The most extreme speculative positioning, judging from the futures market is the long yen position. The bulls added another 3.4k contracts, lifting the gross long position to 82.8k contracts. The record was set in 2008 at 94.7k contracts. The gross short position was trimmed by 4.5k contracts, leaving 29.5k. It is the smallest gross short position since before Abe was elected in Prime Minister in 2012. The net long yen speculative position rose to 53.3k contracts. The record was...

Read More »Greenback Finds Better Traction

The US dollar rose against all the major and most emerging market currencies last week. After selling off following the ECB and FOMC meetings, the dollar found better traction. It was helped by widening interest rate differentials. Regional Fed manufacturing surveys for March suggest the quarter is ending on a firm note. With new orders rising, it is reasonable to expect the momentum to carry into Q2. Nearly half of the regional Fed presidents spoke last week, and the general...

Read More »FX Review Week March 21- March 25

The US dollar rose against all the major and most emerging market currencies last week. After selling off following the ECB and FOMC meetings, the dollar found better traction. It was helped by widening interest rate differentials. Regional Fed manufacturing surveys for March suggest the quarter is ending on a firm note. With new orders rising, it is reasonable to expect the momentum to carry into Q2. Nearly half of the regional Fed presidents spoke last week, and the general...

Read More »The Dollar is having a Reasonably Good Friday

The holiday shutters most markets today. Several Asian markets were open, and equities were narrowly mixed, with Japan and China posting small gains. Most of the other local markets, including Australia, Korea and Taiwan slipped. The US dollar is trading with a firmer bias, but mostly, as one would expect, within yesterday's ranges. Three observations are worth sharing. First, within the modest movement today, sterling is the weakest of the major currencies, as it has been for...

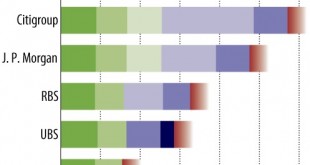

Read More »The Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority don't understand how the Forex markets work. It's not insulting - it's a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions - but none against a central bank. Of...

Read More »The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it’s economic data. That’s because the vast majority don’t understand how the Forex markets work. It’s not insulting – it’s a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions – but none against a central bank....

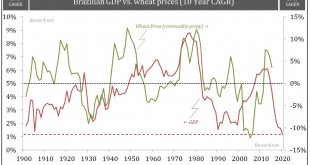

Read More »Latin America – Seven Ugly Sisters in Deep Political Trouble

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices. It’s merely a case of who’s in more advanced states of political decay where left leaning governments’ can’t hang on much longer vs. those trying to buy a bit of time with more ‘centrist’ positions. In...

Read More »Great Graphic: Another Look at the Canadian Dollar

We have been looking for a bottom in the US dollar against the Canadian dollar. It is been difficult, but now it appears that the technicals are turning. This Great Graphic, from Bloomberg, shows that the US dollar is moving above a trend line down off the January 20 high just below CAD1.47. The downtrend line connects the late February high and the mid-March high. It intersects today near CAD1.3200. The 20-day moving average, the green line, also caught the February and mid-March...

Read More »Is that Buzzing Sound Helicopter Money?

Helicopter money is the rage. Central banks are talking about it. Economists are debating it. The media is rife with coverage. While it sounds important, it is not precisely clear what helicopter money means. It appears to have originated with Milton Friedman. In 1969, he wrote: "Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us...

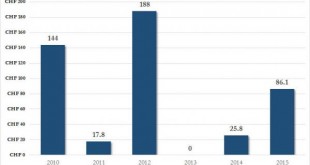

Read More »Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woefully investments in Valeant and the spike in its buying of AAPL stock at its all time high. But while the SNB's stock holdings are updated every quarter courtesy of its informative SEC-filed 13F (we wish the Fed would also disclose the equities...

Read More » SNB & CHF

SNB & CHF