It could have been a disaster. US faltered yesterday, with the S&P 500 again struggling in the 1945-1950 area, and China's PMIs were weaker than expected. However, after initial weakness Asian shares turned higher. The nearly 0.9% rise allowed the MSCI Asia Pacific Index to close at its best level in five sessions. European bourses are firmer, led by the 1.2% rise in the German DAX. The Dow Jones Stoxx 600 is up 0.6% near midway through the session. Consumer discretionary,...

Read More »Retail trade turnover in January 2016: Swiss retail trade turnover falls by 1.3%

01.03.2016 09:15 - FSO, Economic Surveys (0353-1602-20) Retail trade turnover in January 2016 Swiss retail trade turnover falls by 1.3% Neuchâtel, 01.03.2016 (FSO) – Turnover in the retail sector fell by 1.3% in nominal terms in January 2016 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.5% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales...

Read More »January Retail Sales: Real YoY +0.2, Nominal -1.3% YoY

01.03.2016 09:15 – FSO, Economic Surveys (0353-1602-20) Retail trade turnover in January 2016 Swiss retail trade turnover falls by 1.3% in nominal term, +0.2% yoy in retail Neuchâtel, 01.03.2016 (FSO) – Turnover in the retail sector fell by 1.3% in nominal terms in January 2016 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.5% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the...

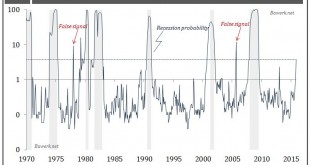

Read More »Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beginning of a recession is not deflationary but the exact opposite. As can be seen from the chart, consumer prices do indeed move higher into recessions as represented by the shaded areas. Why? The most obvious explanation is simply that the...

Read More »Increasing Price Inflation is Not a Sign of Healthy Recovery, but the Last Stage Before Recession

In a recent article by Kessler Companies (hat tip Zerohedge) they correctly point out that inflation, as measured by the consumer price index, have a tendency to accelerate as the US economy moves into a recession. Contrary to popular belief, the beginning of a recession is not deflationary but the exact opposite. As can be seen from the chart, consumer prices do indeed move higher into recessions as represented by the shaded areas. Why? The most obvious explanation is simply that the...

Read More »FAQ: UK’s Referendum on EU Membership

What is the issue? The UK has long had a strained relationship with the EU and has never been comfortable with the ever increasing drive for greater integration and harmonization of rules and regulations coming from Brussels. As the EU has grown, more decisions are made by a qualified majority. Previously decision required unanimity. The shift weakens the power of a UK veto. The UK Prime Minister has called for a national referendum on continued UK membership of the EU. When...

Read More »FAQ: UK’s Referendum on EU Membership

What is the issue? The UK has long had a strained relationship with the EU and has never been comfortable with the ever increasing drive for greater integration and harmonization of rules and regulations coming from Brussels. As the EU has grown, more decisions are made by a qualified majority. Previously decision required unanimity. The shift weakens the power of a UK veto. The UK Prime Minister has called for a national referendum on continued UK membership of the EU. When...

Read More »Emerging Market Preview of the Week Ahead

EM ended last week on a soft note, due to a variety of both external and internal factors. Firm US data continue to support our call for resumed Fed tightening, and this gave the dollar a bit of a bid. With the dollar gaining against the majors, this spilled over into generalized dollar gains vs. EM as well. Weak data out of China this week poses a risk to EM, though we suspect that how China markets react will set the tone for the wider EM.Idiosyncratic EM risk remains in play too. ...

Read More »Emerging Market Preview, First Week of March

EM ended last week on a soft note, due to a variety of both external and internal factors. Firm US data continue to support our call for resumed Fed tightening, and this gave the dollar a bit of a bid. With the dollar gaining against the majors, this spilled over into generalized dollar gains vs. EM as well. Weak data out of China this week poses a risk to EM, though we suspect that how China markets react will set the tone for the wider EM.Idiosyncratic EM risk remains in play too. ...

Read More »Dollar Mixed, While Equities Skid

It seemed that it was only after Asian equity markets fell did reports begin suggesting disappointment with the G20 meeting. The narrative followed the price action rather than the other way around. Before that, at least, one newswire claimed China was the winner of at the G20 meeting. Its currency policy was not criticized. Many, including US Treasury Secretary Lew, welcomed China's clear communication and commitment to avoid a large depreciation of the yuan. The final statement...

Read More » SNB & CHF

SNB & CHF