Headlines Week January 23, 2017 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro during the weak inflation period. The last ECB meeting showed that the...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Week December 09, 2016 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. Last week’s ECB meeting showed that the ECB might be dovish for a...

Read More »Swiss Franc Trade-Weighted Index, Performance Far Worse than Dollar Index

The Swiss Franc index is the trade-weighted currency performance 2016: Update On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar strongly improved. Swiss Franc Index 2009-2012 The CHF Trade-Weighted Index (click link on Unciatrends) shows how the Swissie...

Read More »SNB intervenes for 6.3 billion francs in one week, total 10bn Brexit intervention

Interventions:The SNB intervenes for 6.3 bn francs in the week ending last Friday, the week one after Brexit. Already on Day One , the SNB intervened for an estimated 3-4 bn francs This is once again the a new weekly high since the end of the EUR/CHF peg in January 2015. Seven billion sight deposits come from Swiss banks, when fearful investors moved their money on Swiss bank accounts. FX: Unexpectedly for us, the SNB...

Read More »SNB Intervenes during Brexit Turmoil

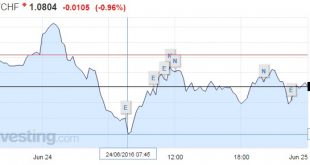

SNB interventions During the Brexit turmoil on Friday, the Swiss National Bank has intervened in markets. Just after they got into the office, at 7.45 am CET, they started the interventions. Apparently the Singapore office did not have a mandate to do interventions. The central bank drove the EUR/CHF price from a low of 1.0646 towards 1.08. FX traders might have moved it higher to 1.0850. We do not think that the...

Read More »Purchasing Power Parity, REER: Swiss Franc Overvalued?

After the strong revaluation of the Swiss franc in recent years, some economists, like the ones at the Swiss National Bank (SNB), claim that the franc were overvalued. Finally this claim is propaganda, because it is based on a not usable models (the REER and purchasing power parity) and wrong assumptions. The mistakes Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or...

Read More »SNB Increased Equities Share from 18 to 20% with Purchases

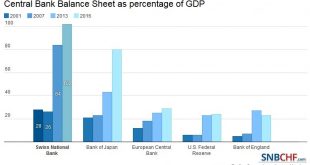

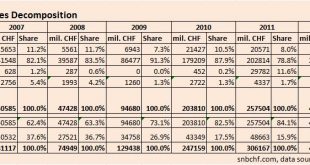

The SNB increased the equities share from 18% to 20% in Q1/2016. Purchases focused on US equities.It raised holdings in U.S. Equities 32 percent in the first Q1 2016, from $41.3 billion at the end of last year. The S&P 500 rose 0.8 percent over that period. This makes obvious that the central bank goes higher risk. The first risk is the risk on equities, the second one is the dollar that is currently quite expensive. Main Positions: Swiss National Bank, 2007-2013 Still in 2009, the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org