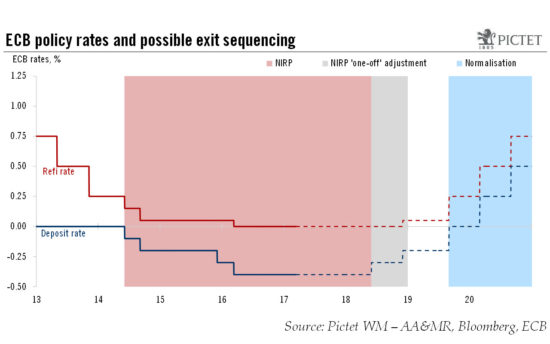

The ECB could announce further changes to its forward guidance in June as part of its exit strategy from negative rates. But we think proper rates normalisation will only start in late 2019.The debate over the ECB’s exit strategy from its negative interest rate policy (NIRP) has started in earnest. Recent comments point to a possible reversal in the exit sequencing, with a deposit rate hike preceding the end of net asset purchases.A one-off adjustment in negative rates would have some merits, including for banks’ interest margins, but also if it is part of a trade-off for a prolonged QE programme.However, any ECB tightening would pose communication challenges. For the first exit steps to be manageable, several conditions need to be met, including a very cautious approach to QE tapering amid idiosyncratic risks in Italy. We think the ECB will insist on the difference between a “one-off adjustment” in its deposit rate and a “proper normalisation cycle”.We expect a change in the ECB’s forward guidance at the 8 June meeting, a first deposit rate hike in Q2 2018 and the rates normalisation cycle to start very slowly in late 2019. Risks are skewed towards an earlier rate hike but a longer QE, in our view.

Topics:

Frederik Ducrozet considers the following as important: ECB exit policy, ECB policy normalisation, Macroview, negative interest rates, NIRP

This could be interesting, too:

Claudio Grass writes Debt cancellation: the new panacea?

Claudio Grass writes Debt cancellation: the new panacea?

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

The ECB could announce further changes to its forward guidance in June as part of its exit strategy from negative rates. But we think proper rates normalisation will only start in late 2019.

The debate over the ECB’s exit strategy from its negative interest rate policy (NIRP) has started in earnest. Recent comments point to a possible reversal in the exit sequencing, with a deposit rate hike preceding the end of net asset purchases.

A one-off adjustment in negative rates would have some merits, including for banks’ interest margins, but also if it is part of a trade-off for a prolonged QE programme.

However, any ECB tightening would pose communication challenges. For the first exit steps to be manageable, several conditions need to be met, including a very cautious approach to QE tapering amid idiosyncratic risks in Italy. We think the ECB will insist on the difference between a “one-off adjustment” in its deposit rate and a “proper normalisation cycle”.

We expect a change in the ECB’s forward guidance at the 8 June meeting, a first deposit rate hike in Q2 2018 and the rates normalisation cycle to start very slowly in late 2019. Risks are skewed towards an earlier rate hike but a longer QE, in our view.