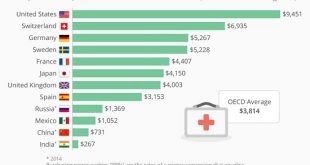

It’s time to start planning for what we’ll do when the current healthcare system implodes. As with many other complex, opaque systems in the U.S., only those toiling in the murky depths of the healthcare system know just how broken the entire system is. Only those dealing daily with the perverse incentives, the Kafkaesque procedures, the endlessly negative unintended consequences, the soul-deadening paper-shuffling, the...

Read More »FX Weekly Preview: After US Health Care, Now What?

United States The first quarter winds down. The dollar moved lower against all the major currencies. The best performer in the first three months of the year has been the Australian dollar’s whose 5.8% rally includes last week’s 1% drop. The worst performing major currency has been the Canadian dollar. It often underperforms in a weak US dollar environment. It’s almost 0.5.% gain is less than half the appreciation...

Read More »Emerging Markets: Week Ahead Preview

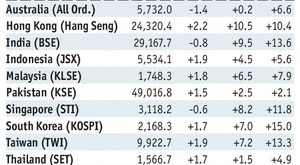

Stock Markets EM FX ended the week on a firm note. Indeed, virtually all of EM was up against the dollar last week, led by ZAR and MXN. BRL and PHP were the laggards. It remains to be seen how markets react to the failure to pass the health care reform in the US. Will Trump move on the tax reform? Can the Republicans proceed with its agenda in light of the fissures within the party? Stock Markets Emerging Markets,...

Read More »FX Weekly Review, March 20 – March 25: Dollar Bottom Near?

Swiss Franc Currency Index In the last week, the Swiss Franc index recovered and gained about 2%. The dollar index lost 1.5%, Trade-weighted index Swiss Franc, March 25(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the...

Read More »The Deep State’s Dominant Narratives and Authority Are Crumbling

This is why the Deep State is fracturing: its narratives no longer align with the evidence. As this chart from Google Trends illustrates, interest in the Deep State has increased dramatically in 2017. The term/topic has clearly moved from the specialist realm to the mainstream. I’ve been writing about the Deep State, and specifically, the fractures in the Deep State, for years. [embedded content] Amusingly, now that...

Read More »Gold ETFs or Physical Gold? Dangers In Exchange Traded Funds

Gold ETFs or gold bars? Bars including one kilo gold bar at bullion dealers Goldcore, in London, U.K. (March 11, 2010). Photographer: Chris Ratcliffe/Bloomberg Considering the public’s waning trust in the banking system, many investors find themselves wondering how GLD stacks up to owning the real thing. When you look at both assets more closely, it’s clear that gold ETFs and gold bullion are very different...

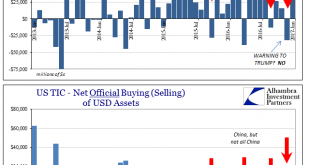

Read More »TIC Analysis of Selling

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke...

Read More »TIC Analysis of Selling

[unable to retrieve full-text content]When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of banana...

Read More »Central Bankers Are Creating A World Where We Are All Serfs: Charles Hugh Smith

Today's Guest: Charles Hugh Smith Websites: Of Two Minds http://www.oftwominds.com Books: Get a Job, Build a Real Career... http://www.amazon.com/gp/product/1497533406/ref=as_li_tl? Why Things Are Falling Apart and What We Can Do About It http://www.amazon.com/gp/product/1480219886/ref=as_li_tl? A Radically Beneficial World http://amzn.com/1517160960 Most of artwork that are included with these videos have been created by X22 Report and they are used as a representation of the subject...

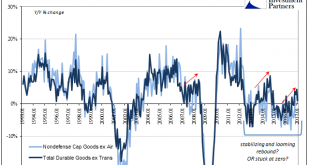

Read More »Durable Goods After Leap Year

New orders for durable goods (not including transportation orders) were up 1% year-over-year in February. That is less than the (revised) 4.4% growth in January, but as with all comparisons of February 2017 to February 2016 there will be some uncertainty surrounding the comparison to the leap year version. That would suggest that orders as well as shipments were somewhat better than they appear at least in in terms of...

Read More » SNB & CHF

SNB & CHF