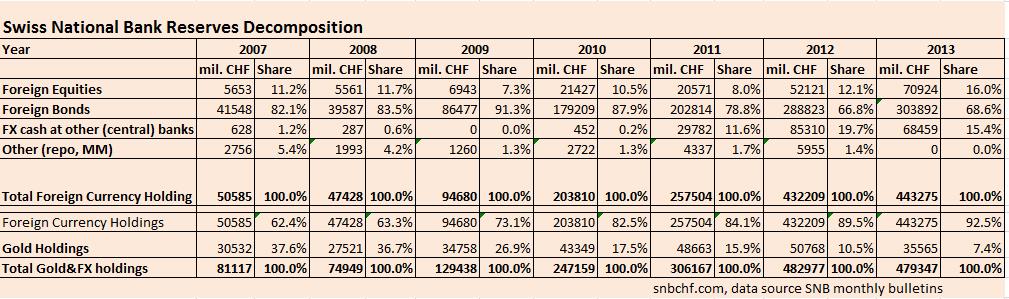

The SNB increased the equities share from 18% to 20% in Q1/2016. Purchases focused on US equities.It raised holdings in U.S. Equities 32 percent in the first Q1 2016, from .3 billion at the end of last year. The S&P 500 rose 0.8 percent over that period. This makes obvious that the central bank goes higher risk. The first risk is the risk on equities, the second one is the dollar that is currently quite expensive. Main Positions: Swiss National Bank, 2007-2013 Still in 2009, the SNB had an equities share of 7.3%. With rising stock prices and more purchases, the share rose to 16% in 2013 and 18% in 2014.In 2016, they continued purchases and the share of equities attained 20%. via Bloomberg SNB Share of Apple, Microsoft, Exxon rises more than the share of rest of the U.S. Market The SNB increased holdings of the U.S. market by 32%. Even if the SNB claims that it has a passive investment strategy, there are some irregularities, maybe caused by investment timing. The number of shares it held in the Apple maker increased 40 percent, while its stake in the software-producer rose 41 percent and that in the oil explorer 38 percent. Unlike many other major central banks, the SNB invests in equities, with 20 percent of its 576.5 billion-franc (3 billion) foreign-exchange portfolio held in shares as of the end of March.

Topics:

George Dorgan considers the following as important: Featured, newsletter, SNB, SNB, George Dorgan's opinion

This could be interesting, too:

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

investrends.ch writes Schweizer Firmen ziehen wieder Investitionen aus dem Ausland ab

investrends.ch writes Die Zurückhaltung der SNB wird mehrheitlich begrüsst

investrends.ch writes Schweizer Inflation fällt etwas stärker als gedacht

The SNB increased the equities share from 18% to 20% in Q1/2016. Purchases focused on US equities.

It raised holdings in U.S. Equities 32 percent in the first Q1 2016, from $41.3 billion at the end of last year. The S&P 500 rose 0.8 percent over that period.

This makes obvious that the central bank goes higher risk. The first risk is the risk on equities, the second one is the dollar that is currently quite expensive.

via Bloomberg

SNB Share of Apple, Microsoft, Exxon rises more than the share of rest of the U.S. Market

The SNB increased holdings of the U.S. market by 32%.

Even if the SNB claims that it has a passive investment strategy, there are some irregularities, maybe caused by investment timing.

The number of shares it held in the Apple maker increased 40 percent, while its stake in the software-producer rose 41 percent and that in the oil explorer 38 percent.

Unlike many other major central banks, the SNB invests in equities, with 20 percent of its 576.5 billion-franc ($603 billion) foreign-exchange portfolio held in shares as of the end of March. That’s a 2 percentage point increase from the end of December. Spokesman Walter Meier at the SNB declined to comment on Wednesday’s SEC filing, which is the only detailed disclosure of the central bank’s stock holdings. It showed the institution had stakes in some 2,600 companies listed in the U.S.

SNB officials have said repeatedly that they replicate broad-based indexes to serve the interest of monetary policy rather than to generate a profit. Some companies are excluded on ethical grounds.

“The SNB adopts a passive approach,” SNB Governing Board Member Andrea Maechler said in a speech on March 31. “This means, in particular, that we do not actively engage in equity selection”