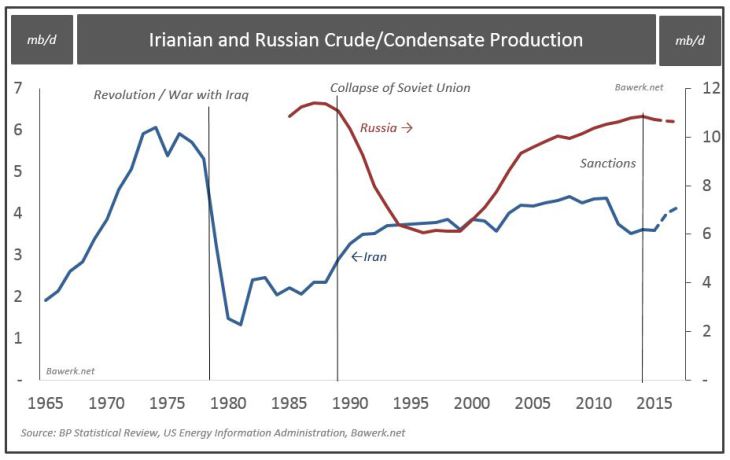

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town. It comes in the form of Russia; the number one global producer that’s not even technically a member of the cartel. Confused? Don’t be. The argument is quite simple. Irianian and Russian Crude/Condensate Production Iranian and Russian Crude/Condensate Production – click to enlarge. Unlike Doha where the outgoing Saudi Oil Minister, Ali Naimi was lining up a Saudi led deal to leave Iran outside the tent as the odd man out refusing to join the 17 country ‘freeze’, this time round, it’s very likely Russia will come back to the table with exactly the same deal, but one they’ve directly brokered with Iran, where the Islamic Republic is conveniently claiming they’ve already hit the magic 4mb/d production targets to bring a ‘freeze agreement’ back into play. Rest assured, if Russia and Iran are on the same page, everyone else will ‘sign on the line’ given their current fiscal difficulties where every petro-dollar counts for self-preservation purposes.

Topics:

Eugen von Böhm Bawerk considers the following as important: Ali Naimi, Bawerk, commodities, Crude Oil, Featured, Geopolitics, Iran, newsletter, OPEC, Putin, Russia

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Another month, another OPEC meeting beckons for 2nd June. But unlike typical meetings on the Danube (let alone dust filled haze of Doha), the producer group might just have a new King in town. It comes in the form of Russia; the number one global producer that’s not even technically a member of the cartel. Confused? Don’t be. The argument is quite simple.

Irianian and Russian Crude/Condensate Production |

Unlike Doha where the outgoing Saudi Oil Minister, Ali Naimi was lining up a Saudi led deal to leave Iran outside the tent as the odd man out refusing to join the 17 country ‘freeze’, this time round, it’s very likely Russia will come back to the table with exactly the same deal, but one they’ve directly brokered with Iran, where the Islamic Republic is conveniently claiming they’ve already hit the magic 4mb/d production targets to bring a ‘freeze agreement’ back into play. Rest assured, if Russia and Iran are on the same page, everyone else will ‘sign on the line’ given their current fiscal difficulties where every petro-dollar counts for self-preservation purposes. That potentially leaves Saudi Arabia outside the ‘freezing tent’ as the latest renegade of the petro-state world – or worse still for Riyadh – signing up to a retro-engineered Russo-Iranian deal, where Saudi Arabia has conceded strategic leadership of the producer. No matter how much Saudi screams and shouts their previous intransigence brought Iran to the table, this is no longer their deal to sell. If Putin goes in for the kill in Vienna, strategic control of the producer group has effectively passed to Moscow, at least on an interim basis. On all fronts, this is entirely up to the Kremlin how they want to spin things. Not only does a Russo-Iranian deal make sense for a ‘resurgent’ Moscow playing the OPEC ‘King’; giving Iran a geopolitical leg up to become the number one ‘cartel princeling’ makes sense for broader Russian geo-strategic interests. Iran remains the most vital co-ordinate on Mr. Putin’s post-Soviet map.

Oil price doesn’t really go anywhere, beyond a short term Viennese waltz

No doubt that will put a wry smile Mr. Naimi’s face given the Kingdom had its chance to remain the OPEC lynchpin in Doha, but opted to bump off the old man for internal power grabs instead. But we still need to be very careful to strip out what remain two totally separate debates here around OPEC political theatrics on the one hand vs. any actual market impact any so called freeze would have on the other. Unsurprisingly, we expect exactly the same Doha bluff to come through in Vienna, in what’s essentially a ‘license to pump’ agreement all round. Kuwait will claim it can do 3.2mb/d; Iraq will keep pitching 4.8mb/d; Venezuela will ‘hold firm’ at 2.6mb/d. All numbers grounded in political fantasies, not physical realities. Most importantly, Iran’s probably not quite back at 4mb/d, which ironically reinforces why a June freeze agreement remains absolutely ‘no regrets’ for the Islamic Republic to game. Claim 4mb/d targets are hit; keep making incremental gains over the next few months; but do so scoring lots of diplomatic points against Saudi Arabia along the way. To cap things off, Russia will obviously pitch its tent towards 11.5mb/d given Moscow’s currently ramming through tax tweaks to keep production at 11.2mb/d. Everyone gets to pump. Nobody has to ‘formally’ cheat. The price doesn’t really go anywhere, beyond a short term Viennese waltz. But most of all, it leaves Saudi Arabia with a major petro-diplomacy decision to make: Either accept it’s no longer calling the OPEC shots when it comes to producer ‘co-operation’ or completely bulk at Russo-Iranian overtures, and put their head back in the volumetric sands to ramp as far and fast as they can. OPEC gets left in its wake.

How much can Saudi-Arabia really pump?

Unfortunately for the Kingdom, that’s the real rub here: It’s far from clear Riyadh still holds the volumes based crown either in OPEC. For all the noise coming out of the Kingdom they can do 11.5mb/d, 12mb/d, 12.5mb/d or even ‘20mb/d’ if they ‘wanted to’, the acid test will come over the summer months when domestic demand will be through the roof. Unless everyone sees ‘total’ Saudi production going well above 11mb/d to maintain its stakes in the volumes game, the working assumption the Kingdom can always pump at will simply isn’t credible. If the ‘King’s dead so be it, but Riyadh should know better than anyone else, there’s also someone willing to take your place. Odds on Russia will wear that regal crown, at least for short term political posturing. While Iran can assume its logical role as the new Crown Prince.