Heresy! Legendary former hedge fund manager Stanley Druckenmiller at the Ira Sohn conference – not an optimist at present, to put it mildly. Photo credit: David A. Grogan / CNBC NORMANDY, France – The Dow rose 222 points on Tuesday – or just over 1%. But we agree with hedge-fund manager Stanley Druckenmiller: This is not a good time to be a U.S. stock market bull. Speaking at an investment conference in New York last week, George Soros’ former partner warned that… “…higher valuations, three more years of unproductive corporate behavior, limits to further easing, and excessive borrowing from the future suggest that the bull market is exhausting itself.” But we promised to return to the scene of our crime today. In these pages, we recently committed heterodoxy…even heresy! We don’t know what got into us and we are deeply sorry for our misdoings, the remembrance of which is grievous unto us… … but in a moment of weakness (oh, ye gods of democracy, why have you forsaken us?) we dared to question whether voting makes any damned sense. We concluded that it didn’t. We don’t know the candidates well enough to know who is really better. We don’t have any idea what challenges the next president will face, nor which candidate would be better equipped to deal with them.

Topics:

Bill Bonner considers the following as important: Debt and the Fallacies of Paper Money, Donald Trump, Featured, Federal Debt, George Soros, newsletter, On Politics, public debt, Stanley Druckenmiller

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Heresy!

Legendary former hedge fund manager Stanley Druckenmiller at the Ira Sohn conference – not an optimist at present, to put it mildly. Photo credit: David A. Grogan / CNBC

NORMANDY, France – The Dow rose 222 points on Tuesday – or just over 1%. But we agree with hedge-fund manager Stanley Druckenmiller: This is not a good time to be a U.S. stock market bull.

Speaking at an investment conference in New York last week, George Soros’ former partner warned that…

“…higher valuations, three more years of unproductive corporate behavior, limits to further easing, and excessive borrowing from the future suggest that the bull market is exhausting itself.”

But we promised to return to the scene of our crime today. In these pages, we recently committed heterodoxy…even heresy! We don’t know what got into us and we are deeply sorry for our misdoings, the remembrance of which is grievous unto us…

… but in a moment of weakness (oh, ye gods of democracy, why have you forsaken us?) we dared to question whether voting makes any damned sense. We concluded that it didn’t.

We don’t know the candidates well enough to know who is really better. We don’t have any idea what challenges the next president will face, nor which candidate would be better equipped to deal with them. We don’t know if the candidates believe what they say they believe or whether they will do what they promise to do.

We only know our vote, statistically, won’t make a bit of difference. And that we don’t want the “lesser of two evils.” And that we don’t feel any obligation to play this game! Dear readers canceled their subscriptions… and heated up their irons.

“What about the ‘social contract’?” a reader wanted to know. We’ll come back to that in a minute. First, we want to touch on a remarkable statement, by a remarkable candidate, in a remarkable election.

Donald’s Debt “Discount”

Donald Trump let it be known last week that if the U.S. federal debt begins to weigh too heavily on his shoulders, he will do what he does best – renegotiate. He will get a “discount.”

“WHAT??!!!”

General Trump has an idea. The funny thing is, much of what he said about the public debt is not all that far-fetched. It is simply part of a huge confidence game, which could be easily upset if too much truth is spoken. Image via ifunny.co

The question flew down Wall Street and around the back alleys of lower Manhattan… across the City of London… and through other major financial centers all over the world.

“What did he say? Did he just say he was going to default on the U.S. debt? I can’t believe it!”

“Renegotiating” the terms of debt… getting a discount… is what you do when you can’t pay. It’s what Argentina just did, after years of wrangling in the courts, in which its creditors seized one of its naval vessels in a foreign port.

The idea of discounting U.S. Treasury bonds – the world’s safest credits – was beyond remarkable… It was unthinkable. The New York Times was on the case immediately, claiming Trump’s proposal would create “cracks in investor confidence” and cost the country “a lot of money” (in higher interest charges).

The Washington Post followed up, pointing out that confidence in U.S. debt was the “glue that holds global finance together.” Any doubt about the glue, it said, would “instantly destabilize” the whole world economy.

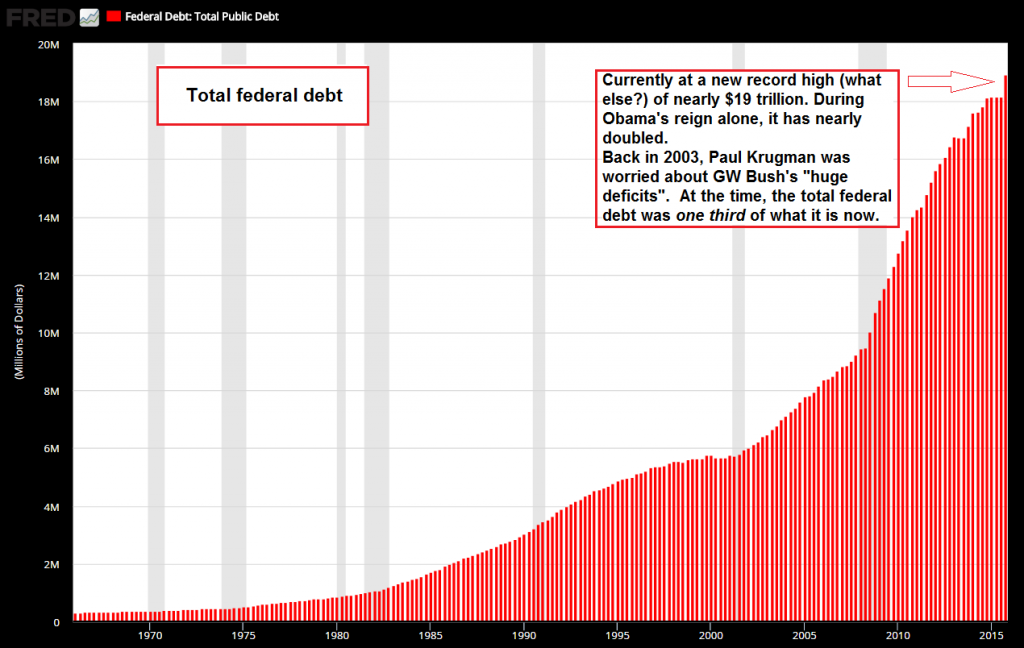

Federal Debt: Total Public DebtThere’s just one little problem with this debtberg – it can never be paid back, and everybody knows it. At least not at the terms of the original contract – the money to pay it can (and will) of course be printed. |

Poor Donald. He had broken another taboo. He had to backtrack and explain himself. Trump doesn’t seem to understand how the scam works, but he was right about what it means.

The U.S. federal government is the monopoly issuer of the world’s reserve currency. It doesn’t have to renegotiate. It doesn’t have to ask for a discount. And it even influences – by way of its central bank, the Fed – the value of the currency in which its debt is denominated. That means it gets to rip off the world’s investors without saying a word.

For now, the dollar is riding high… and buyers stand in line to get more U.S. Treasury debt. Later, the shoe will be on the other foot. But the U.S. will not be standing on one foot, begging for discounts on its debt. Instead, owners of U.S. Treasury bonds – retirees, mostly – will be begging on street corners.

The True “Social Contract”

But let’s return to the wild and wonderful world of the U.S. presidential elections. Why not just hold your nose… and go along gracefully, and with good humor… with the gag? Why not just “do your duty,” as one reader put it in yesterday’s Mailbag?

According to the “social contract theory,” we all have our roles and responsibilities. As citizens, we have a duty to inform ourselves, pay our taxes, rat out our neighbors, vote, volunteer for military service, get frisked by the TSA… and let ourselves get robbed and bullied by every jackass in a position of power.

The actual definition of the mythical “social contract”. This is certainly a politically incorrect way of putting it. The problem with the truth is that it is usually both laugh-out-loud funny and utterly depressing – and is certain to offend a great many people.

The actual definition of the mythical “social contract”. This is certainly a politically incorrect way of putting it. The problem with the truth is that it is usually both laugh-out-loud funny and utterly depressing – and is certain to offend a great many people.

Our leaders have responsibilities, too. They are supposed to respect the constitution, except when it is inconvenient for them. They are supposed to uphold the Law of the Land, or pass new laws, as it suits them.

They are supposed to protect the country and provide for the general commonweal – and then collect millions in speaking fees from Goldman Sachs and General Dynamics.

That is the true “social contract.” We don’t remember signing such a contract. Do you remember signing it? If it were laid in front of you, would you sign?

We looked around and our copy seems to have gone missing too. Also, we must have been drunk when we signed it, because we can’t remember doing so either. Image via bastiatinstitute.org

Our “leaders” – aka the Deep State – can change the terms any time they want. What kind of contract is it where one party can change the deal and the other can’t? And where the other party was never given the opportunity to negotiate it, or even approve it?

It’s not a contract at all. It’s just part of the mythology of modern democracy. It imposes “duties,” but they only make sense if you swallow the whole enchilada of minor insults and major delusions that keep the Deep State in business.

What are our real duties? Shouldn’t your editor, under torture of course, confess his sins, renounce his apostasy, and register to vote before it is too late? Isn’t democracy – for all its faults – still the best game in town?

More to come…

Chart by St. Louis Federal Reserve Research

Chart and image captions by PT (PS: we commend Bill for these recent displays of anarchist thinking. It is only natural to become more radical with age, it happens to many of us)

The above article originally appeared as “Donald Trump Wants to Do the Unthinkable” at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

Previous post