Yu Ting Hotel - Chen Hotel Branch 3 Stars Hotel in Guangzhou ,China Within US Travel Directory One of our top picks in Guangzhou. Very close to Haiyin Cloth Wholesale Market, Yu Ting Hotel ( Chen Hotel Branch) is located in Guangzhou. Free WiFi access is available throughout the entire property. It takes 16 minutes by taxi to the Canton Tower and 23 minutes by taxi to Pazhou Complex Centre. Both the Coach Terminal and Railway Station can be reached in a 15-minute drive. Baiyun...

Read More »Yu Ting Hotel – Dong Chen Hotel Branch – Guangzhou Hotels, China

Yu Ting Hotel - Chen Hotel Branch 3 Stars Hotel in Guangzhou ,China Within US Travel Directory One of our top picks in Guangzhou. Very close to Haiyin Cloth Wholesale Market, Yu Ting Hotel ( Chen Hotel Branch) is located in Guangzhou. Free WiFi access is available throughout the entire property. It takes 16 minutes by taxi to the Canton Tower and 23 minutes by taxi to Pazhou Complex Centre. Both the Coach Terminal and Railway Station can be reached in a 15-minute drive. Baiyun...

Read More »US chart of the week – Job market is open

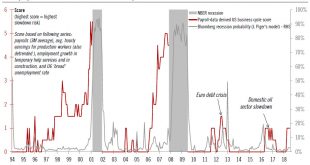

The positive job openings data in the US is a sign that the US economy continues to weather ongoing trade tensions.The latest job openings data release for June brought another positive signal for the longevity of the US business cycle, echoing other encouraging indicators from US data releases, including the July employment report (see our Flash Note and our ‘business cycle score’ derived from monthly payroll data). These data add further support for the continued strength of the US economy...

Read More »US-China trade tensions could persist

China’s latest retaliatory measures seem fairly restrained, but the tension between the two nations could drag on for quite some time.On 3 August, the Chinese government announced a list of additional tariffs on USD 60 billion worth of US imports in retaliation to the US’s proposed tariffs on USD 200 billion of Chinese goods. When these tariffs are implemented will depend on when the US activates its tariffs. The announcement came shortly after President Trump stated that he was considering...

Read More »Weekly View – new headwinds

The CIO office’s view of the week ahead.Apple made headlines for being the first company to reach a market capitalisation of USD 1 trillion. This milestone highlights two key points about the technology sector, in particular the FAANGs (Facebook, Apple, Amazon, Netflix, Google) which dominate it. Apple and Amazon’s continued success stems from their highly diversified business, which makes them less dependent on narrow revenue sources. Meanwhile, advertising-driven Facebook and Google and...

Read More »US employment – chugging along

The July employment report confirmed that the US economy is in great shape, and still unaffected by international trade tensions.The US labour market remains in fine fettle, as the three-month average in job growth up to July was 224,000. The unemployment rate dropped to 3.9%, while the ‘broader’ unemployment rate (U6) fell to 7.5%, its lowest level since May 2001.Wage growth remained relatively tame (especially in light of the low unemployment rate), with average hourly earnings growth at...

Read More »Europe chart of the week – UK households

ONS data suggest that UK households lived beyond their means in 2017 as they became net borrowers for the first time in nearly 30 years.The latest UK sectoral accounts from the Office for National Statistics (ONS) has received considerable attention over the past few days as it shows UK households’ outgoings surpassed their income in 2017 for the first time in nearly 30 years. The ONS noted that, on average, each UK household spent or invested around GBP 900 more than it received in income...

Read More »House View, August 2018

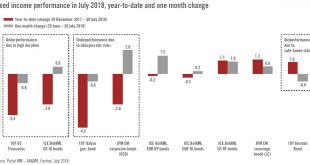

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six- month basis we are maintaining our neutral stance on developed-market equities in general in light of increasing trade and political frictions, but we remain more upbeat on their prospects further out.We have a bullish short-term stance on Asian (ex-Japan) equities given their increasingly attractive valuations but we are paying close attention to...

Read More »Japan: Minor tweaks to the BoJ’s policy

In line with our expectations, the Bank of Japan decided to keep the basic framework of the existing monetary easing programme in place.After a two-day meeting at the end of July, the Bank of Japan (BoJ) has decided to maintain its existing monetary easing framework, but has announced a few minor changes to improve the sustainability of the framework.The BoJ’s latest policy decisions are largely in line with our expectations of no major changes to the policy framework due to inflation...

Read More »(邊緣人提摩)垃圾黃計程車逼車 講不贏還關窗戶

#逼車#計程車#已檢舉

Read More » Perspectives Pictet

Perspectives Pictet