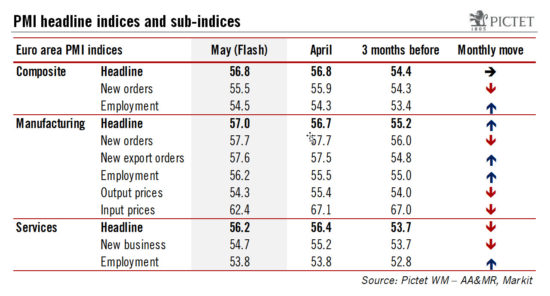

Flash PMI surveys indicate continuation of a “solid and broad” recovery. We expect ECB to move cautiously toward a more neutral policy stance.The euro area May PMI indices remained consistent with Mario Draghi’s assessment of the ongoing recovery as “solid and broad”. The composite flash PMI remained stable at 56.8 in May, against expectations of a small decline. This apparent stability masked further improvement in the largest member states as business confidence outperformed in the French services and the German manufacturing sectors, both at 6-year highs (see table and details below). Meanwhile the German IFO index also exceeded expectations, rising to 114.6 in May, a 47-year high!We continue to believe that euro area PMI indices are overstating the actual pace of growth, which is likely to have peaked in the first half of this year. The French presidential election likely played a role in boosting expectations. Still, the broad picture remains one of a “solid and broad” recovery.Importantly for the ECB, input cost pressures moderated for the first time in 15 months. With core inflation likely to ease to around 1% in the next few months, the ECB should be in no rush to tighten.We continue to expect the ECB to make further change to its communication, gradually moving towards a more neutral stance.

Topics:

Frederik Ducrozet considers the following as important: ecb policy stance, euro area business sentiment, Euro area PMI, euro area recovery, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Flash PMI surveys indicate continuation of a “solid and broad” recovery. We expect ECB to move cautiously toward a more neutral policy stance.

The euro area May PMI indices remained consistent with Mario Draghi’s assessment of the ongoing recovery as “solid and broad”. The composite flash PMI remained stable at 56.8 in May, against expectations of a small decline. This apparent stability masked further improvement in the largest member states as business confidence outperformed in the French services and the German manufacturing sectors, both at 6-year highs (see table and details below). Meanwhile the German IFO index also exceeded expectations, rising to 114.6 in May, a 47-year high!

We continue to believe that euro area PMI indices are overstating the actual pace of growth, which is likely to have peaked in the first half of this year. The French presidential election likely played a role in boosting expectations. Still, the broad picture remains one of a “solid and broad” recovery.

Importantly for the ECB, input cost pressures moderated for the first time in 15 months. With core inflation likely to ease to around 1% in the next few months, the ECB should be in no rush to tighten.

We continue to expect the ECB to make further change to its communication, gradually moving towards a more neutral stance. Euro area PMI indices are fully consistent with the ECB dropping the downside risks to activity from its statement in June while keeping a very cautious assessment of the outlook for (core) inflation. The September meeting is when the ECB is most likely to make hard decisions on policy, including a tapering announcement and a potential change to the exit sequencing (see “Revisiting the case for a reversal in the ECB’s exit sequencing”).