Summary:

Without the stimulus of ever-rising credit, the global economy craters in a self-reinforcing cycle of defaults, deleveraging and collapsing debt-based consumption.

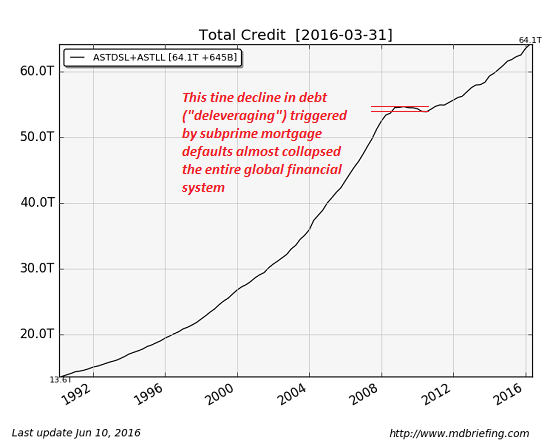

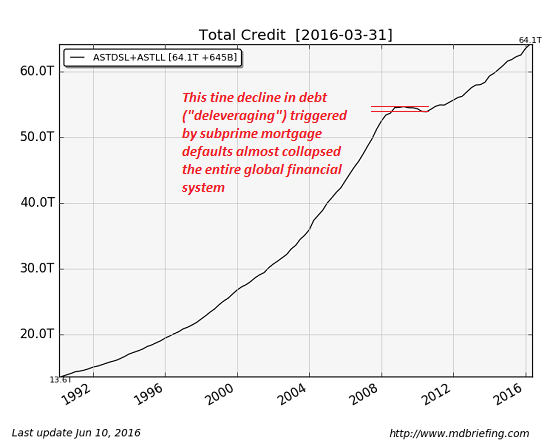

In an economy based on borrowing, i.e. credit a.k.a. debt, loan defaults and deleveraging (reducing leverage and debt loads) matter. Consider this chart of total credit in the U.S. Note that the relatively tiny decline in total credit in 2008 caused by subprime mortgage defaults (a.k.a. deleveraging) very nearly collapsed not just the U.S. financial system but the entire global financial system.

Every credit boom is followed by a credit bust, as uncreditworthy borrowers and highly leveraged speculators inevitably default. Homeowners with 3% down payment mortgages default when one wage earner loses their job, companies that are sliding into bankruptcy default on their bonds, and so on. This is the normal healthy credit cycle.

Total Credit ASTDSL + ASTLLTotal Credit ASTDSL + ASTLL – click to enlarge.

Bad debt is like dead wood piling up in the forest. Eventually it starts choking off new growth, and Nature’s solution is a conflagration–a raging forest fire that turns all the dead wood into ash. The fire of defaults and deleveraging is the only way to open up new areas for future growth.

Topics:

Charles Hugh Smith considers the following as important:

Debt and the Fallacies of Paper Money,

Featured,

Federal Reserve,

newslettersent

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Without the stimulus of ever-rising credit, the global economy craters in a self-reinforcing cycle of defaults, deleveraging and collapsing debt-based consumption.

| In an economy based on borrowing, i.e. credit a.k.a. debt, loan defaults and deleveraging (reducing leverage and debt loads) matter. Consider this chart of total credit in the U.S. Note that the relatively tiny decline in total credit in 2008 caused by subprime mortgage defaults (a.k.a. deleveraging) very nearly collapsed not just the U.S. financial system but the entire global financial system.

Every credit boom is followed by a credit bust, as uncreditworthy borrowers and highly leveraged speculators inevitably default. Homeowners with 3% down payment mortgages default when one wage earner loses their job, companies that are sliding into bankruptcy default on their bonds, and so on. This is the normal healthy credit cycle. |

Total Credit ASTDSL + ASTLL Total Credit ASTDSL + ASTLL – click to enlarge.

|

Bad debt is like dead wood piling up in the forest. Eventually it starts choking off new growth, and Nature’s solution is a conflagration–a raging forest fire that turns all the dead wood into ash. The fire of defaults and deleveraging is the only way to open up new areas for future growth.

Unfortunately, central banks have attempted to outlaw the healthy credit cycle.In effect, central banks have piled up dead wood (debt that will never be paid back) to the tops of the trees, and this is one fundamental reason why global growth is stagnant.

The central banks put out the default/deleveraging forest fire in 2008 with a tsunami of cheap new credit. Central banks created trillions of dollars, euros, yen and yuan and flooded the major economies with this cheap credit.

They also lowered yields on savings to zero so banks could pocket profits rather than pay depositors interest. This enabled the banks to rebuild their cash and balance sheets– at the expense of everyone with cash, of course.

Having unleashed tens of trillions of dollars in new credit since 2008, the central banks have simply increased the likelihood and scale of the coming default conflagration. Now the amount of deadwood that’s piled up is many times greater than it was in 2008.

Very few observers explore what happens after defaults start cascading through the system. Defaults mean loans and bonds won’t be paid back. The owners of the bonds and debt (mortgages, auto loans, etc.) will have to absorb massive losses.

Recall that banks rarely own the debt they originate: mortgages and auto loans are bundled and sold to investors such as pension funds, insurance companies, mutual funds, etc. So banks aren’t the only institutions at risk: every institutional owner of debt-based assets is at risk.

Two things happen in a default/deleveraging conflagration. One is that lenders get very wary of lending more money to anyone or any entity other than those with the lowest-risk profiles. That constricts lending to the bottom 95% who are already over-indebted.

Please note the Federal Reserve and other central banks cannot force banks to lend to uncreditworthy borrowers. Low interest rates puts additional burdens on lenders: why issue a loan to a risky borrower when the yield on the loan is so meager?

The second thing that happens is that owners of debt-based, interest-bearing assets such as mortgages and bonds not only lose the principal that will never be paid back–they also lose the future income stream. So let’s say a pension fund owns $1 million in auto loans that default. The fund must book that loss on their balance sheet as a $1 million reduction in assets.

But the truly devastating hit is to future earnings. All the interest that would have been collected on those loans also vanishes. Now the fund has two losses to book: a loss in assets and a loss in future earnings.

At today’s low rates around 4%, over the course of a 30-year mortgage, borrowers end up paying around 100% of the initial mortgage as interest on the original mortgage: in other words, the borrowers pay $200,000 over the 30 year period: $100,000 in interest and repaying the $100,000 principal.

So a fund doesn’t just lose 100% of the loan principal–it loses all the interest income it was counting on.

Where is the fund going to find high-yielding, low-risk debt-based assets to replace the ones lost to default? There won’t be any such assets available: the only debt that will be available will be zero-interest (or negative-interest) rate sovereign bonds that pay no interest at all. Since lenders have no incentive to make low-interest loans to borrowers at a high risk of default in a global recession, debt issuance dries up.

Without the stimulus of ever-rising credit, the global economy craters in a self-reinforcing cycle of defaults, deleveraging and collapsing debt-based consumption.

Recent interviews:

My new book is #9 on Kindle short reads -> politics and social science For more, please visit the

book's website.