Summary:

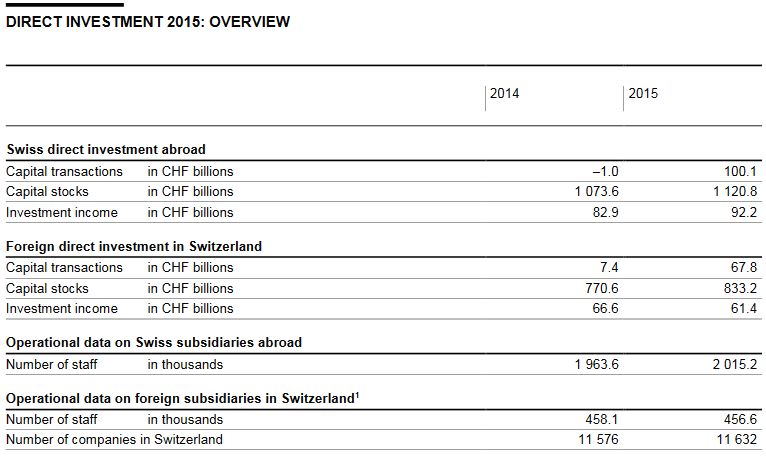

Swiss direct investment abroad Companies domiciled in Switzerland invested CHF 100 billion abroad, compared with disinvestment of CHF 1 billion the year before. Thus, Swiss direct investment abroad was significantly above the average for the past ten years. At CHF 54 billion, over half of the investment was made by finance and holding companies (2014: CHF 3 billion). Substantial fluctuations in direct investment by this category are not unusual and can often be attributed to group reorganisation, as was also the case in the year under review. Companies in the trade category invested CHF 27 billion abroad, primarily in the form of loans to affiliated companies. Direct investment by manufacturing amounted to CHF 12 billion, which was mainly attributable to the companies concerned reinvesting profits in their subsidiaries abroad. Manufacturing also made considerable acquisitions abroad, though withdrew similar amounts from subsidiaries in the same period. Companies in Switzerland invested CHF 77 billion in Europe. As in 2014, investment flowed into the EU holding locations of Ireland, the Netherlands and Luxembourg, but also into France. Outside Europe, Asia was the most important investment destination. Domestic companies also invested in Australia, North America and Africa.

Topics:

Swiss National Bank considers the following as important: Featured, newslettersent, SNB, SNB Press Releases

This could be interesting, too:

Swiss direct investment abroad Companies domiciled in Switzerland invested CHF 100 billion abroad, compared with disinvestment of CHF 1 billion the year before. Thus, Swiss direct investment abroad was significantly above the average for the past ten years. At CHF 54 billion, over half of the investment was made by finance and holding companies (2014: CHF 3 billion). Substantial fluctuations in direct investment by this category are not unusual and can often be attributed to group reorganisation, as was also the case in the year under review. Companies in the trade category invested CHF 27 billion abroad, primarily in the form of loans to affiliated companies. Direct investment by manufacturing amounted to CHF 12 billion, which was mainly attributable to the companies concerned reinvesting profits in their subsidiaries abroad. Manufacturing also made considerable acquisitions abroad, though withdrew similar amounts from subsidiaries in the same period. Companies in Switzerland invested CHF 77 billion in Europe. As in 2014, investment flowed into the EU holding locations of Ireland, the Netherlands and Luxembourg, but also into France. Outside Europe, Asia was the most important investment destination. Domestic companies also invested in Australia, North America and Africa.

Topics:

Swiss National Bank considers the following as important: Featured, newslettersent, SNB, SNB Press Releases

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Swiss direct investment abroadCompanies domiciled in Switzerland invested CHF 100 billion abroad, compared with disinvestment of CHF 1 billion the year before. Thus, Swiss direct investment abroad was significantly above the average for the past ten years. At CHF 54 billion, over half of the investment was made by finance and holding companies (2014: CHF 3 billion). Substantial fluctuations in direct investment by this category are not unusual and can often be attributed to group reorganisation, as was also the case in the year under review. Companies in the trade category invested CHF 27 billion abroad, primarily in the form of loans to affiliated companies. Direct investment by manufacturing amounted to CHF 12 billion, which was mainly attributable to the companies concerned reinvesting profits in their subsidiaries abroad. Manufacturing also made considerable acquisitions abroad, though withdrew similar amounts from subsidiaries in the same period.

Companies in Switzerland invested CHF 77 billion in Europe. As in 2014, investment flowed into the EU holding locations of Ireland, the Netherlands and Luxembourg, but also into France. Outside Europe, Asia was the most important investment destination. Domestic companies also invested in Australia, North America and Africa. Capital was withdrawn from Central and South America, however.

Stocks of direct investment abroad increased by CHF 47 billion (4%) to CHF 1,121 billion. The increase arising from transactions was offset by exchange rate losses following the discontinuation of the minimum exchange rate by the Swiss National Bank (SNB). At CHF 393 billion, finance and holding companies reported the highest capital stocks abroad by far, followed by chemicals and plastics, at CHF 169 billion.

Income from direct investment abroad continued to increase – from CHF 83 billion to CHF 92 billion – driven mainly by higher income from finance and holding company subsidiaries. Investment income from subsidiaries in manufacturing attained the same level as the previous year.

|

Direct Investment 2015: Switzerland Swiss direct investment abroad, Foreign Investment in Switzerland, Swiss subsidiaries abroad Source: snb.ch - Click to enlarge |

Foreign direct investment in Switzerland

Foreign countries invested CHF 68 billion in companies in Switzerland (2014: CHF 7 billion), CHF 44 billion of which flowed into finance and holding companies. CHF 13 billion was invested in manufacturing and the same amount in companies in the trade category. In the case of finance and holding companies and the trade category, a considerable number of transactions were related to group reorganisation, while acquisitions were of particular importance in manufacturing. Domestic investment took the form of equity capital and reinvested earnings. By contrast, foreign investors withdrew funds from subsidiary companies in Switzerland in the form of intragroup lending.

Stocks of foreign direct investment in Switzerland climbed by CHF 62 billion, or 8%, to CHF 833 billion. A breakdown by immediate investor shows that 78% of the capital stocks originate from investors in the EU and 12% from investors in the US. The breakdown by immediate investor, however, only partially shows the countries of origin for investors which control companies in Switzerland. This is due to the fact that the stocks of foreign direct investment in Switzerland are largely held via intermediate companies controlled by groups headquartered in a third country. For this reason, the SNB publishes an alternative breakdown of capital stocks by country of origin of the ultimate beneficial owner. This breakdown reveals that investors from the EU and the US controlled 42% and 37% of capital stocks respectively.

Investment income from foreign direct investment in Switzerland fell from CHF 67 billion to CHF 61 billion. The decisive factor in this decrease was the lower earnings for finance and holding companies as well as for banks.

Operational data on multinational companies

In their subsidiaries abroad, Swiss companies employed a total of 2,015,000 people, of whom 853,000 (42%) were in Europe and 538,000 (27%) were in Asia. The number of people employed advanced by 51,000, or 3%, compared with the previous year. The increase in Europe is roughly in line with the average for the last ten years; it is above average in America and Africa and considerably lower in Asia.

In 2015, 457,000 people were employed by foreign-controlled companies in Switzerland, approximately 1,000 fewer than the year before. This is around 9% of all people employed in the manufacturing and services sectors in Switzerland. These employees were spread across approximately 11,600 foreign-controlled companies, corresponding to slightly more than 2% of all companies in the manufacturing and services sectors. A total of 73% of these companies were controlled by investors from the EU, with Germany being by far the most important country of origin (22%).

Availability and revision of data

Comprehensive tables on direct investment and operational data for multinational companies are available on the SNB’s data portal (data.snb.ch) under ‘International economic affairs’. The data can be accessed in the form of configurable tables and are currently available for 1998 to 2015. Following a one-year interruption to the series, the publication of the

Direct Investment report for 2015 means that operational data for domestic parent companies as well as the number of companies with foreign majority participation are now available again. Both tables will be published on the data portal for the first time. Information on methods used is also available under ‘Notes – International economic affairs’.

The publication of the Direct Investment report for 2015 contains the usual revision of the previous year’s figures (for 2014) as well as a revision of figures from 2011 to 2013. These revisions are usually as a result of relevant data on business transactions or group structures concerning the respondent companies only becoming available after the previous year’s report has gone to press. Of the revisions made to the 2014 figures, capital stocks in finance and holding companies (both investment directions) as well as the other manufacturing and construction category (foreign) and trade category (domestic) were the most affected.

Tags: Featured,newslettersent