The ECB’s scheme of negative interest rate loans to banks has also helped boost inflation in the euro area.The fourth and final of the ECB’s Targeted Long-Term Refinancing Operations (TLTRO) today attracted EUR233bn in demand from 474 euro area banks, well above consensus (EUR110bn). Expectations of an ECB deposit rate hike may have boosted demand for this operation, as it provided a last opportunity for banks to secure four-year funding at a rate that can go as low as -0.40%.There is no breakdown for take-up of TLTRO loans available across countries. We estimate that banks in Italy and Spain account for at least 60% of total TLTROs holdings. Peripheral banks are likely to benefit most from negative TLTRO rates, provided that lending improves further in Italy, Spain, Portugal and Greece.Since TLTROs were introduced, the transmission of monetary policy has provided a 0.3-0.4% boost to euro area inflation over a two year horizon in our estimates.TLTROs could still prove to be a useful tool in the future in the event of downside risks materialising, as Mario Draghi indicated during his last press conference. Even if no new operations are announced, the ECB could always ease the terms of the existing ones, for instance by increasing their maturity as needed.

Topics:

Frederik Ducrozet considers the following as important: ECB negative rates, European bank credit, Macroview, Monetary policy transmission, TLTRO

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ECB’s scheme of negative interest rate loans to banks has also helped boost inflation in the euro area.

The fourth and final of the ECB’s Targeted Long-Term Refinancing Operations (TLTRO) today attracted EUR233bn in demand from 474 euro area banks, well above consensus (EUR110bn). Expectations of an ECB deposit rate hike may have boosted demand for this operation, as it provided a last opportunity for banks to secure four-year funding at a rate that can go as low as -0.40%.

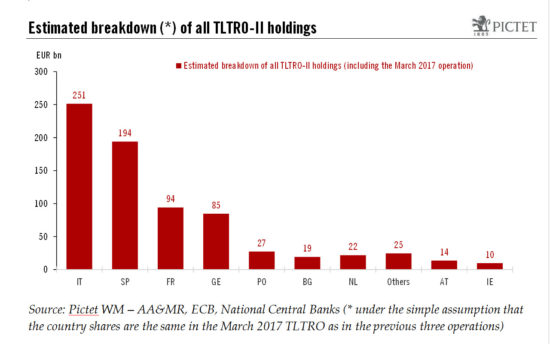

There is no breakdown for take-up of TLTRO loans available across countries. We estimate that banks in Italy and Spain account for at least 60% of total TLTROs holdings. Peripheral banks are likely to benefit most from negative TLTRO rates, provided that lending improves further in Italy, Spain, Portugal and Greece.

Since TLTROs were introduced, the transmission of monetary policy has provided a 0.3-0.4% boost to euro area inflation over a two year horizon in our estimates.

TLTROs could still prove to be a useful tool in the future in the event of downside risks materialising, as Mario Draghi indicated during his last press conference. Even if no new operations are announced, the ECB could always ease the terms of the existing ones, for instance by increasing their maturity as needed.