Heresy! Legendary former hedge fund manager Stanley Druckenmiller at the Ira Sohn conference – not an optimist at present, to put it mildly. Photo credit: David A. Grogan / CNBC NORMANDY, France – The Dow rose 222 points on Tuesday – or just over 1%. But we agree with hedge-fund manager Stanley Druckenmiller: This is not a good time to be a U.S. stock market bull. Speaking at an investment conference in New York last week, George Soros’ former partner warned that… “…higher...

Read More »OPEC Politics: Russian King, Iranian Crown Prince?

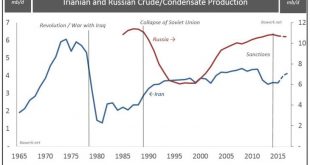

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town. It comes in the form of Russia; the number one global producer that’s not even technically a member of the cartel. Confused? Don’t be. The argument is quite simple. Irianian and Russian Crude/Condensate Production Iranian and Russian Crude/Condensate Production – click to enlarge. Unlike...

Read More »Population projections for the cantons in Switzerland 2015-2045: Large increase expected in number of retired people

12.05.2016 09:15 – FSO, Demography and Migration (0353-1605-00) Population projections for the cantons in Switzerland 2015-2045 Large increase expected in number of retired people Neuchâtel, 12.05.2016 (FSO) – Almost all cantons will record positive population growth over the next thirty years. This growth will be accompanied by a marked increase in the number of people of retirement age in all the cantons according to the new population trend scenarios for Switzerland’s cantons...

Read More »Should the Gold Price Keep Up with Inflation?

The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true? Most people define inflation as rising prices. Economists will quibble and say technically it’s the increase in the quantity of money, however Milton Friedman expressed the popular belief well. He said, “Inflation is always and everywhere a monetary phenomenon.” There you have it. The Federal Reserve increases the money supply and that, in turn, causes an...

Read More »Staying Home on Election Day

Pretenses and Conceits US election circus: Deep State Rep vs. Rage Channeller The markets are eerily quiet… like an angry man with something on his mind and a shotgun in his hand. We will leave them to brood… and return to the spectacle of the U.S. presidential primaries. On display are all the pretenses, conceits, and absurdities of modern government. And now, the race narrows to the two most widely distrusted and loathed candidates. The first, a loose reality-TV star with a hot...

Read More »Gold – The Commitments of Traders

Commercial and Non-Commercial Market Participants The commitments of traders in gold futures are beginning to look a bit concerning these days – we will explain further below why this is so. Some readers may well be wondering why an explanation is even needed. Isn’t it obvious? Superficially, it sure looks that way. As the following chart of the net position of commercial hedgers illustrates, their position is currently at quite an extended level: Gold Hedgers Position Net position...

Read More »Keith Weiner: Gold Standard etc.

Should the Gold Price Keep Up with Inflation? The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true? Who Lends to the Fed? Recently, I wrote to argue against the idea that the Federal Reserve prints money. This leads to our present question. To speak of borrowing and a ready market in which the Fed can borrow, means there is a lender. Who is the lender to the Fed? What is Money Printing? There is a populist idea...

Read More »Spain Sells 3x Oversubscribed 50-Year Bond

Following a scramble by European nations to issue ultra long-dated government paper, which saw France and Belgium sell 50-year bonds last month, while Ireland and Belgium went all the way and issued century bonds, with even Switzerland locking in 42-year paper yesterday, moments ago Spain was the latest to extend maturities all the way to 2066 when it sold €3 billion in 50 year bonds at Midswaps+50. According to MarketNews, the issue was over 3 times oversubscribed with the orderbook...

Read More »FX Daily, May 12: Yen Recovers After Being Thrown for 2%

The Japanese yen is recovering from two-day two percent decline. The yen is the strongest of the majors today, rising about 0.6%. The greenback initially extended its gains marginally in early Tokyo before the selling pressure emerging. The price action reinforces the importance of the JPY109.50 resistance area. The Nikkei initially moved higher and filled the gap created by the sharply lower opening on May 3, following disappointment with the BOJ lack of action at the end of the...

Read More »65-Year-Old Swiss Native Lost His Life’s Savings For Failing To File A Form to the US

By all accounts Bernhard Gubser was living the American Dream. Born in Switzerland he moved to the Land of the Free in the early 1980s to work at an international shipping company based in Laredo, Texas. Eventually Mr. Gubser worked his way up to be President of the company and began traveling around the world to expand the business. He became a naturalized citizen of the United States in the 1990s, something that would eventually cost him $1.35 million. As a Swiss native, Gubser had a...

Read More » SNB & CHF

SNB & CHF