GDP shows economic performance is somewhere between what hard and soft data are suggesting.According to Eurostat’s preliminary flash estimate released today, euro area real GDP expanded by 0.5% q-o-q in Q1 2017 (+0.455% q-o-q; 1.8% q-o-q annualised; 1.7% y-o-y), slightly above consensus expectations (0.4%). This flash estimate confirms that most business confidence surveys overestimated growth at the beginning of the year, with the ‘true pace’ of economic expansion lying somewhere in between...

Read More »Where Do We Go From Here?

[embedded content] Published: Tuesday May 02 2017Evidence that hard data is catching up on soft data continues to put wind in the sails of equity markets, which are also benefiting from strong earnings news. A revival of Trump’s tax plans could further help risk assets. But political and geopolitical risk has not entirely disappeared. Cesar Perez Ruiz, Pictet Wealth Management’s Chief Investment Officer, discusses the road ahead.

Read More »Pictet Perspectives – Where Do We Go From Here?

Evidence that hard data is catching up on soft data continues to put wind in the sails of equity markets, which are also benefiting from strong earnings news. A revival of Trump’s tax plans could further help risk assets. But political and geopolitical risk has not entirely disappeared. Cesar Perez Ruiz, Pictet Wealth Management’s Chief Investment Officer, discusses the road ahead.

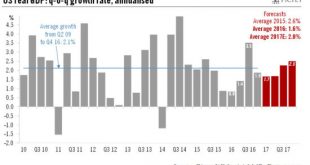

Read More »US economic prospects look good

After soft GDP in first quarter, we expect a significant rebound in the current quarter. The underlying strength of the US economy remains intact.US GDP growth decelerated from 2.8% in H2 2016 to 0.7% quarter on quarter (q-o-q) annualised in Q1, slightly below consensus expectations (1.0%). However, this weak reading is mainly due to statistical anomalies (growth tends to be lower in Q1) and transitory factors that weighed on consumer spending and stockbuilding. However, fixed investment...

Read More »The Pictet Group Annual Review 31 December 2016

The Pictet Group is proud to present its Annual Review of activites for 2016, covering Pictet Wealth Management, Pictet Asset Management and Pictet Asset Services.We are pleased to introduce the Annual Review of the Pictet Group for 2016 — my first as Senior Partner. After I assumed the role on 1 July last year, I was asked if Pictet’s strategic direction would change. The Senior Partner is, by tradition, chair and primus inter pares of the board of partners, only assuming the position...

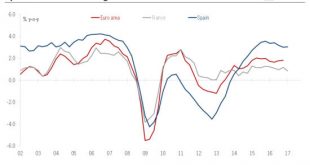

Read More »France & Spain: Q1 GDP growth

Available data point towards 0.5% GDP growth in the euro area in the first quarter.France and Spain today became the first big countries in the euro area to publish GDP growth figures for Q1. French real GDP expanded by 0.3% q-o-q in Q1 2017, down from +0.5% q-o-q in Q4, and lower than what was expected by the consensus.The details were more encouraging than the headline figure. In particular, investment accelerated sharply. Some of the weaknesses in private consumption were explained by...

Read More »ECB: the courage not to act

The ECB remains dovish, but a reassessment of its plans for exiting quantitative easing could come later this year and hikes in the deposit rate in 2018 if core inflation data improve.The European Central Bank left policy and forward guidance unchanged at today’s meeting notwithstanding the “increasingly solid” recovery and “diminished” downside risks to the outlook. Our impression is that there is a strong consensus to “finish the job” by keeping the monetary stance very accommodative until...

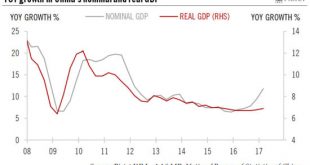

Read More »China GDP beats expectations, but no change in core scenario

China’s Q1 GDP higher than forecasts, but we maintain our view that growth will start to slip, especially in the second half of 2017.Chinese GDP grew 6.9% year-over-year (y-o-y) in real terms in Q1 2017, up from 6.8% in Q4 2016 and 6.7% for the full year of 2016. The strong growth figure beats both the consensus forecast (6.8%) and our own estimate (6.7%). In nominal terms, the rise in GDP was even more significant, growing 11.8% over the year to March 31, mainly driven by higher prices...

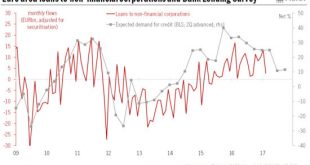

Read More »Bank lending gives no ground for ECB to change stance

The April Bank Lending Survey remains consistent with the ECB leaving its stance unchanged on credit conditions, negative rates and QE.Credit standards on loans to euro area enterprises eased in Q1, according to the ECB’s Bank Lending Survey (BLS), released today. Although banks expect a small net tightening of credit standards across all loan categories in Q2, credit conditions remain broadly favourable in the euro area.Demand for credit continued to rise in Q1, albeit at a slower pace than...

Read More »Macron victory still raises questions for markets

The market implications of Emmanuel Macron’s win are likely to prove positive but short lived as the focus will quickly shift to the legislative elections in June.The first round of the French presidential election has come as a relief for markets as a pro-European, reformist candidate came first and now looks very likely to win the second round. For once, opinion polls were fairly accurate in capturing voting intentions and last-minute momentum. But the result of the first round is not...

Read More » Perspectives Pictet

Perspectives Pictet