Corporate results are in keeping with our central scenario of 10% total returns for global equities this year.Our 2017 scenario, drawn up last December, called for a total annual return of 10% for global equities this year. We attributed the bulk of this performance to a double-digit rise in estimated corporate profits. As the Q4 2016 reporting season draws to a close, 2017 earnings expectations are proving resilient or are being revised upwards. Yet the earnings cycle is turning out to be desynchronised across regions, making it difficult to identify a unique common risk factor for equity markets.Current 2017 US earnings growth expectations are proving resilient. A large part of this estimated growth is attributable to the oil sector, which is expected to contribute 3.2 percentage points. This means that the growth in 2017 earnings for all other sectors on the S&P500 excluding oil is expected to be 6.3%. But these factors still do not factor in either potential supply-side reforms or fiscal stimulus.In Europe, 2017 earnings growth forecasts have skyrocketed, mainly driven by a base effect triggered by European financials. Even when excluding financials, expected 2017 growth in Europe remains above 10%. Despite upward revisions in corporate operating margins, Europe has not bridged the gap with the US.

Topics:

Wilhelm Sissener and Jacques Henry considers the following as important: 2017 earnings, global earnings forecast, Macroview, profit dynamics, total annual returns

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Corporate results are in keeping with our central scenario of 10% total returns for global equities this year.

Our 2017 scenario, drawn up last December, called for a total annual return of 10% for global equities this year. We attributed the bulk of this performance to a double-digit rise in estimated corporate profits. As the Q4 2016 reporting season draws to a close, 2017 earnings expectations are proving resilient or are being revised upwards. Yet the earnings cycle is turning out to be desynchronised across regions, making it difficult to identify a unique common risk factor for equity markets.

Current 2017 US earnings growth expectations are proving resilient. A large part of this estimated growth is attributable to the oil sector, which is expected to contribute 3.2 percentage points. This means that the growth in 2017 earnings for all other sectors on the S&P500 excluding oil is expected to be 6.3%. But these factors still do not factor in either potential supply-side reforms or fiscal stimulus.

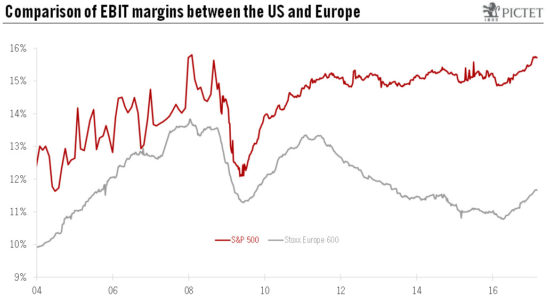

In Europe, 2017 earnings growth forecasts have skyrocketed, mainly driven by a base effect triggered by European financials. Even when excluding financials, expected 2017 growth in Europe remains above 10%. Despite upward revisions in corporate operating margins, Europe has not bridged the gap with the US. The main factor explaining the gap is the lack of technology companies in Europe. Currently, expected 2017 EBIT margins to stand at 11.7% for the Stoxx Europe 600 and 15.7% for the S&P 500.

While Japanese corporate results significantly disappointed in Q3 2016, results came in above expectations in Q4 2016. As the yen weakened in Q4 2016, Japanese companies have seen their profit growth increase. As a result, 2017 profit growth estimates now stand at 14.5% for 2017, compared with 9% at year-end 2016. Three-quarters of this growth is attributable to cyclical sectors (in particular automobiles), which are especially large beneficiaries of a weak yen.

Current earnings trends allow us to be confident about our 2017 scenario, which foresees an average 10% return for major equity markets. Yet sources of risk have not vanished, especially given upcoming elections in Europe, and bouts of volatility could materialise in the course of the year.