China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been –...

Read More »Economics Through The Economics of Oil

The last time oil inventory grew at anywhere close to this pace was during each of the last two selloffs, the first in late 2014/early 2015 and the second following about a year after. Those events were relatively easy to explain in terms of both price and fundamentals, though the mainstream managed to screw it up anyway (“supply glut”). By and large, the massive contango of the futures curve that showed up as a result...

Read More »New calculation of SNB exchange rate indices

Change to a more comprehensive and up-to-date methodology The Swiss National Bank (SNB) is putting the Swiss franc exchange rate indices it calculates and publishes on a new footing. The adjustment allows the Swiss economy’s competitive and trading relationships to be replicated in a more comprehensive and up-to-date way. The new indices, too, show that the Swiss franc is significantly overvalued. The SNB exchange rate...

Read More »Status of US Pivot To Asia

Summary: Pivot still taking place, but without TPP, more militaristic. President Trump seems a little less confrontational toward China. China is unlikely to be cited as a currency manipulator in next month’s Treasury report. The Obama Administration tried restarting US-Russian relations with little success. The inability to secure the European flank weakened the pivot to Asia. The Trans-Pacific Partnership...

Read More »Peak Gold – Biggest Gold Story Not Being Reported

– Peak gold – Biggest gold story not being reported– Gold ‘Mining Zombie Apocalypse’ caused miners to slash exploration budgets– Decline in gold production at world’s top 10 gold mining companies – Byron King– “No new big mines being built in the world today” – Glencore CEO Glasenberg– Primary global gold output declined in 2016 – Thomson Reuters via Mining.com– 2016 was first year of fall in mine production since 2008–...

Read More »Peak Gold – Biggest Gold Story Not Being Reported

– Peak gold – Biggest gold story not being reported– Gold ‘Mining Zombie Apocalypse’ caused miners to slash exploration budgets– Decline in gold production at world’s top 10 gold mining companies – Byron King– “No new big mines being built in the world today” – Glencore CEO Glasenberg– Primary global gold output declined in 2016 – Thomson Reuters via Mining.com– 2016 was first year of fall in mine production since 2008–...

Read More »Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule. So much changed after that one day, a buying panic in the...

Read More »All In The Curves

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December. Thus, despite two rate...

Read More »Switzerland’s economic prospects remain positive

Economic forecasts by the Federal Government’s Expert Group – spring 2017*. Swiss economic growth turned out disappointingly weak in the second half of 2016. However, the leading indicators are pointing to a clear upward trend in early 2017 and the global economy is sending out positive signals. The Federal Government’s Expert Group is therefore expecting growth in gross domestic product (GDP) to accelerate to +1.6% in...

Read More »FX Daily, March 21: Euro Recovery Continues, Posts New Six Week High Other Currencies Mixed

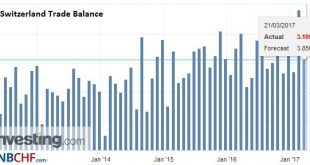

Swiss Franc Switzerland Trade Balance, February 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge GBP/CHF The Swiss Franc continues to remain incredibly strong as it maintains its status as a safe haven currency in these uncertain economic times globally. The Swiss National Bank quarterly bulletin is released tomorrow afternoon at 14pm which is produced by the...

Read More » SNB & CHF

SNB & CHF