Commercial and Non-Commercial Market Participants The commitments of traders in gold futures are beginning to look a bit concerning these days – we will explain further below why this is so. Some readers may well be wondering why an explanation is even needed. Isn’t it obvious? Superficially, it sure looks that way. As the following chart of the net position of commercial hedgers illustrates, their position is currently at quite an extended level: Gold Hedgers Position Net position of commercial hedgers in COMEX gold futures – i.e., the inverse of the total net speculative position. Similarly large net positions were only recorded in late 2009 and late 2010. Gold Hedgers Position – click to enlarge. However, as we have stressed many times, the interpretation of this indicator is not as straightforward as many observers seem to assume. As an aside to this, the often made assertion that commercial hedgers represent the so-called “smart money” doesn’t make much sense. It would be much better to refer to them as “completely neutral market participants”. Most commercial traders aren’t betting on market direction at all. This category of traders comprises producers, merchants, processors, users and bullion banks, including arbitrageurs such as swap dealers.

Topics:

Pater Tenebrarum considers the following as important: Dan Mitchell, Featured, Gold - Commodity Exchange INC., Gold - Futures COT, Gold - Spot Price CME, Gold and its price, Gold Hedgers Position, Jordan Roy-Byrne, newsletter, Precious Metals, Speculative Position

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Commercial and Non-Commercial Market Participants

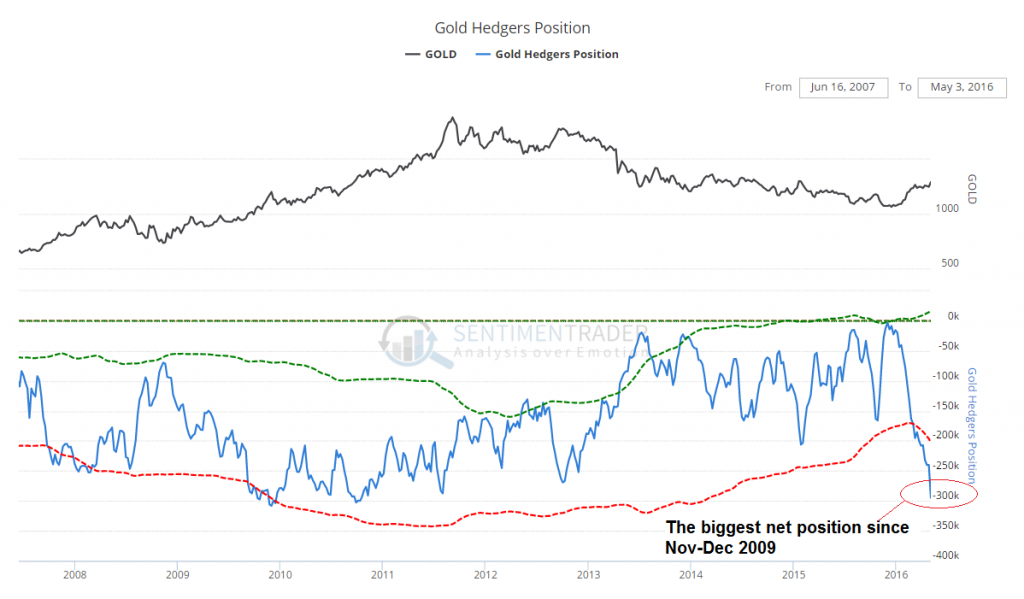

The commitments of traders in gold futures are beginning to look a bit concerning these days – we will explain further below why this is so. Some readers may well be wondering why an explanation is even needed. Isn’t it obvious? Superficially, it sure looks that way.

As the following chart of the net position of commercial hedgers illustrates, their position is currently at quite an extended level:

Gold Hedgers PositionNet position of commercial hedgers in COMEX gold futures – i.e., the inverse of the total net speculative position. Similarly large net positions were only recorded in late 2009 and late 2010. |

However, as we have stressed many times, the interpretation of this indicator is not as straightforward as many observers seem to assume. As an aside to this, the often made assertion that commercial hedgers represent the so-called “smart money” doesn’t make much sense. It would be much better to refer to them as “completely neutral market participants”.

Most commercial traders aren’t betting on market direction at all. This category of traders comprises producers, merchants, processors, users and bullion banks, including arbitrageurs such as swap dealers. They are either hedging a physical inventory, future physical production or deliveries, or offsetting financial positions, including producer forward sales in which they act as intermediaries, carry trades and other arbitrage activities.

Carry trades often involve physical inventory, but even a calendar spread in futures contracts alone can be seen as a variation of a carry trade. In gold’s case, carrying inventory can be an enticing proposition, especially in a ZIRP or near-ZIRP environment, as Keith Weiner reminds us every week in his update on gold basis spreads.

Trades that involve holding warehouse inventories offset by futures positions so as to capture the spread between spot and futures prices are in principle possible (and are indeed undertaken) in all sorts of commodities. Precious metals have the advantage though that their stocks are extremely large and that they don’t take up much space, so they invite a lot of arbitrage activity. Note that arbitrage is also an essential characteristic of open-ended ETFs backed by bullion such as GLD – which is why they don’t develop large premiums, resp. discounts to NAV.

A Holistic Approach

The only thing that matters about the commitments of traders are actually the activities of speculators. When their position becomes very lopsided – which is currently indeed the case – the market becomes at least vulnerable to a sizable short term correction. Speculators in futures as a rule follow strict technical and money management guidelines, thus there will always be layers of stops both below and above current market prices. These stops will exacerbate selling, resp. buying pressure when these levels are violated.

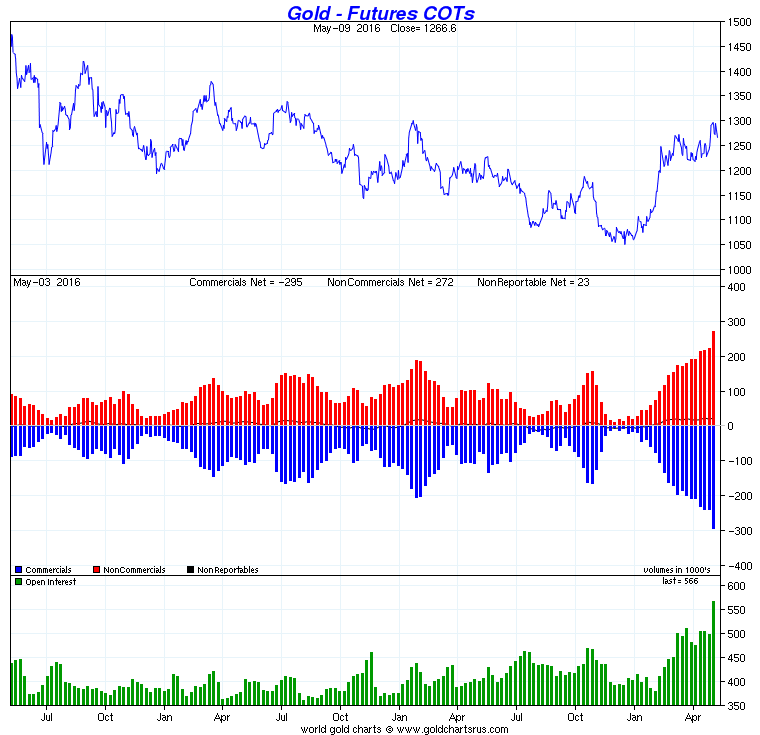

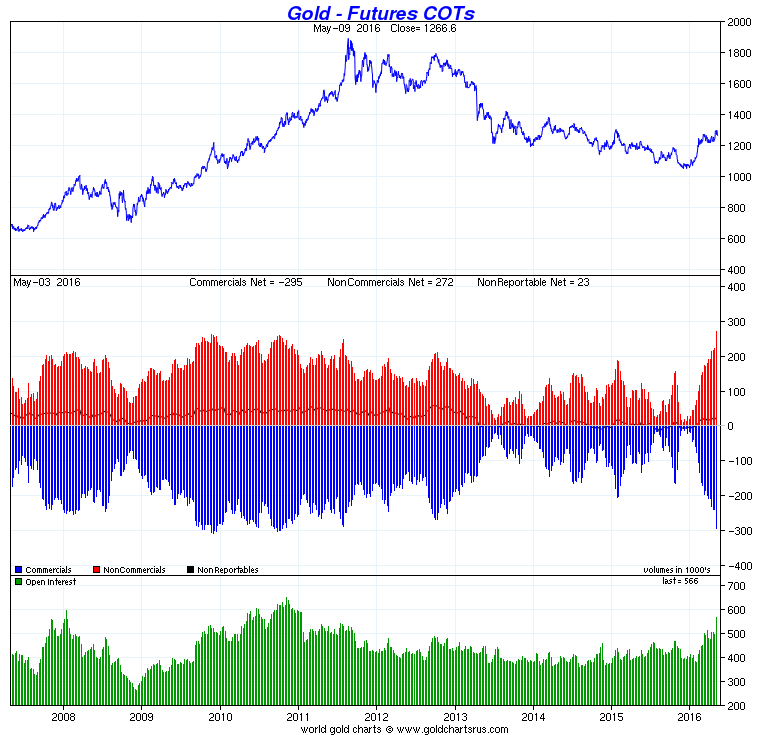

Here is a more detailed depiction of the positions of the three main groups of market participants over the past three years:

Gold – Futures COTsNet positions of commercial hedgers (blue bars), big speculators (red bars) and small speculators (line), plus open interest in gold futures (green bars). |

So yes, the current size of the speculative position suggests that the market has become vulnerable to a correction in the near term. However, as we have pointed out previously, in order to properly interpret the situation, a more holistic view is required. It is not enough to simply say “the position is very large, and therefore X will happen” – which is precisely what many gold market analysts have recently done.

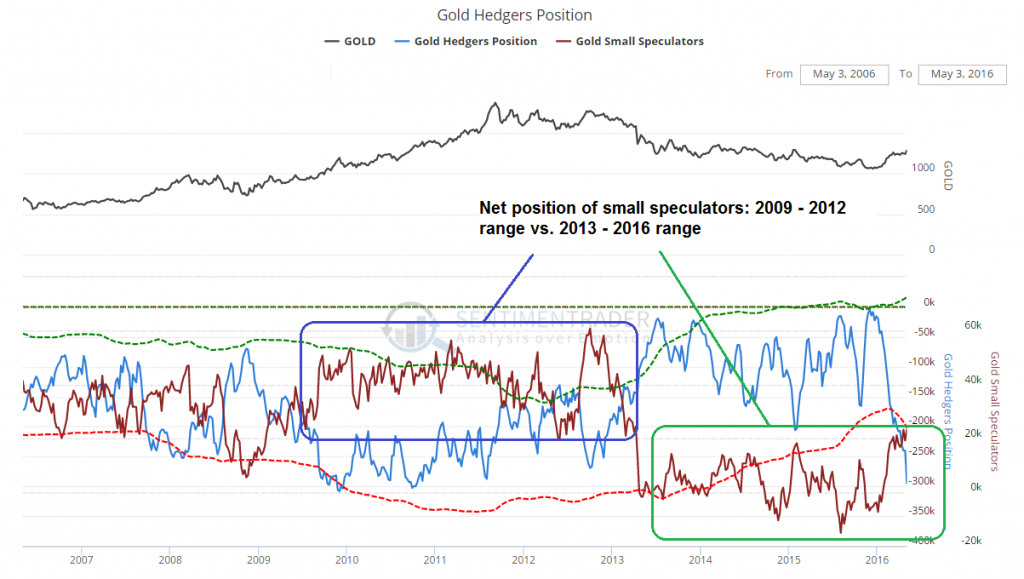

One noteworthy detail we have mentioned in the past is e.g. the fact that small speculators (non-reportable positions) have been far less enthusiastic about the rally than they have been back in 2009-2012. Their net position has recently increased, but has still only made it back to the lower boundary of the range it inhabited back then. This can be seen a bit more clearly in the following chart:

Gold Hedgers PositionsSmall speculators have yet to display the degree of enthusiasm seen in 2009-2012. |

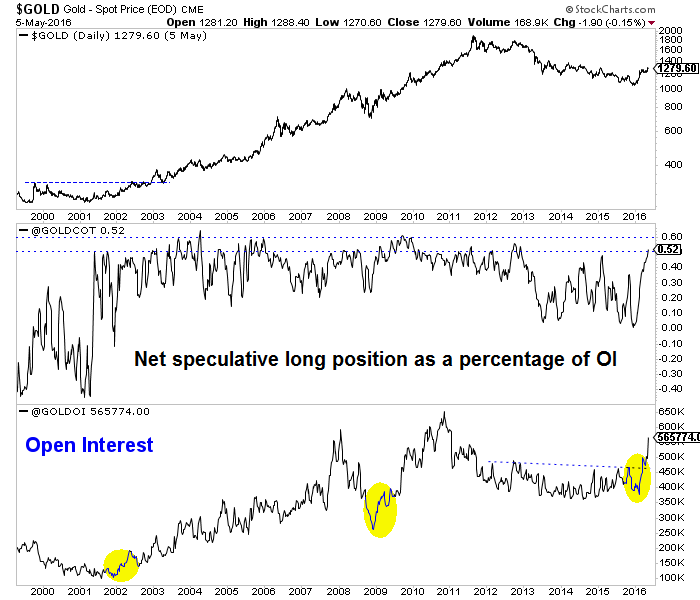

That is however not all there is to it. As can be seen in the second chart above, open interest in gold futures has soared recently. This is a very important detail, as Jordan Roy-Byrne points out here (as an aside to this, JRB’s gold market-related analysis strikes us generally as being of outstanding quality). We reproduce one of his charts below, which shows the speculative long position as a percentage of open interest. This is a lot more informative than the “naked” figures are per se.

Gold – Spot Price (EOD) CMEGold, the net speculative position as a percentage of open interest and open interest. |

As this chart illustrates, the speculative position as percentage of OI is no larger today than it was back in 2001, right at the beginning of a huge long term rally. Consider also the open interest changes JRB has highlighted with yellow circles. It is a recurring feature of large-scale advances that the trend in open interest strongly reverses from down to up. In order for the market to rally, an increase in speculative activity is actually a sine qua non precondition – both open interest and the net speculative long position actually need to rise, otherwise there will be no bull market.

At the same time, the chart suggests that caution is increasingly warranted in the short term, as the percentage reading is now entering the region which denotes speculative long positioning extremes. This should also be brought into context with Keith’s recent fundamental price calculation, which indicates that speculative buying of futures is currently not sufficiently supported by physical demand. Naturally this doesn’t mean that there cannot be even more short term upside – but it certainly constitutes a “heads-up” type of warning sign.

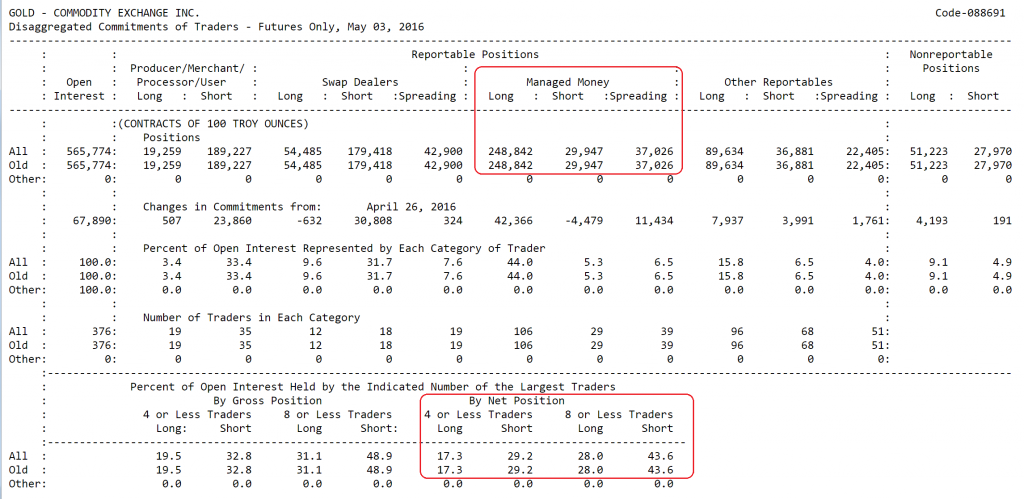

Here is a look at the disaggregated commitments of traders report, which breaks the three main groups of traders in the legacy report down further. We have highlighted two important details:

Gold – Commodity Exchange INC.Table showing disaggregated positioning data in COMEX gold futures. Note the highlighted data. |

First of all, the gross positions of the “managed money” category – which consists mainly of trend-followers such as CTAs – are currently skewed approx. 9:1 in favor of long positions. These traders will hold on and add to their long positions as long as the market’s technical condition suggests it remains appropriate to do so. But they will also sell immediately when certain technical thresholds are violated.

Secondly, the net short exposure of the 4, resp. 8 largest traders is by now relatively large as well. Again, both data points suggest caution is warranted in the short term, but they could still expand further before the market actually reverses.

Rising Investor Interest in Gold

Lastly, we want to briefly address why interest in buying and holding gold has recently intensified so significantly (the positioning of futures traders mirrors a general increase in investor interest in gold). We have previously already mentioned the fact that faith in the policies of central banks is increasingly coming under strain – deservedly so.

Many investors are presumably also worried about the extreme overvaluation of the stock market, as well as that of most government bond markets and are turning to gold as insurance. The state of the banking system, especially in Europe and China, is undoubtedly also cause for concern (see “The Walking Dead” and “Drowning in Bad Loans” for some color on the situation in Europe).

However, one aspect that hasn’t yet received a lot of attention in this context is the ongoing concerted assault on financial privacy by Western regulatory democracies.

There is e.g. the barrage of propaganda on banning cash currency – accompanied, as it were, by actual restrictions on cash transactions and the recent bizarre withdrawal of the 500 euro note by the ECB under what is clearly a spurious pretext (one has to be incredibly naïve to believe that this will actually suppress criminal activity – evidently, Europe’s socialist political and bureaucratic elite thinks of the citizens of the euro zone as complete morons who will believe anything).

Gold – Futures COTsCommitments of traders over the past nine years – both open interest and net positions have soared to levels close to previous highs. This mirrors a general resurgence in investor interest in gold. |

There is also the recent release of the so-called “Panama papers” (we will soon discuss this event in greater detail in a separate post), which has hastened the implementation of the global version of “FATCA”, nicknamed “GATCA”. This wholesale destruction of financial privacy has been heavily promoted by the OECD – an extremely costly bureaucratic stronghold of central planning, socialism and globalism if ever there was one.

Moreover, in the wake of this extremely dubious theft and subsequent publication of private data (which is normally considered a crime, unless it serves the globalist agenda of course) financial privacy rights that have existed for hundreds of years have been wiped away in one stroke, as the Daily Bell points out. Similar to all government interventions, this will have “unintended consequences”.

As Dan Mitchell of the Cato Institute explains in a video we have posted in “The Attack on Tax Havens”, an enormous amount of investment has flown into developed economies from anonymous investment trusts bases in low-tax jurisdictions. It is a good bet that quite a bit of these investment flows will now dry up – instead, capital will go even deeper into hiding (we will address the legitimacy of hiding assets elsewhere, here we are merely concerned with what is likely to happen).

One of these hiding places will be gold, which is not depending on anyone’s promise to pay and can be stored outside of the wobbly financial system. This will help a number of private fortunes to survive, but gold held in vaults for the purpose of preserving privacy and providing insurance is also inert. It isn’t going to fund the next Google, that much is certain.

Conclusion

Net speculative positions in gold (and silver) futures are becoming quite stretched in the short term, which makes a correction ever more likely. However, one must always keep in mind that this position cannot be properly interpreted in isolation – a holistic analysis is required to come to correct conclusions about it.

Lastly, it should also be pointed out that the “goal posts” for these data series are moving over time. It is highly likely that if a longer term advance in precious metals prices has indeed begun, new record highs in futures open interest and speculative net long positioning will be seen in coming years.

Charts and tables by: SentimenTrader, Sharelynx, Jordan Roy-Byrne / StockCharts, CFTC

Previous post