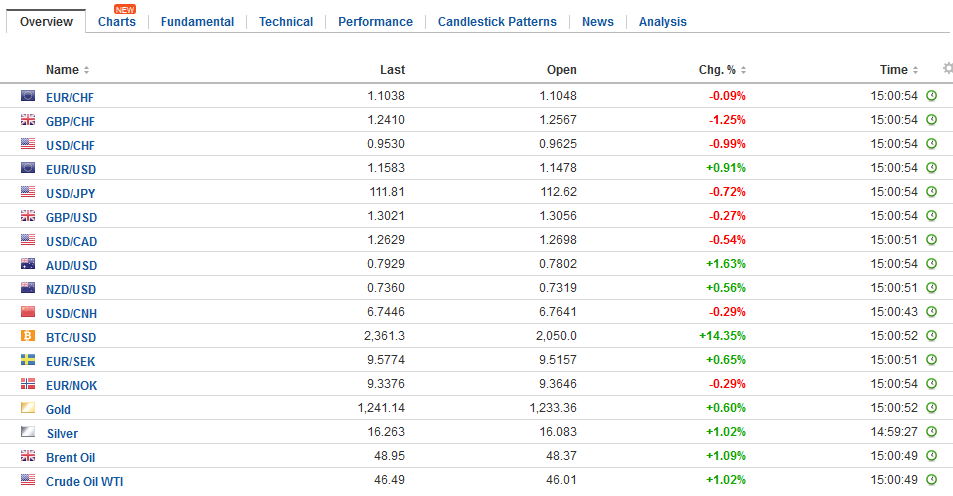

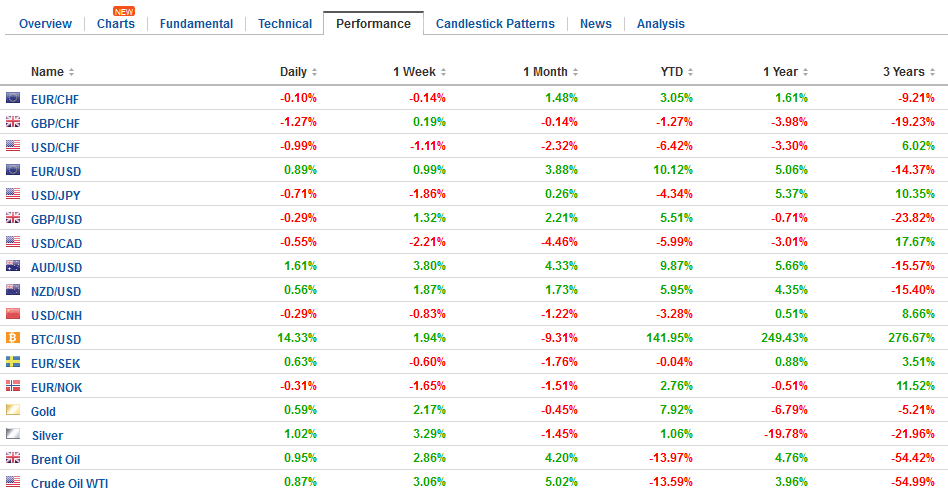

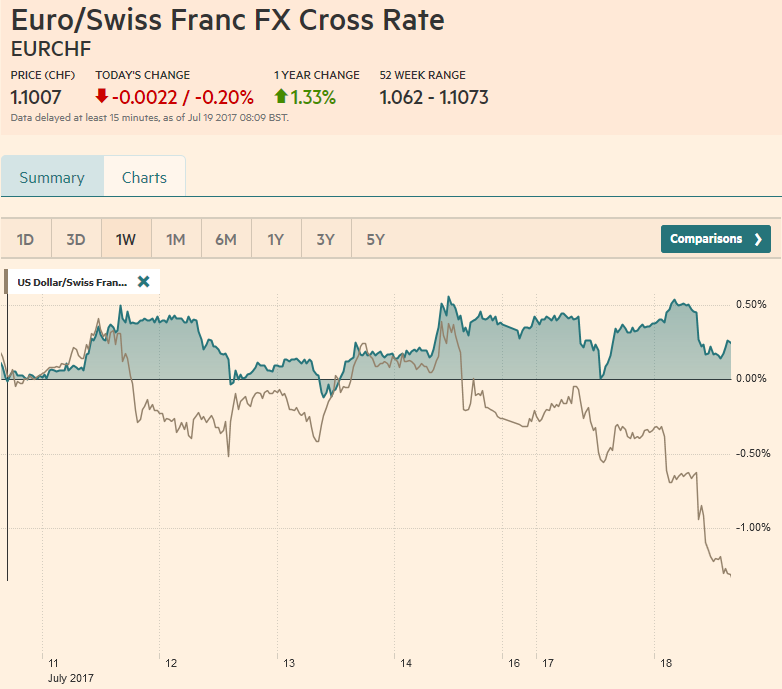

Swiss Franc The Euro has fallen by 0.20% to 1.1007 CHF. EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates News of the defection of two more Republican Senators doomed the Senate attempt to replace and repeal America’s national health care. The failure to replace the system dubbed Obamacare, despite the Republican majority in both legislative chambers and the executive branch raises questions about the broader strategy of the Administration and raises serious questions about the rest of its legislative agenda. The US dollar was already trending lower against most of the major currencies, and the losses had accelerated following disappointing

Topics:

Marc Chandler considers the following as important: AUD, EUR, Eurozone ZEW Economic Sentiment, Featured, FX Trends, Germany ZEW Economic Sentiment, JPY, newslettersent, U.K. Consumer Price Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.20% to 1.1007 CHF. |

EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesNews of the defection of two more Republican Senators doomed the Senate attempt to replace and repeal America’s national health care. The failure to replace the system dubbed Obamacare, despite the Republican majority in both legislative chambers and the executive branch raises questions about the broader strategy of the Administration and raises serious questions about the rest of its legislative agenda. The US dollar was already trending lower against most of the major currencies, and the losses had accelerated following disappointing news on retail sales and uninspiring CPI. News of the failure of the Senate’s effort saw the greenback take another leg lower in early Asia, for which it has not been able to recover. Sterling is the main exceptions. At $1.3025, it is off about 0.25% on the day. It had been participating in the broad move against the dollar, rising to new highs since last September (~$1.3125), until news of softer than expected UK inflation sent it down a little more than a cent. Judging from derivative prices, investors never took seriously the possibility of a rate hike at the next BOE meeting (August 3), but the softer CPI figures further reduced the perceived odds of a rate hike in H1 18. |

FX Daily Rates, July 18 |

| Sterling is posting a potential key reversal by making a new high for the move and then selling off through the previous day’s low. A close below that low (~$1.3050) would complete the one-day reversal and point to losses that could carry sterling toward $1.2930 initially. Resistance in the North American session will likely be encountered in the $1.3050-$1.3060 area. There is a $1.3050 option strike for nearly GBP220 mln that expires today.

The euro took a step higher, through $1.1500 and toward $1.1540 on news from the US Senate. It then consolidated before taking another leg higher late in the European morning that carried it to nearly $1.1560. The next immediate target is $1.1615, last year’s high, and then the August 2015 high near $1.1715. For the record, the upper Bollinger Band is found near $1.1585 today. |

FX Performance, July 18 |

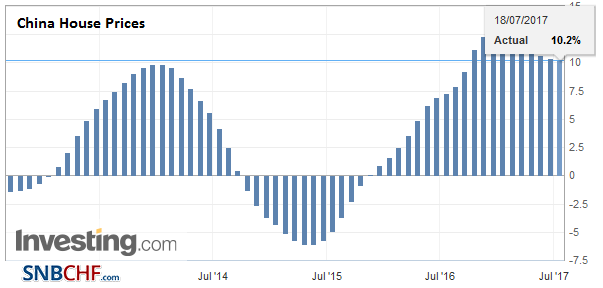

ChinaThe fall in yields is helping the yen recover. Recall that from around the middle of June (the day of the FOMC meeting) to almost the middle of the July, the dollar rose 5.25% against the yen to reached nearly JPY114.50 a week ago. Today the greenback traded at its lowest level since July 3 at JPY112.00. The JPY111.65 is the 50% retracement of the recent advance and JPY111 is the 61.8% retracement. There are $850 mln options struck at JPY112.25 that expire today can influence the price action. |

China House Prices YoY, June 2017(see more posts on China House Prices, ) Source: Investing.com - Click to enlarge |

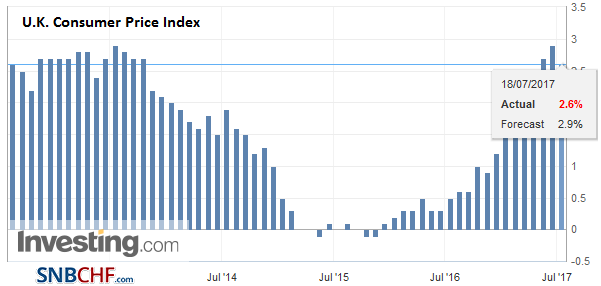

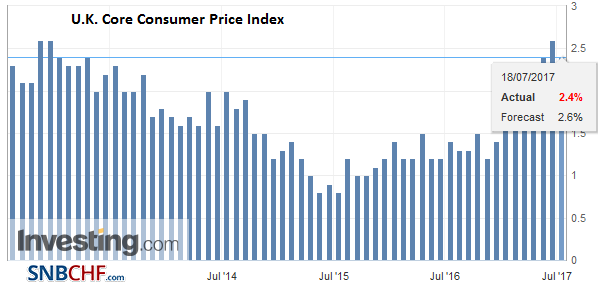

United KingdomUK consumer prices were flat in June, and this saw the year-over-year rate slow to 2.6% from 2.9%. Most expected an unchanged pace. The BOE’s new preferred measure, CPIH eased to 2.6% from 2.7%. Core inflation slowed to 2.4% from 2.6%. It is the first drop in the year-over-year headline rate since last October. While we suspect that the UK price pressures are near a peak, we wonder if today’s data is exaggerated by seasonal developments. In particular, we note that clothing and footwear prices fell 1.0%. This looks like summer discounting. |

U.K. Consumer Price Index (CPI) YoY, June 2017(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| While sterling is the weakest of the majors, the Australian dollar is the strongest, gaining 1.6% on the back of the weaker US dollar, a 5.7% surge in iron ore prices (highest since early May), and minutes from the RBA meeting whose overall tone was optimistic on the economy and wages. The Australian dollar is at two-year highs and is racing toward $0.8000 and the 2015 high near $0.8165. A note of caution comes from the fact that the surge in the Australian dollar has pushed it above its upper Bollinger Band (two standard deviations above the 20-day moving average) found near $0.7855). Indeed the Aussie is closer to three standard deviations above the 20-day moving average (~$0.7955). |

U.K. Core Consumer Price Index (CPI) YoY, June 2017(see more posts on U.K. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

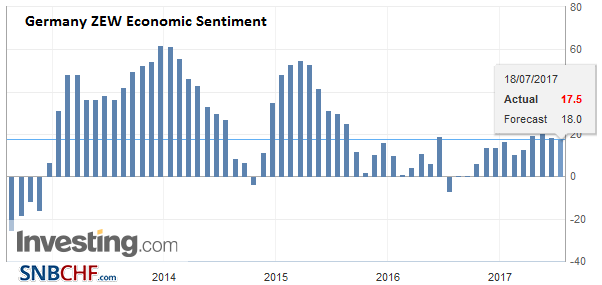

GermanyNews that Germany’s ZEW survey weakened more than expected in July has been lost in the US dollar drop. The investor sentiment survey is not often a market mover, but today’s response was barely noticeable. The assessment of the current situation eased to 86.4 from 88.0, which is still highly elevated. The expectations component eased to 17.5 from 18.6. It is the second consecutive decline, something not seen since the start of last year. |

Germany ZEW Economic Sentiment, July 2017(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

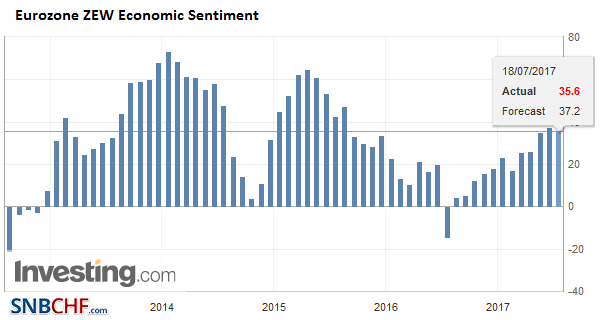

EurozoneAhead of Thursday’s ECB meeting, where Draghi is expected to repeat his assessment that inflation is not yet on a sustainable and durable path toward its target, European bonds are unwinding more of the mini-taper tantrum. Peripheral yields are off 4-5 bp, while the core bonds yields are a couple of basis points lower. US 10-year yields are lower for the third day running and for the sixth time in the past seven sessions. |

Eurozone ZEW Economic Sentiment, July 2017(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

United States

The US economic calendar features import and export prices and at the close the May TIC data. The political implication of the health care reform failure is the main consideration today. The political developments take place amid skepticism over the trajectory of monetary policy in light of the poor data. Market participants were still digesting Yellen’s testimony before Congress last week. Many observers heard her more dovish than we did, and note that the cleanest read of her impact on policy expectations was to be found in the unchanged Fed funds futures rather than the softening yield at the long-end. We do not think that she opened the door to a pause in September. That door was already open as very few participants expected a hike then. Yellen did not break fresh ground in her testimony and even referred to the FOMC’s statement regarding monitoring inflation.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$EUR,$JPY,Eurozone ZEW Economic Sentiment,Featured,Germany ZEW Economic Sentiment,newslettersent,U.K. Consumer Price Index