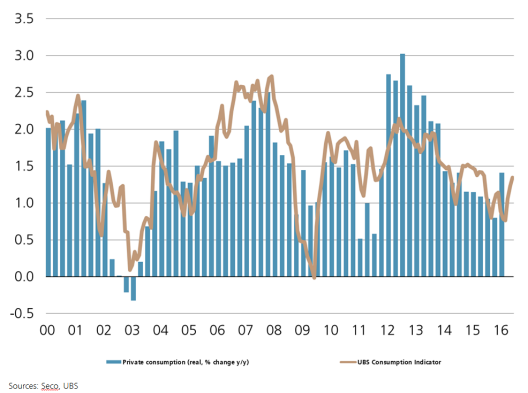

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. In June, the UBS consumption indicator rose from 1.24 to 1.34 points. This was mainly due to a better performance in the tourism industry as well as a slight improvement in sentiment in the retail trade. However, the situation in the labor market is still strained and is weighing on consumer sentiment. Zurich, 27 July 2016 – The rise in the UBS consumption indicator in June from 1.24 to 1.34 points continues to point to an upward trend in Swiss private consumption. The situation in domestic tourism appears to be normalizing. The number of overnight stays in hotels rose by 1.3% in May compared to the previous year, though this was mainly due to domestic visitors, who made up 60% of the additional overnight stays. Furthermore, a slight improvement in the retail industry has also became apparent – despite the recent hefty fall of almost 10% year-on-year in clothing and shoe store revenue, combined with the ongoing exchange rate headwind. The KOF survey result for the retail industry rose to -9 index points from -10 index points in May, suggesting cautious optimism. Private consumption vs.

Topics:

UBS Switzerland AG considers the following as important: Featured, newsletter, Private Consumption, Swiss Macro, Switzerland Private Consumption, UBS Consumption Indicator

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

In June, the UBS consumption indicator rose from 1.24 to 1.34 points. This was mainly due to a better performance in the tourism industry as well as a slight improvement in sentiment in the retail trade. However, the situation in the labor market is still strained and is weighing on consumer sentiment.

Zurich, 27 July 2016 – The rise in the UBS consumption indicator in June from 1.24 to 1.34 points continues to point to an upward trend in Swiss private consumption. The situation in domestic tourism appears to be normalizing. The number of overnight stays in hotels rose by 1.3% in May compared to the previous year, though this was mainly due to domestic visitors, who made up 60% of the additional overnight stays. Furthermore, a slight improvement in the retail industry has also became apparent – despite the recent hefty fall of almost 10% year-on-year in clothing and shoe store revenue, combined with the ongoing exchange rate headwind. The KOF survey result for the retail industry rose to -9 index points from -10 index points in May, suggesting cautious optimism.

Private consumption vs. UBS Consumption IndicatorPrivate consumption grew in the first quarter at an annualized rate of 2.8%. This was a significant improvement over the previous quarter and supported Switzerland’s economic growth. Even though private consumption may well continue to be a strong supporting pillar of growth over the rest of the year, it is unlikely that it will be able to maintain the strong growth rate of the first quarter. The strained situation on the labor market, along with lower immigration levels, is preventing more dynamic consumption growth. |

How the UBS Consumption Indicator is calculated

The UBS Consumption Indicator signals private consumption trends in Switzerland with a lead time of one to three months on the official figures. At more than 50%, private consumption is by far the most important component of Swiss GDP. UBS calculates this leading indicator from six consumer-related parameters: new car registrations, business activity in the retail sector, the number of domestic overnight hotel stays by Swiss residents, the consumer sentiment index, employment figures and credit card transactions made via UBS at points of sale in Switzerland. With the exception of the consumer sentiment index and employment figures, all of this data is available monthly.