Alien Economics There was, indeed, a time when clear thinking and lucid communication via the written word were held in high regard. As far as we can tell, this wonderful epoch concluded in 1936. Everything since has been tortured with varying degrees of gobbledygook. One should probably not be overly surprised that the abominable statist rag Time Magazine is fulsomely praising Keynes’ nigh unreadable tome. We too suspect that this book has actually lowered the planet-wide IQ – in fact, similar to Marx’ Das Kapital, it has done permanent damage. We have to admit that we have read it ourselves (and what a slog it was!) – contrary to Keynes himself, who once published a scathing critique of Mises’ Theory of Money and Credit without reading even one word of it, we prefer to actually read what those we criticize have published. In the first German edition of the book, Keynes freely admitted that his policy recommendations were probably more useful for a totalitarian State than a free society (i.e., it would be easier to implement them, because of their coercive nature). The biggest problem is though that most of the book is a rehash of hoary inflationist ideas that were already long refuted by the time of its publication.

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Dennis M. Kelleher, Featured, Kenneth Rogoff, Maynard Keynes, newsletter, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Alien EconomicsThere was, indeed, a time when clear thinking and lucid communication via the written word were held in high regard. As far as we can tell, this wonderful epoch concluded in 1936. Everything since has been tortured with varying degrees of gobbledygook.

|

The General Theory of Employment, Interest, and Money. John Keynes Source: abebooks.com - Click to enlarge |

| The fall from grace was triggered by the 1936 publication of John Maynard Keynes’ The General Theory of Employment, Interest and Money. The book is rigorously indecipherable. What’s more, it has the ill-effect of making those who read it dumber [ed note: not all of them we hope! If you possess the required intellectual armor, you may emerge baffled, but still sane and without IQ losses. PT].

Nonetheless, politicians and establishment economists remain enamored with Keynes’ gibberish. For it offers an academic rationale for governments to do what they love to do most – borrow money and spend it on inane programs. In particular, Keynes inter alia advocated filling bottles with money and burying them in coalmines for people to dig up as a way to end unemployment. Somehow, this public works egg hunt would make everyone rich. Over the years, this reasoning has inspired countless government stunts to save the economy from itself. Not long ago, Keynes devotee Paul Krugman took this logic and ran with it to the outer limits of deep space. In the process, he seems to have lost what was left of his mind. According to Krugman, the proper way to propel an economic growth chart up and to the right is to borrow massive amounts of money and spend it preparing for an alien invasion. Naturally, it takes a Nobel Prize winning economist to come up with such nonsense. |

Oh yes, he really did. Here you see Krugman offering up this insane idea in a debate with fellow etatiste Kenneth Rogoff from the monetarist school (which means Rogoff would rather replace deficit spending with loads of money printing and negative interest rates, coupled with a cash ban to prevent people from escaping the well-meaning attentions of central planners). It is a typical utterly pointless “who has the better plan” debate between interventionist academics, except for the fact that Krugman’s proposal is a particularly amusing inanity. This has brought him a lot of well-deserved ridicule over the years and as an added benefit, it has greatly helped in unmasking the “value” of the Sverige Riksbank’s pseudo-Nobel prize for economics, as it demonstrates that complete economic ignorance is not an obstacle to winning it. |

“Better” MarketsUnfortunately, Keynes’ drivel became the archetype for illogical economic thought, and continues to infect economic discourse to this day. You can hardly browse the headlines of Yahoo finance without your eyeballs being lacerated by it. Just this week, for instance, we came across a headline titled, The Coming Trump Financial Crash. The author, Dennis M. Kelleher, happens to be President and CEO of the oddly named company Better Markets. The company website clarifies that Better Markets is “a nonprofit that promotes the public interest in the financial markets.” What exactly this Washington, D.C. based nonprofit does – or how they keep the lights on – is unclear. But what is clear is that Kelleher is very comfortable applying words and terms to construct sentences with haphazard syntax. Kelleher also seems panicked that financial deregulation by Trump is going to cause a big crash:

Do you follow the logic? |

Dennis Kelleher, who used to be a firefighter in the US air force, is CEO of “Better Markets” these days (the pay is presumably better). While we haven’t followed the activities of this “think tank”, it is a good bet that when someone is advocating for “better” markets, he doesn’t actually mean free markets. Screenshot via C-Span - Click to enlarge |

Don’t Blame Trump When the World EndsHere at the Economic Prism we think Kelleher is giving President Trump too much credit for what he can and can’t do. We agree a stock market crash is eventually in the cards. Unlike Kelleher, when the crash does inevitably come, we don’t think the fingers of blame should be pointed at President Trump. |

|

| Regulations, which Kelleher advocates, don’t get at the core of the problem. Rather, the core of the problem is that today’s fiat money system is completely out of control. Until something is done about it, we will continue to experience epic asset bubbles and busts.

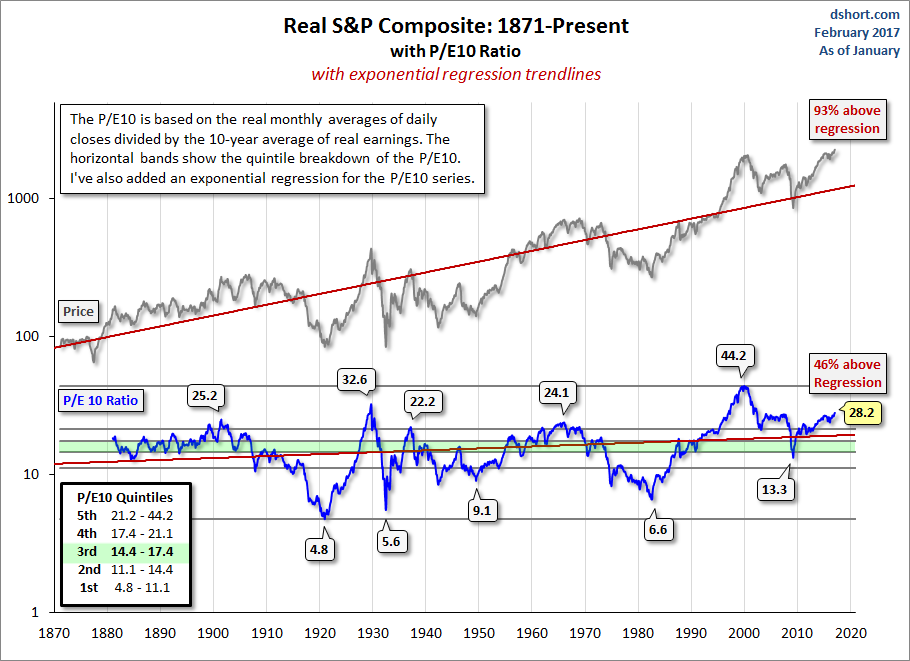

President Trump’s efforts to ease corporate tax policy or financial regulations are small potatoes compared to the destructive market whipsaws that come with rampant credit creation. Offshore corporate coffers would’ve never been stuffed so full if we had sound money with honest limits. You may love the man. You may hate him. But the fact is, President Trump has been dealt the worst hand of any incoming U.S. President since James Buchanan – or maybe ever. He is taking over at a time when the national debt has experienced exponential growth for over 45 years. The national debt was under $400 billion when Tricky Dick Nixon closed the gold window in 1971. Today it’s nearly $20 trillion. In short, the debt curve is entering a hyperbolic state. No amount of monetary gas will be able to propel it straight up forever. Of course, when you tack on unfunded liabilities, like social security, prescription drugs, and medicare, the debt runs up to a breathtaking $104.6 trillion. Each taxpayer is on the hook for over $874,800. At the same time, the stock valuations are at nose bleed heights. The Shiller’s Cyclically Adjusted Price Earnings (CAPE) ratio, for instance, is currently 28.5. That’s 70 percent higher than the CAPE’s long-term historical average. |

Real S&P Composite The Shiller P/E ratio, a.k.a. CAPE (cyclically adjusted P/E) or P/E-10. The US stock market has rarely been as overvalued as it is today. We should add here, in terms of the valuation of the median stock (as opposed to the capitalization-weighted valuation that is the basis of the Shiller P/E), the market is currently at the by far most overvalued levels in all of history. In fact, it matters little which valuation measures one looks at (Tobin’s Q, market cap vs. retail money funds, market ap vs. GDP, etc., etc.), all of them are in extreme territory relative to their history. So yes, a stock market crash is an inescapable certainty, only the timing and the level from whence it will begin are open to question - Click to enlarge |

| In addition, there have only been two occasions over the last 100 years that saw the CAPE at a higher valuation than today. One was during the late 1920s, right before the stock market crash. The other was the late 1990s, just prior to the popping of the internet bubble.

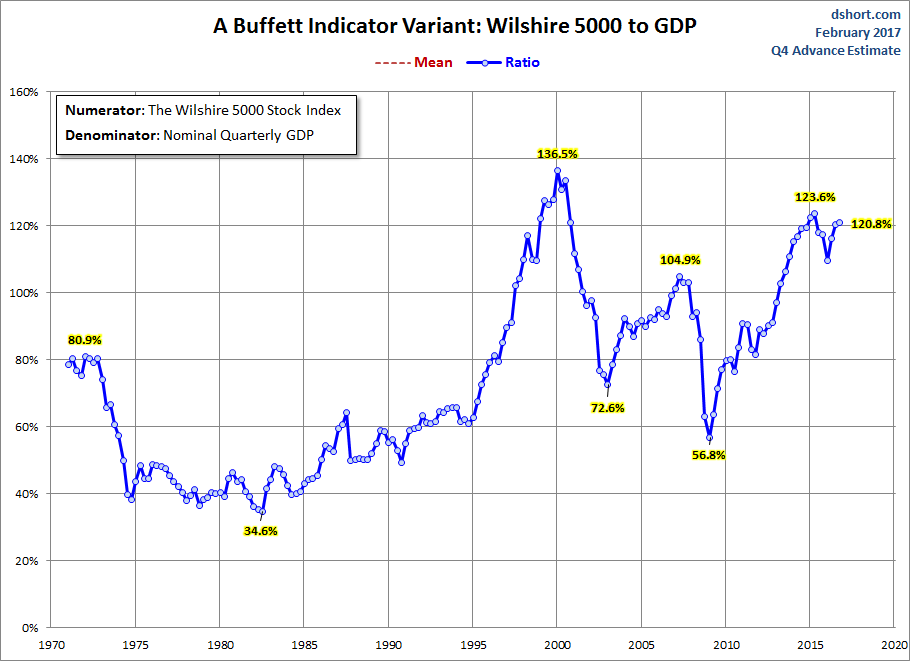

Similarly, the Buffett indicator, which is a ratio of the total market capitalization over gross domestic product, also shows that stocks are significantly overvalued. The ratio currently stands at about 126 percent. A fairly valued market is a ratio somewhere between 75 and 90 percent. Anything above 115 percent is considered significantly overvalued. The point is a century of scientific mismanagement of the currency has pushed the economic, financial, and social order well past any rational limit. Total government debt and stock valuations are at all-time extremes. Something big is coming. You can guarantee it. But don’t blame Trump when the world ends. There ain’t a doggone thing he or anyone else can do to stop it. Charts by: Doug Short/ AdvisorPerspectives Chart and image captions by PT |

Buffett Indicator Variant An interesting variant of the “Buffett indicator” – the market capitalization of the Wilshire 5000 Index (which essentially captures the entire market) vs. GDP. As can be seen, since 1970 the market was only more overvalued at the peak of the tech mania in 2000 (which was followed by an 82% crash in the Nasdaq over the next two years) - Click to enlarge |

Tags: Dennis M. Kelleher,Featured,Kenneth Rogoff,Maynard Keynes,newsletter,On Economy,On Politics