Summary:

Pictet Wealth Management’s latest positioning in fast-evolving markets. Asset AllocationMarkets are starting to revise their expectations for the Trump administration. We still see some prospect of a US fiscal stimulus, but it is likely to be later (not kicking in before 2018) and less ambitious than hoped.Improving economic performance and strong earnings growth support our positive stance on DM equities, despite high valuations. However, room for disappointment is limited.We expect core sovereign bond yields to rise as economic growth strengthens and inflation expectations pick up.Favourable economic fundamentals do not favour buying gold, but a call option on gold offers a way to hedge geopolitical risk.CurrenciesAlthough the US dollar’s up-cycle is mature, the greenback should remain strong in 2017.With hard Brexit still the most likely scenario and the UK economy starting to suffer, upside potential for sterling is likely limited.EquitiesEarnings growth has surprised positively and we see good momentum for 2018.Positive profit margin momentum in Europe supports our overweight in European equities.The strong performance of European equities also supports our view that it is better to play EM through DM.Fixed incomePeripheral euro area bond spreads could widen on anticipations of ECB tapering, as well as the approach of Italian elections in 2018.

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management’s latest positioning in fast-evolving markets. Asset AllocationMarkets are starting to revise their expectations for the Trump administration. We still see some prospect of a US fiscal stimulus, but it is likely to be later (not kicking in before 2018) and less ambitious than hoped.Improving economic performance and strong earnings growth support our positive stance on DM equities, despite high valuations. However, room for disappointment is limited.We expect core sovereign bond yields to rise as economic growth strengthens and inflation expectations pick up.Favourable economic fundamentals do not favour buying gold, but a call option on gold offers a way to hedge geopolitical risk.CurrenciesAlthough the US dollar’s up-cycle is mature, the greenback should remain strong in 2017.With hard Brexit still the most likely scenario and the UK economy starting to suffer, upside potential for sterling is likely limited.EquitiesEarnings growth has surprised positively and we see good momentum for 2018.Positive profit margin momentum in Europe supports our overweight in European equities.The strong performance of European equities also supports our view that it is better to play EM through DM.Fixed incomePeripheral euro area bond spreads could widen on anticipations of ECB tapering, as well as the approach of Italian elections in 2018.

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management’s latest positioning in fast-evolving markets.

- Markets are starting to revise their expectations for the Trump administration. We still see some prospect of a US fiscal stimulus, but it is likely to be later (not kicking in before 2018) and less ambitious than hoped.

- Improving economic performance and strong earnings growth support our positive stance on DM equities, despite high valuations. However, room for disappointment is limited.

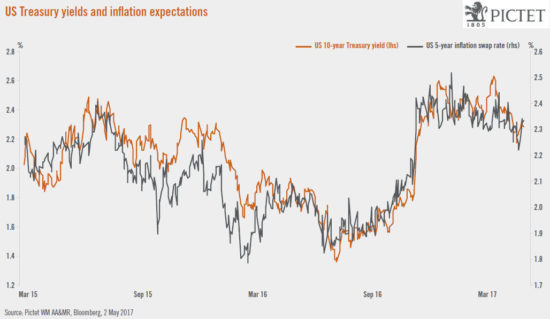

- We expect core sovereign bond yields to rise as economic growth strengthens and inflation expectations pick up.

- Favourable economic fundamentals do not favour buying gold, but a call option on gold offers a way to hedge geopolitical risk.

Currencies

- Although the US dollar’s up-cycle is mature, the greenback should remain strong in 2017.

- With hard Brexit still the most likely scenario and the UK economy starting to suffer, upside potential for sterling is likely limited.

Equities

- Earnings growth has surprised positively and we see good momentum for 2018.

- Positive profit margin momentum in Europe supports our overweight in European equities.

- The strong performance of European equities also supports our view that it is better to play EM through DM.

- Peripheral euro area bond spreads could widen on anticipations of ECB tapering, as well as the approach of Italian elections in 2018.

- We continue to favour high yield within fixed income. Although spreads have fallen, they retain some potential to decline further.

Alternatives

- Hedge funds are enjoying significant alpha. Despite the elevated geopolitical risks and high equity valuations, we continue to favour the long/short equity strategy.

- We expect private equity to continue to display attractive returns. The environment is challenging, but there are good opportunities in less obvious places and beyond plain vanilla strategies.

- Valuations, and potentially risk, are high in core real estate. However, there are attractive opportunities elsewhere, including in real estate debt—particularly the mezzanine tranche.