Some high-ranking ECB officials seem open to the idea of raising negative deposit rates before tapering quantitative easing.Recent comments from ECB executive board member Benoît Coeuré have confirmed that the ECB is likely to make further changes to its communication at its 8 June meeting, moving towards a neutral stance despite a likely downward revision to the 2017 inflation staff forecast. Importantly, Coeuré sounded open to further changes to the ECB’s forward guidance, including a potential reversal in the exit sequencing.We have highlighted the merits of a one-off hike in the ECB’s deposit rate (see “ECB: escape the (NIRP) room”), which in our view would help the banking sector while providing a cheap concession to the policy hawks, if not a complete trade-off against a slower tapering. Coeuré made it clear that a change in the exit sequencing would be based on a cost-benefit analysis of negative rates, adding that “today” the net impact was still positive. However, our impression is that the ECB’s assessment is slowly changing. The longer QE lasts, the closer the banking sector is likely to move to a ‘pain threshold’ where negative rates can hurt bank profitability and credit supply. This is the key development to watch.

Topics:

Frederik Ducrozet considers the following as important: ECB policy normalisation, ECB reverse sequentcing, ECB tapering, Macroview, negative interest rates

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Some high-ranking ECB officials seem open to the idea of raising negative deposit rates before tapering quantitative easing.

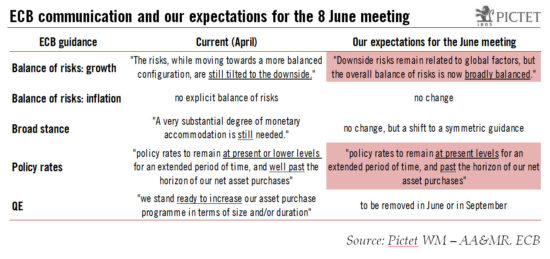

Recent comments from ECB executive board member Benoît Coeuré have confirmed that the ECB is likely to make further changes to its communication at its 8 June meeting, moving towards a neutral stance despite a likely downward revision to the 2017 inflation staff forecast. Importantly, Coeuré sounded open to further changes to the ECB’s forward guidance, including a potential reversal in the exit sequencing.

We have highlighted the merits of a one-off hike in the ECB’s deposit rate (see “ECB: escape the (NIRP) room”), which in our view would help the banking sector while providing a cheap concession to the policy hawks, if not a complete trade-off against a slower tapering.

Coeuré made it clear that a change in the exit sequencing would be based on a cost-benefit analysis of negative rates, adding that “today” the net impact was still positive. However, our impression is that the ECB’s assessment is slowly changing. The longer QE lasts, the closer the banking sector is likely to move to a ‘pain threshold’ where negative rates can hurt bank profitability and credit supply. This is the key development to watch. However, our baseline remains unchanged: we expect a tapering announcement in September 2017 (starting very slowly in Q1 2018), a deposit rate hike in June 2018 (a 15bp adjustment would be a good compromise) and a proper rate normalisation cycle to start in 2019. But should there a formal communication change on exit sequencing, we suspect that September could be the earliest date.

Either way, the ECB is likely to use the 8 June meeting to stress that its main refinancing rate policy, currently at 0%, is still likely to remain low for an extended period of time.