The price of household goods for Swiss consumers rose 3.4% in June compared to the same month last year, led by the surging cost of fuel and heating oil. “Inflation, which has de facto been absent for more than a decade, is back with a vengeance,” said economic forecast group BAK Economics. “However, this is no reason for inflation or stagflation [rising prices combined with slower economic output] panic.” BAK Economics is confident that a number of factors will slow annual inflation to 2.7% in Switzerland. These include interest rate hikes, moderate salary increases and an easing of the supply logjams that have plagued the global economy since the ending of Covid-19 lockdowns. “The first signs of a demand-related easing on the price front are already appearing

Topics:

Swissinfo considers the following as important: 1) SNB and CHF, 3) Swiss Markets and News, 3.) Swissinfo Business and Economy, Business, Featured, newsletter

This could be interesting, too:

RIA Team writes The Benefits of Starting Retirement Planning Early in Your Career

Swissinfo writes Swiss residential real estate to remain in demand in 2025

Thomas J. DiLorenzo writes Stakeholder Capitalism and the Corporate KPI Cult

Swissinfo writes Parliament stalemate on abolishing Swiss homeowner tax

The price of household goods for Swiss consumers rose 3.4% in June compared to the same month last year, led by the surging cost of fuel and heating oil.

“Inflation, which has de facto been absent for more than a decade, is back with a vengeance,” said economic forecast group BAK Economics. “However, this is no reason for inflation or stagflation [rising prices combined with slower economic output] panic.”

BAK Economics is confident that a number of factors will slow annual inflation to 2.7% in Switzerland. These include interest rate hikes, moderate salary increases and an easing of the supply logjams that have plagued the global economy since the ending of Covid-19 lockdowns.

“The first signs of a demand-related easing on the price front are already appearing visible. A downward movement has already been observed for some commodities recently,” it said.

The core rate of inflation, minus energy and fuel costs, was 1.9% in June, said the Federal Statistical Office (FSO) on MondayExternal link.

Nevertheless, June’s inflation hike is the strongest since 1993. But the headline rate is still below that seen in the United States and the eurozone (8.6%). This is because the strong franc gives importers greater purchasing power and Switzerland’s hydropower network means the Alpine state is less dependent on imported gas and oil than neighbouring countries, such as Germany.

However, the monthly rate is still above the central bank’s 2% target rate, forcing the Swiss National Bank (SNB) to raise interest rates by half a percentage point last monthExternal link. The SNB expects inflation to hit 2.8% for the whole year and economists expect further interest rate hikes in the coming months.

Property prices stable

The SNB has also slowed the volume of foreign currencies it purchasesExternal link to prevent the franc from appreciating too much. This signals that the SNB is more prepared to allow the franc to retain its strength against other currencies to fight inflation.

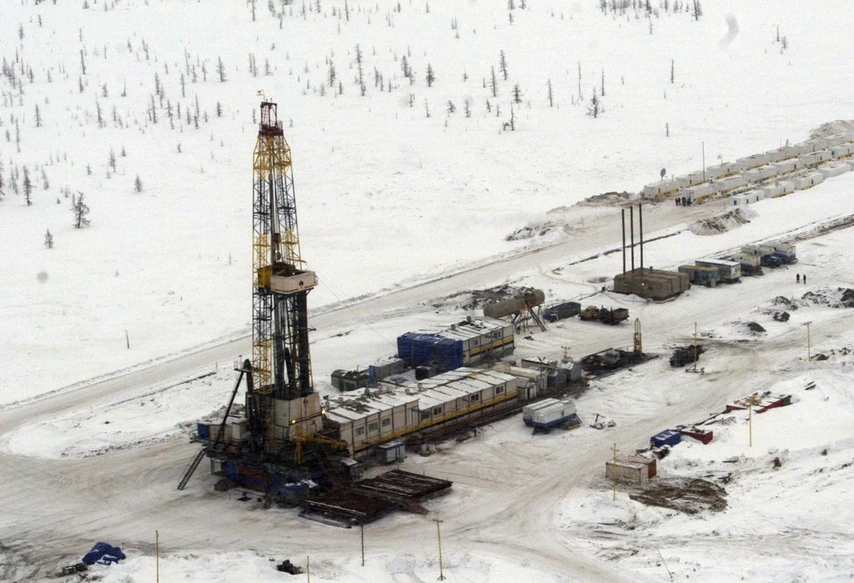

The price of all imported goods rose 8.5% last month, says the FSO. According to the latest figures, petroleum products were 48.4% more expensive in June this year compared to the same month in 2021. The cost is passed onto consumers at petrol stations – with the cost of transport rising 13%.

Heating oil, used to heat many Swiss homes, is among the ‘Energy and Fuels’ products that have risen in cost by nearly 30%. The Swiss energy regulator has already warned households to expect energy bill increasesExternal link of up to 47% next year.

Fruit and vegetables were among the “non-durable” goods that also saw a significant increase in price.

The property market has yet to feel the effects of inflation, with offers for apartments rising just 1.1% in June and 0.3% for family homes, according to SMG Swiss Marketplace Group and the real estate consultancy IAZI.

Rising interest rates will continue to keep prices in check, the real estate experts say, along with an increase in heating costs.

Tags: Business,Featured,newsletter