Flash PMI surveys indicate continuation of a “solid and broad” recovery. We expect ECB to move cautiously toward a more neutral policy stance.The euro area May PMI indices remained consistent with Mario Draghi’s assessment of the ongoing recovery as “solid and broad”. The composite flash PMI remained stable at 56.8 in May, against expectations of a small decline. This apparent stability masked further improvement in the largest member states as business confidence outperformed in the French...

Read More »The ECB debates sequencing of policy moves

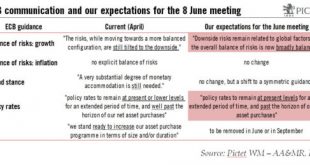

Some high-ranking ECB officials seem open to the idea of raising negative deposit rates before tapering quantitative easing.Recent comments from ECB executive board member Benoît Coeuré have confirmed that the ECB is likely to make further changes to its communication at its 8 June meeting, moving towards a neutral stance despite a likely downward revision to the 2017 inflation staff forecast. Importantly, Coeuré sounded open to further changes to the ECB’s forward guidance, including a...

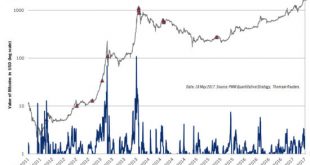

Read More »Crypto-currencies in a bubble

Crypto-currencies like Bitcoin and Ripple are caught in a “bubble regime”, oscillating between extreme peaks and troughs. A new peak is close….Pictet’s inhouse quantitative analysis can provide ways of spotting certain kinds of bubble and predicting when they will burst (see article ‘Forecasting Financial Extremes’).One aspect of this analysis is focused on investor herding behaviour, as measured by the combination of super-exponential cycles and ever faster oscillations around those cycles....

Read More »Oil prices: limited upside potential

Having faltered this year, predictions of prices above USD60/b in 2017 appear premature.The market was highly optimistic about oil price at the beginning of this year, with oil analysts expecting that prices would have recovered to USD60-65 by now. These hopes have clearly been dashed, as WTI prices have fluctuated in a range of USD45-55 since January 1.We have been much less optimistic than the market, based on our own modelling of the equilibrium oil price, which has proved a reliable...

Read More »Chinese growth momentum moderates

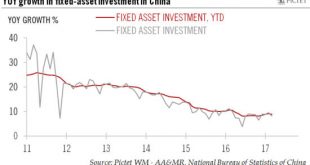

Growth momentum in China has softened a bit after a strong first quarter. Meanwhile, US-China trade relations look like they might be improving.Economic indicators for April point to some softening in growth momentum in China. Hard data confirm the moderation seen in manufacturing and non-manufacturing PMIs released earlier this month, and the direction of change is consistent with our expectation that Q1 marked the peak of growth momentum in China for 2017.In our view, the deceleration in...

Read More »US Treasuries cast doubt on Trumponomics

We are sticking with our core scenario of a 10-year Treasury yield of 2.8-3.0% by year’s end. However, the chances of a yield as low as 2.5% are rising.At the beginning of 2017, in our outlook for sovereign bonds, we forecasted that the 10-year US Treasury yield would rise to 2.8-3% by year’s end. However, yields have been stuck in a range of 2.2-2.6%, so a review looks warranted.Indeed, the risk has increased of an alternative to the core scenario, but we are sticking to our target. We...

Read More »Eliminating the ocean’s garbage patches

Published: Tuesday May 16 2017Youthful entrepreneur Boyan Slat is pioneering a technology to remove the millions of tons of unsightly plastic trash floating on the surface of the world’s oceans, which endangers marine species and pollutes the human food chain.The five plastic garbage patches circulating in the world’s largest oceans have long been seen as a threat to marine life which is poisoned by this persistent material or becomes entangled in it. It also introduces organic pollutants...

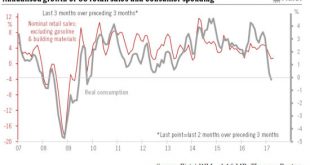

Read More »U.S. consumer spending showing signs of rebound

After a weak first quarter, consumer spending in the US is showing healthier signs. We remain upbeat about prospects for the rest of this year too.Core retail sales in the US rose by 0.2% m-o-m in April, below consensus expectations (+0.4%). However, retail sales for March were revised up by 0.2%.The result was that between Q1 and April, nominal core retail sales grew by a healthy 3.6% annualised, following an increase of 3.5% q-o-q in Q1 and 3.1% in Q4 2016. However, although up month on...

Read More »Monthly Investment Strategy Highlights, May 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets. Asset AllocationMarkets are starting to revise their expectations for the Trump administration. We still see some prospect of a US fiscal stimulus, but it is likely to be later (not kicking in before 2018) and less ambitious than hoped.Improving economic performance and strong earnings growth support our positive stance on DM equities, despite high valuations. However, room for disappointment is limited.We expect core...

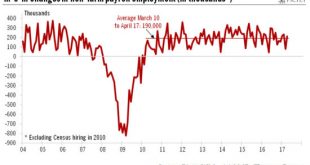

Read More »US unemployment falls to fresh cyclical low

US average hourly earnings data were slightly disappointing in April, but the non-farm payroll figure was robust and the unemployment rate continued to decline.Non-farm payroll employment rose by a solid 211,000 in April, above consensus expectations.Unexpectedly, the US unemployment rate continued to fall from 4.5% in March to 4.4% in April, and is now significantly below the Fed’s median estimate for full employment (4.8%).However, wage data were somewhat disappointing, with the pace of...

Read More » Perspectives Pictet

Perspectives Pictet