The exaggerated response to last week's ECB meeting continues to unwind. Draghi's dovish comments and the strength of US employment data have helped keep the divergence meme front and center. The euro traded quietly in Asia before breaking down to almost $1.0800 in the European morning. There seemed to be only two news developments that had a bearing. First, the results of the first round of the French elections saw the National Front capitalize on the refugee and terrorism to lead...

Read More »Silver Rocket Report 6 Dec, 2015

The prices of the metals moved mostly sideways this week. That is, until Friday. Then foom! (Foom is the sound of a rocket taking off.) From 6 to 10am (Arizona time, i.e. 8 to 12 NY time) the price of gold rose from $1,061 to $1,087. Not surprisingly, the silver price rose a greater percentage, from $14.14 to $14.59. The catalyst seems to be the Bureau of Labor Statics jobs report. There were a few more jobs created than expected, which means the economy is doing well and/or the Fed is...

Read More »After Gorging On News, Time To Digest

Last week lived up to the hype. It was indeed a momentous week. China joined the SDR, with a weight that puts it in third place behind the dollar and euro. The ECB did ease policy. It delivered a 10 bp cut in the deposit rate (now -30 bp), extended its asset purchase program for six months (to March 2017), broadened the range of assets that can be bought to include regional bonds, and declared intentions to reinvest maturing proceeds. The US employment data removed what was perceived as...

Read More »Observations from the Speculative Positioning in the Futures Market

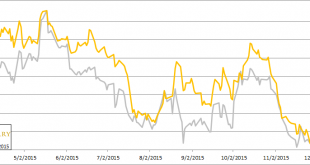

1. Given the large moves in prices shortly after the CFTC reporting period ended on 1 December renders the latest Commitment of Traders report more dated than is usually the case. 2. The Thanksgiving holiday that closed US markets reduced participation in the currency futures. Of the 16 gross positions of the eight currency futures we track, none had a significant adjustment (more than 10k contracts). The 9.8k contract increase of speculative gross shorts euro futures (to 261.6k) was...

Read More »Once Unleashed, Corrective Forces Dominate

The market's disappointment with the ECB unleashed pent-up corrective forces in the foreign exchange market. This leg up in the dollar began in mid-October. Through the day before the ECB, the euro was the weakest of the major currencies, losing 7.5% against the dollar. The yen and sterling shed a little less than half as much. The Australian dollar was the only one of the majors to have gained against the dollar. And even then, its 0.12% appreciation had only been achieved here in...

Read More »Emerging Markets: What has Changed

(from my colleague Ilan Solot) 1) The Chinese yuan will be in the SDR. 2) Brazil had one of the most important weeks of the year, and possibly of its history. 3) Russia enacted sanctions against Turkey, while Turkey got a deal from the EU. 4) Moody’s raised Russia’s credit-rating outlook to stable from negative. In the EM equity space, China (+2.6%), Taiwan (0.0%), and Israel (+0.0%) outperformed over the last week, while Poland (-5.4%), South Africa (-4.6%), and Chile (-3.3%) have...

Read More »Jobs Data Keeps Fed on Track to Hike

After the ECB's disappointment yesterday market nerves were shattered, but the largely as expected US jobs data may help the focus return to the underlying fundamental fact. The ECB just eased policy. Not as much as the market expected, and that speaks to market positioning, but it did ease. And the 211k increase in November jobs, with the October series being revised up 27k to 298k, Fed officials looking for more improvement in the labor market got it. The unemployment rate was...

Read More »From the ECB’s Failure to Communicate to US Jobs to Confirm Fed Signals

The only way to explain the largest swing in the euro in six years yesterday is to appreciate the disconnect between what was expected and what was delivered by the ECB. Draghi's urgency and commitment to do "what it must" fanned expectations, and more importantly, substantial positions, in various asset classes--short euros, long European debt, and equities. The washout was dramatic. Even though there was no promise by Draghi, there is nearly universal agreement that he over-promised and...

Read More »ECB Fireworks

Market participants knew that volatility would rise today with the ECB meeting. What they got was far worse than could have been anticipated. It started with a report on the Financial Times a few minutes before the ECB's official announcement claiming, disappointingly, that there was no rate cut. The euro took off, spiking to almost $1.07 from around $1.0550. A few minutes later the ECB announced the ten bp cut in the deposit rate (to -30 bp). The euro pulled back but then rallied...

Read More »Draghi’s Day to Deliver

The much anticipated ECB meeting is at hand. Yesterday's disappointing eurozone CPI figures only fanned the anticipation. Today the service PMI was softer than expected at 54.2, down from 54.6. What will Draghi do? There are four moving parts. The first is the deposit rate, which currently stands at -20 bp. When first adopted in September 2014, that rate was said to be have exhausted the scope for interest rate policy. Of course, we know factually it is not because other...

Read More » SNB & CHF

SNB & CHF