Arguments advanced to support a political position often fail to withstand the slightest scrutiny. Rather, they are meant to make an impression on the impressionable—those who lack the context required to make an evaluation—and draw large numbers of the uninformed to one side of a political debate. Such is the case with libertarian economist Bryan Caplan’s recent article in favor of unrestricted immigration, wherein he uses the United Arab Emirates as a supposed template for open borders policy.As an Arabic speaker and former resident of the UAE—I lived and worked there for five years, managing a large portfolio of hotel investments owned by the sovereign wealth fund of Dubai—I have a particular context that Caplan does not, having only passed through on his way

Read More »Articles by Artis Shepherd

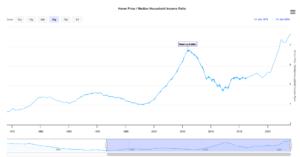

Homeownership Is Not the American Dream

September 30, 2024In a recent interview with Bill Maher, Nancy Pelosi discussed a recently proposed California law—Assembly Bill 1840—that aimed to provide taxpayer funds to first-time homebuyers regardless of immigration status. In defense of the proposed law, which was ultimately vetoed by California Governor Gavin Newsom, Pelosi stated that she wanted to help illegal immigrants achieve the “American Dream.”Setting aside the insanity of compelling California taxpayers to fund home loans for illegal immigrants, homeownership is not the American Dream. Politicians propagate this myth, with the help of their crony partners in the banking and housing industries, because it gives government a handy excuse to further entrench itself in a $40 trillion industry, always accruing more

Read More »The Comic Absurdity of a US Sovereign Wealth Fund

September 25, 2024In recent weeks, both candidate Donald Trump and President Biden—via his staff—have expressed support for the idea of a US sovereign wealth fund (“SWF”). An SWF is simply an investment fund run by a national government. Ostensibly, the goals of such a venture are twofold—to increase the wealth of America and its citizens, and to spur innovation in “critical” areas like infrastructure, technology, and medicine.An American SWF is bound to fail on at least these two counts, as the idea of investing funds stolen from Americans in order to increase their prosperity is incoherent, and the federal government is incapable of innovation or excellence in any productive matter.Structural IncompatibilityI was employed by an SWF in the Persian Gulf for several years,

Read More »Why the Crony Class Loves Artificially-Low Interest Rates—And Why You Shouldn’t

September 4, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »How To Destroy an Economy—Kamala’s Housing Plan

August 29, 2024Political analysis is often pointless, given the utter dishonesty with which politicians spew nonsense, especially during an election year. Despite that, I want to zero in specifically on the housing proposals made recently by Kamala Harris—the left’s latest political avatar and presidential candidate.In building the narrative of her candidacy, Kamala has made a slew of recent remarks about things like price gouging, the housing shortage, and apartment rents. According to her, she has a plan to address those issues. What follows is a high-level analysis of her proposed solutions, such as they are currently.Friedman’s Boiling KettleImagine you’re in your kitchen. You have water in a kettle on the stove, on high heat. The water begins a rapid boil, threatening to

Read More »Kamala’s Housing Plan Will Make Housing Even More Expensive

August 29, 2024Political analysis is often pointless, given the utter dishonesty with which politicians spew nonsense, especially during an election year. Despite that, I want to zero in specifically on the housing proposals made recently by Kamala Harris—the left’s latest political avatar and presidential candidate.In building the narrative of her candidacy, Kamala has made a slew of recent remarks about things like price gouging, the housing shortage, and apartment rents. According to her, she has a plan to address those issues. What follows is a high-level analysis of her proposed solutions, such as they are currently.Friedman’s Boiling KettleImagine you’re in your kitchen. You have water in a kettle on the stove, on high heat. The water begins a rapid boil, threatening to

Read More »Why the Crony Class Loves Artificially-Low Interest Rates—And Why You Shouldn’t

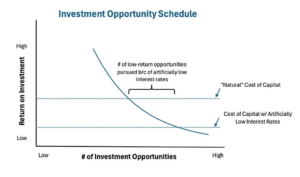

August 29, 2024In our bureaucratically-managed economy, financial prosperity increasingly depends on how close one can position himself to the dissemination of newly-created money. Understanding this critically means identifying the link between this “prosperity” and newly-created money. Since creating money from nothing can’t possibly be productive, or enhance wealth in any real way, there is no direct link to prosperity. The connection must be indirect, and indeed it is.The federal government’s persistent deficit and the Federal Reserve’s inflation policy necessitate continuous money creation. This new money enters the economy unevenly, benefiting early recipients who can spend or invest at current prices. As this money flows into specific sectors or assets, prices rise. Those

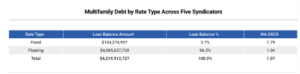

Read More »Are apartment syndicators incompetent or crooked? The answer is yes

July 29, 2024From roughly 2020 to 2022, “syndicators” took over the apartment investment market. During that time, this group of dimwitted rent seekers used bridge loans to finance their apartment acquisitions. At 85% leverage, the bridge loans left only a sliver of equity to raise, for which these syndicators used third parties or online platforms built for anonymous fundraising from average Americans with cash to burn and no place to earn a yield in the zero interest rate environment of the time.To the extent there was a business case underlying these acquisitions, it involved two sets of assumptions. First, that heavy renovations on apartments, financed by additional bridge loan money, would lead to immediate and massive increases in rent. Second, that benchmark interest

Read More »Fear is the mind killer: America’s dangerous obsession with ‘safety’

July 28, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »Biden’s 5% cap on apartment rents: Washington’s latest economic folly

July 22, 2024Recently, the Biden administration introduced plans to limit increases in apartment rents to 5% annually. Far from a straightforward cap, this plan contains various nuances, which I will explain below. Nevertheless, the basic fraud on display here is twofold.First, the state continues to ignore private property rights while manipulating markets with price controls – an attempt to commandeer the market’s fundamental role of price discovery and place it in the hands of bureaucrats.Second, and more to the point, the current regime is trying a desperate political maneuver in an election year – one that will ultimately harm the target audience, but sound the right progressive notes in the meantime.Brief BackgroundOne of the primary benefits of owning rental property is

Read More »Fear Is the Mind Killer: America’s Dangerous Obsession with ‘Safety’

July 16, 2024In modern America, an obsessive fixation on “safety” has given rise to a culture of fear, paralyzing action and warping decision-making across all levels of society. The conditioning begins early, with children trained to be fearful rather than competent in facing challenges or unfamiliar situations. In their formative years, children are inundated with rules and guidelines, ostensibly designed to maintain safety. But this only stunts their adventurous spirit, undercuts the development of real confidence, and provides an excuse to avoid the uncertain striving necessary for growth.Corporations and commercial establishments claim “safety is the highest priority” while failing to understand what that statement entails when taken to its logical extreme. If safety is

Read More »The State Wants to Nationalize Second Mortgages. What Possibly Can Go Wrong?

June 28, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »How Washington and the Fed Caused the Commercial Real Estate Crisis

June 28, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »The State Wants to Nationalize Second Mortgages. What Possibly Can Go Wrong?

June 21, 2024Recently, Freddie Mac, a government-sponsored enterprise, sought approval from its oversight agency, the Federal Housing Finance Agency (FHFA), to purchase and guarantee second mortgages in the United States.While the business case for this proposal is deficient (for an excellent perspective on that, see the article by R. Christopher Whalen), I will discuss the economic and political premises behind this move and its possible consequences.What Does It Mean to “Nationalize Second Mortgages”?Understanding the single-family mortgage market in the US means realizing that there is no market in the real sense of that term. A whopping 70 percent of home mortgages in the US are owned or guaranteed by Freddie Mac and Fannie Mae, the two government-sponsored enterprises

Read More »Scott Galloway’s TED Talk Reveals a Basic Ignorance of Economics

June 18, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »How Washington and the Fed Caused the Commercial Real Estate Crisis

June 17, 2024Mainstream financial news today is replete with stories about “distress” in the commercial real estate market. But what is the precise nature of this distress, and what implications does it have for those outside of the respective industry or asset class? More importantly, what set of factors contributed to the distress, and what does that say about its potential alleviation?Broadly, “distress” in the commercial real estate context refers to the inability of a property, or portfolio of properties, to make required payments on the underlying loan (to “service debt,” in industry terms). There is also physical distress—lack of physical upkeep, accumulation of deferred maintenance, etc.—but the inability to service debt is what’s generally referred to as distress in

Read More »Scott Galloway’s TED Talk Reveals a Basic Ignorance of Economics

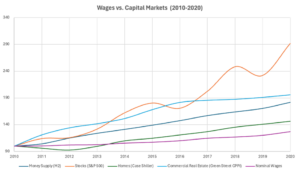

June 3, 2024Scott Galloway, a professor in marketing from New York University and a frequent guest on networks like the execrable CNBC, gave a recent TED talk titled How the US Is Destroying Young People’s Future.With a title like that, you might expect a hard-hitting indictment of the United States regime’s fiscal profligacy, the welfare- and war-state leviathans, and the Federal Reserve’s insistence on robbing Americans by at least 2 percent per year while creating an endless cycle of boom and bust that benefits those proximate to government at the expense of everyone else.You would be sorely disappointed. Galloway gives a roughly fifteen-minute talk steeped in collectivist ethics and confused premises. The result is a mélange of unoriginal, ineffective, and immoral

Read More »Hair of the Dog — Progressives in Congress Need Another Hit of Low Interest Rates

April 9, 2024Bernie Sanders, Elizabeth Warren, and the Congressional Progressive Caucus recently sent an open letter to the chairman of the Federal Reserve, Jerome Powell, demanding lower interest rates.The letter is full of the economic illiteracy one would expect from progressives, especially those in Congress. For example, it misreads price inflation data and argues that the failure to lower interest rates endangers home affordability and increases income inequality. These assertions are false and easily disproven.Artificially low interest rates lead to more of the same economic sickness—malinvestment, bloated government and personal debt, and a never-ending cycle of boom and bust that enriches the political class while impoverishing the average American.Home

Read More »Apartment Bridge Loans Are Collapsing

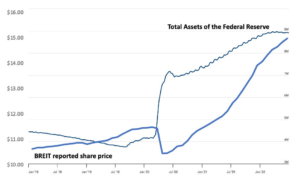

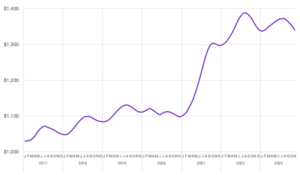

March 6, 2024Stoked by ultra-loose monetary policy from the Federal Reserve, capital markets have been in a persistent bubble for several years. Printing trillions of new dollars and maintaining a zero-interest rate policy (“ZIRP”) was marketed by politicians and bureaucrats as supportive of the “main street economy,” but those trillions were directed primarily towards speculation in capital markets. Nowhere was this malinvestment more apparent than in apartment investing. After rising consistently for several years during the Bernanke-Yellen era, valuations for apartment rental properties reached unthinkable levels in the wake of the covid panic and related monetary splurge of 2020-2021. During this time, syndicators with little or no prior experience in real estate

Read More »Private REITs Hide Commercial Real Estate Distress While Begging for Bailouts

March 4, 2024During the most recent commercial real estate bubble, two things happened in tandem. First, due to the Federal Reserve’s zero interest rate policy, savers were unable to invest their cash at a decent rate of return. Second, prices of illiquid assets inflated in an extreme manner, riding on cheap debt and the rush of investors stretching for yield on their capital.Such was the state of capital markets for several years, as the Obama, Trump, and Biden regimes—along with their counterparts at the Fed—pumped trillions of newly created dollars into the United States economy. Predictably, commercial real estate prices soared, rising to a crescendo in late 2021 to early 2022.Throughout this time, the market for real estate investment trusts (REITs), companies that invest

Read More »Government Prohibitions on Raw Milk Are Ignorant and Dangerous

January 9, 2024Since government regulates nearly everything, it is not surprising that regulations often prohibit the sale and consumption of raw milk. Like many other regulations, these prohibitions reflect political favoritism, not health science.

Original Article: Government Prohibitions on Raw Milk Are Ignorant and Dangerous

[embedded content]

Tags: Featured,newsletter

Read More »Negative Leverage: The Fed’s Latest “Gift” to Apartment Investors

January 9, 2024The Federal Reserve’s inflation of the money supply and interest rate manipulation distort capital markets through, among other things, the creation of asset bubbles. As the cost of borrowing decreases and cheap money floods an economy, speculation in capital markets increases, leading to prices unmoored from fundamentals.

Underlying these asset bubbles is a certain investor psychology—one based on expectations, encouraged by Fed actions over the last thirty-five years—that the Fed will always step in with easy money when asset prices threaten to decline.

Overleveraged speculators caught out by rising interest rates and risky loans are experiencing significant distress. Meanwhile, the apartment market continues to demonstrate dangerously speculative behavior.

Apartment Investment Syndication: A Predictably Unraveling Scheme, Thanks to the Fed

December 11, 2023The apartment investment industry has experienced severe malinvestment over the last several years, resulting in a massive bubble that has only recently begun to deflate with rising interest rates. A tidal wave of easy money—enabled by the Federal Reserve and four consecutive United States administrations, from George W. Bush to Joe Biden—drastically lowered the barriers to entry. As a result, even those with no investment acumen have raised and used other people’s money for complex, high-risk projects like buying, developing, and managing apartment buildings. Bridge loans, a natural outgrowth of enormous amounts of liquidity searching for yield in an environment with a zero-interest rate policy, have facilitated this process. The results should not be surprising,

Read More »