against the Swiss Franc. Yesterday we saw a brief respite for the Pound vs the Swiss Franc with the release of...

Read More » SNB & CHF

SNB & CHF