But today's credit report means ECB will have to tread carefully when it comes to reducing the degree of monetary accommodation.The euro area M3 and credit report for February was slightly disappointing overall. Broad money growth (M3) eased from 4.8% to 4.7% y-o-y. Bank loans to non-financial corporations fell back to 2.0% y-o-y in February, from 2.3% in January, as a result of weaker lending flows across the region.Notwithstanding this modest setback, the euro area credit cycle remains broadly on track and further improvements in credit flows are likely in the next few months. Aggregate demand is rising, interest rates remain low, and ECB’s TLTROs should help at the margin. Finally, we note that euro area banks have continued to increase long-term loans with a maturity over 5 years, which bodes well for business investment spending this year.Against this backdrop, we continue to expect the ECB to tread carefully when it comes to reducing the degree of monetary accommodation.

Topics:

Frederik Ducrozet considers the following as important: credit flows, euro area credit, M3, Macroview, Money Supply

This could be interesting, too:

Keith Weiner writes The Anti-Concepts of Money: Conclusion

Jeffrey P. Snider writes Testing The Supply Chain Inflation Hypothesis The Real Money Way

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

But today's credit report means ECB will have to tread carefully when it comes to reducing the degree of monetary accommodation.

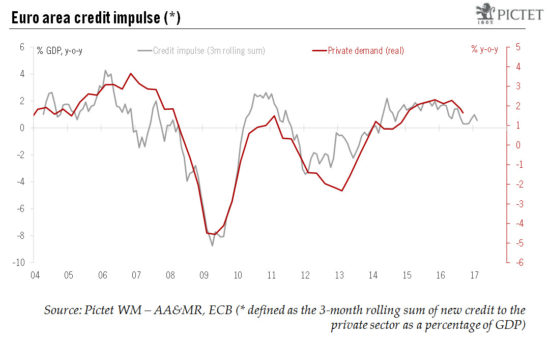

The euro area M3 and credit report for February was slightly disappointing overall. Broad money growth (M3) eased from 4.8% to 4.7% y-o-y. Bank loans to non-financial corporations fell back to 2.0% y-o-y in February, from 2.3% in January, as a result of weaker lending flows across the region.

Notwithstanding this modest setback, the euro area credit cycle remains broadly on track and further improvements in credit flows are likely in the next few months. Aggregate demand is rising, interest rates remain low, and ECB’s TLTROs should help at the margin. Finally, we note that euro area banks have continued to increase long-term loans with a maturity over 5 years, which bodes well for business investment spending this year.

Against this backdrop, we continue to expect the ECB to tread carefully when it comes to reducing the degree of monetary accommodation.