Growing by about 10% over the past year, a regime shift in IT spending is supporting the US economy.Q2 GDP growth data (which showed GDP growing by 4.1% quarter-on-quarter and 2.8% year-on-year) was another indication of the strong shape the US economy is in.Particularly solid support for growth in recent quarters, and again in Q2, has come from business investment. We have long highlighted our belief that robust investment growth would be a major contributor to US GDP growth, which we forecast will average 3% this year. This seems to be indeed what is happening.Drilling into the details of investment spending in the Q2 GDP report, one sees strong investment growth particularly in two sectors: energy and IT (computers and software). In fact, IT seems to have witnessed a genuine ‘regime

Topics:

Thomas Costerg considers the following as important: investment growth, Macroview, US investment spending, US IT spending

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Growing by about 10% over the past year, a regime shift in IT spending is supporting the US economy.

Q2 GDP growth data (which showed GDP growing by 4.1% quarter-on-quarter and 2.8% year-on-year) was another indication of the strong shape the US economy is in.

Particularly solid support for growth in recent quarters, and again in Q2, has come from business investment. We have long highlighted our belief that robust investment growth would be a major contributor to US GDP growth, which we forecast will average 3% this year. This seems to be indeed what is happening.

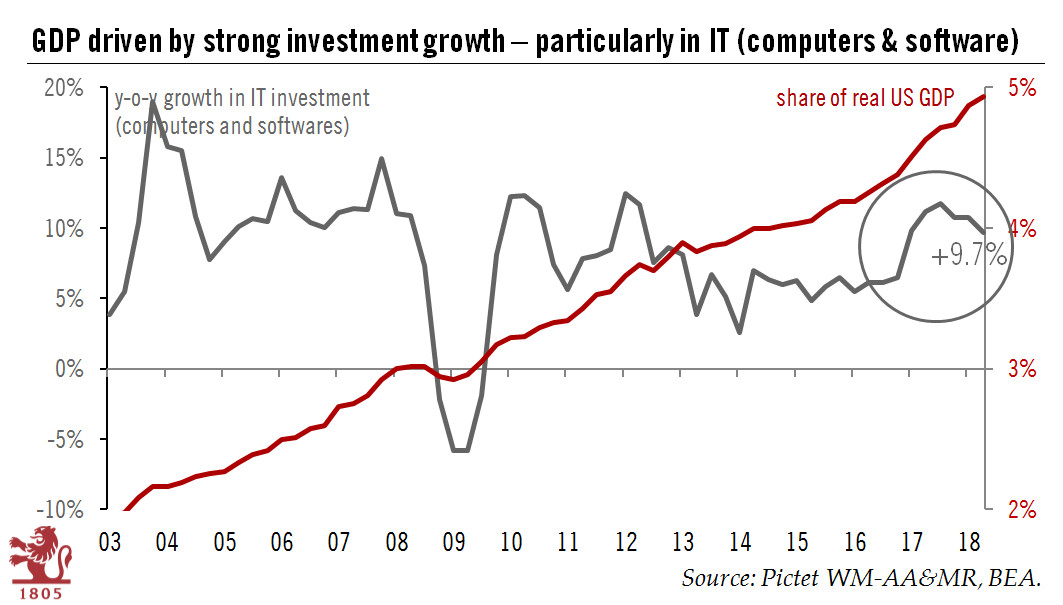

Drilling into the details of investment spending in the Q2 GDP report, one sees strong investment growth particularly in two sectors: energy and IT (computers and software). In fact, IT seems to have witnessed a genuine ‘regime shift’, with a considerable acceleration in investment since mid-2017. From 5.8% on average between 2013 and 2016, growth doubled to 10.7% on average between Q1-2017 to Q2 2018. In Q2, investment in IT grew by 9.7% y-o-y.

Furthermore, IT investment is no longer peripheral, since IT represents amost 5% of US (real) GDP versus less than 2% in 2003 (see graph). A piece of good news is that IT upgrades, as well as investment in US oil and gas, should be less affected by recent trade tensions than say, investment in manufacturing capacity or exports—providing a solid underpinning for US growth in coming quarters even if international trade tensions ratchet up further.