Summary:

PMI surveys surprised to the upside in March. The euro area composite PMI surged to 56.7, its highest level since April 2011.The average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017Both the euro area composite PMI and the price pressure gauges are now firmly in ‘ECB tightening’ territory. Today’s PMI indices confirm our expectations that a change in the ECB’s forward guidance is likely at the 8 June meeting as a formal discussion on an “exit package” could start. We forecast a first deposit rate hike in Q2 2018 and a very gradual tapering in asset purchases between Q1 and Q4 2018.In Germany, the flash composite PMI index increased from 56.1 in February to 57.0 in March, against expectations of a stable print. The increase is the fastest rate of growth in private sector in six years and was broad based across sectors. Meanwhile, increasing demand pushed firm to step up recruitment in both sectors. The rate of job creation strengthened again, to the highest since March 2011 and was the second-strongest since the series began in January 1998.In the meantime, France has an even stronger rebound.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Composite PMI, ECB policy rates, euro area, Euro PMI, Macroview

This could be interesting, too:

PMI surveys surprised to the upside in March. The euro area composite PMI surged to 56.7, its highest level since April 2011.The average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017Both the euro area composite PMI and the price pressure gauges are now firmly in ‘ECB tightening’ territory. Today’s PMI indices confirm our expectations that a change in the ECB’s forward guidance is likely at the 8 June meeting as a formal discussion on an “exit package” could start. We forecast a first deposit rate hike in Q2 2018 and a very gradual tapering in asset purchases between Q1 and Q4 2018.In Germany, the flash composite PMI index increased from 56.1 in February to 57.0 in March, against expectations of a stable print. The increase is the fastest rate of growth in private sector in six years and was broad based across sectors. Meanwhile, increasing demand pushed firm to step up recruitment in both sectors. The rate of job creation strengthened again, to the highest since March 2011 and was the second-strongest since the series began in January 1998.In the meantime, France has an even stronger rebound.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Composite PMI, ECB policy rates, euro area, Euro PMI, Macroview

This could be interesting, too:

Jeffrey P. Snider writes As The Fed Seeks To Justify Raising Rates, Global Growth Rates Have Been Falling Off Uniformly Around The World

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

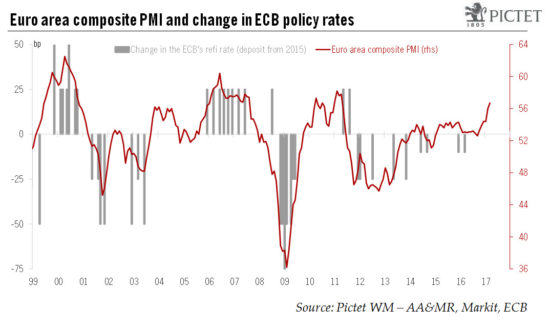

PMI surveys surprised to the upside in March. The euro area composite PMI surged to 56.7, its highest level since April 2011.

- The average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017

- Both the euro area composite PMI and the price pressure gauges are now firmly in ‘ECB tightening’ territory. Today’s PMI indices confirm our expectations that a change in the ECB’s forward guidance is likely at the 8 June meeting as a formal discussion on an “exit package” could start. We forecast a first deposit rate hike in Q2 2018 and a very gradual tapering in asset purchases between Q1 and Q4 2018.

- In Germany, the flash composite PMI index increased from 56.1 in February to 57.0 in March, against expectations of a stable print. The increase is the fastest rate of growth in private sector in six years and was broad based across sectors. Meanwhile, increasing demand pushed firm to step up recruitment in both sectors. The rate of job creation strengthened again, to the highest since March 2011 and was the second-strongest since the series began in January 1998.

- In the meantime, France has an even stronger rebound. The French flash PMI indices managed to improve further in March, with the composite PMI up to a six-year high of 57.6. The headline manufacturing PMI index rose to 53.4 from 52.2 in February, despite a modest drop in the pace of output expansion. The bulk of the improvement was driven by the services sector, with the PMI surging to a six-year high of 58.5.

- Finally, Markit indicated that outside Germany and France, “growth of output and new orders slipped lower but remained close to the best seen for almost a decade, while jobs growth hit a near ten-year high.