(Disclosure: Some of the links below may be affiliate links) Since the beginning of 2019, Swiss investors cannot buy Exchanged Traded Funds (ETFs) domiciled in the United States from my previous broker, DEGIRO. This event is terrible news for Swiss investors. This problem is due to new regulations that will come into play. These regulations already affected all European investors since 2018. But Switzerland was not affected before. We are going to see what changed. These issues are based on several European and Swiss laws. These laws are sad news for European investors and Swiss investors. I am not a legal expert at all. So this is only my interpretation of these laws. If I am wrong or I missed something, please let me know! Normally, this should only come into effect in January 2022.

Topics:

Mr. The Poor Swiss considers the following as important: Investing, Switzerland

This could be interesting, too:

Lance Roberts writes Yardeni And The Long History Of Prediction Problems

Michael Lebowitz writes The MACD: A Guide To This Powerful Momentum Gauge

Lance Roberts writes Exuberance – Investors Have Rarely Been So Optimistic

Lance Roberts writes Exuberance – Investors Have Rarely Been So Optimistic

(Disclosure: Some of the links below may be affiliate links)

Since the beginning of 2019, Swiss investors cannot buy Exchanged Traded Funds (ETFs) domiciled in the United States from my previous broker, DEGIRO. This event is terrible news for Swiss investors.

This problem is due to new regulations that will come into play. These regulations already affected all European investors since 2018. But Switzerland was not affected before. We are going to see what changed. These issues are based on several European and Swiss laws. These laws are sad news for European investors and Swiss investors. I am not a legal expert at all. So this is only my interpretation of these laws. If I am wrong or I missed something, please let me know!

Normally, this should only come into effect in January 2022. But DEGIRO decided to implement this earlier, effectively cutting Swiss Investors from the best ETFs available. I have now switched to Interactive Brokers.

In this post, we are going to see why this is happening. And we are also going to see what are the different options for us. There are several possible solutions to this issue. But none of them is perfect, as we will see.

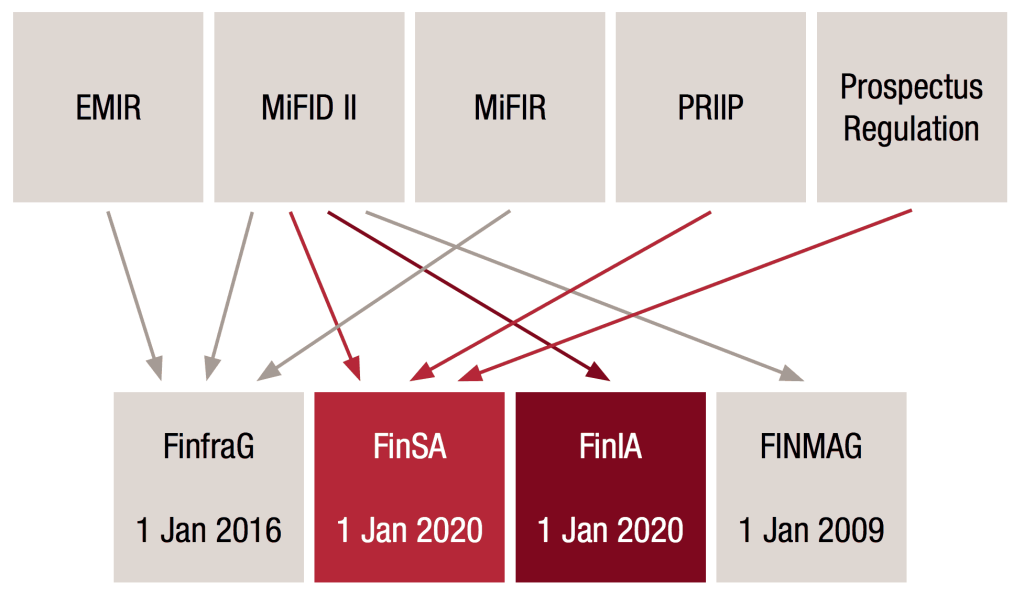

PRIIPs Regulation for European investors

It all started in January 2018, when PRIIPs regulations entered into effect. PRIIPS is a part of the bigger Markets in Financial Instruments Directive (MiFID) II law. PRIIPs or Packaged Retail and Insurance-based Investment Products is a regulation that is supposed to protect investors. I am not going to go into details about the law.

I am only going to focus on the part that is the problem now. These regulations enforce that all funds provide a so-called Key Investor Document (KID). This document must give some information about the funds and some standardized advice and recommendations to investors. Supposedly, it was made to make sure that all investors have access to all the necessary information to invest in these funds.

When this law came into force, U.S. fund providers did not provide any KID documents. And therefore, brokers stopped offering them to their European customers. For these fund providers, where most of the clients are from the U.S., providing these documents is not a priority. Doing so is too costly for little advantage. For instance, Vanguard already stated that they would not comply with these regulations. That means that for European customers, the only option is to use European ETFs.

Forcing people is what the European Union wanted. This law has nothing to do about protecting investors. It is only a strategy by European fund providers to force European investors to invest in their sub-par funds instead of going with the better U.S. funds. Instead of providing better funds, they simply forced people to use their funds. Forcing people to invest is sad that something supposed to protect the investors is doing them a disservice by forcing them to invest in inferior products and reducing their investment options.

PRIIPs regulations are enforced to people from the European Economic Area (EEA). And Switzerland is not part of the EEA. Therefore, Swiss investors were not affected by this problem last year.

So why am I talking about this issue? DEGIRO just stopped offering these ETFs to its Swiss customers. I can still sell my positions. But I cannot buy any more of these ETFs. It is because of a new set of Swiss laws that will soon come into force. Let’s take a look at these Swiss laws now.

FinIA/FinSA for Swiss investors

In 2018, the Swiss government voted two new laws: the Financial Services Act (FinSA) and the Financial Institutions Act (FinIA). Once again, I am not going to go into details of these laws. They are more or less a copy of the European laws for Swiss investors. They also enforce each fund to offer a Key Investor Documented (KID) to all Swiss investors. So, they cause the same issue to Swiss investors that PRIIPS caused to European investors.

Once again, I have the same point of view on this law as I have on the other one. It is just a crude attempt to force people to invest in bad funds and block the U.S. funds instead of focusing on improving European funds.

This new set of laws will enter into force on January 1, 2020. However, several of the items will take longer to be active. From my understanding, only in 2022 will we lose access to U.S. ETF.

From January 2022, Swiss investors will not be able to invest in non-compliant ETFs and funds. So, Swiss investors will only be able to invest in Swiss and European funds.

And there are several interpretations of the law. I have not been able to find a good source of information that would clearly state whether we will or will not lose access to our great U.S. ETFs. But we should be safe until at least 2022.

That is still giving us until 2022, no? Yes, it should indeed give us several years before these regulations come into force for us. So why did DEGIRO already enforce this? It seems that DEGIRO decided to start implementing them early for reasons of their own. Supposedly, they said that they believe this will protect the investors.

I think they are doing that simply to simplify their systems to have the same set of offers for all Europeans. I think this a bad move on their side. There has been no communication whatsoever about this. One morning, my products were simply closed with the message “Product is closed for the client”. DEGIRO did a lousy job handling the situation, in my opinion.

So what can we do? I see a few solutions to this problem. Let’s examine each of them.

Solution 1: Change broker? Temporary!

If you are still using DEGIRO, you can switch to another broker. This will give you until 2022 at least to use U.S. ETF.

It is what I did. And I currently can invest in U.S. ETF. It is really worth changing brokers just for this reason.

However, as the two Swiss laws become applicable in 2022, that could be the end of it. After that point, I may have to find another solution anyway. Interactive Brokers already stopped offering these ETFs to European investors last year, per the law. So, I think they will follow the law in 2022 and stop offering these to Swiss investors.

Solution 2: Change funds?

Another solution is to comply with the new dumb law and switch to European-domiciled funds. We are not going to lose access to U.S. stock market indexes, only U.S. funds. There are equivalent European tracking the same indexes. However, this is not a very good solution. European funds are more expensive and smaller. And there is less choice for funds around.

For instance, the fund that I will miss is Vanguard Total World (VT). This fund replicates the performance of the entire world market. It manages around 17 billion of dollars of stocks. And it has a Total Expense Ratio (TER) of 0.10%. It is made of more than 8000 different stocks. VT is a great ETF.

On the European side, there is no full world ETF, at least not in the acceptable TER range. The closer they get is with Developed World ETF. But that still means it is necessary to own several ETFs instead of a single one.

If I had to choose one European Developed World ETF, I would probably go with iShares Core MSCI World UCITS ETF. It has around 1600 stocks in 23 developed countries and manages more than 14 billion dollars. It has a TER of 0.20%. That is twice more expensive for an inferior fund. It is not bad, of course. But it pales in comparison to VT.

If I were to switch to the European equivalent of VT, I would probably have to hold two funds. And they would be more expensive than VT. So, I am not convinced by this solution. Another thing that shows that these laws are not doing anything good for the investors.

To learn more, you can check out the entire ETF Portfolio with European Funds I would have used.

Solution 3: Use several funds?

The next solution I am thinking of is to use European funds but not use a World fund. It is possible to replicate the performance of a world fund by holding several region funds. Of course, it is still better to own the world fund if there is a good option for it. But in Europe, there is no great option of a world fund.

The Vanguard Total World (VT) ETF is composed of stocks from these regions:

- North America: 58.40%

- Europe: 18.60%

- Pacific: 13.30%

- Emerging Markets: 9.40%

- Middle East: 0.20%

- Other: 0.10%

I think we can safely ignore the last two ones and still replicate the performance of the world market fund accurately. That means we would need to hold four funds. You need one U.S. ETF, one Europe ETF, one Pacific ETF, and one Emerging Markets ETF. If you want to have better accuracy, you could also add Canada that is usually included in North America. Or you could find a North American ETF. But I did not find a good one.

It is not a great solution, but this would still beat a world ETF from a European provider. It would be a better TER. You can find U.S. ETF around 0.07% in Europe. And since the U.S. is about 55% of the VT ETF, this would bring down the global TER.

The problem is that you have four funds instead of one. I think that simplicity should be preferred in a portfolio. It may make rebalancing a bit more complicated as some funds may underperform or outperform the others. And you may have to change the allocations if there is a shift in the economy in the world. But I still think it beats having a 0.20% TER fund.

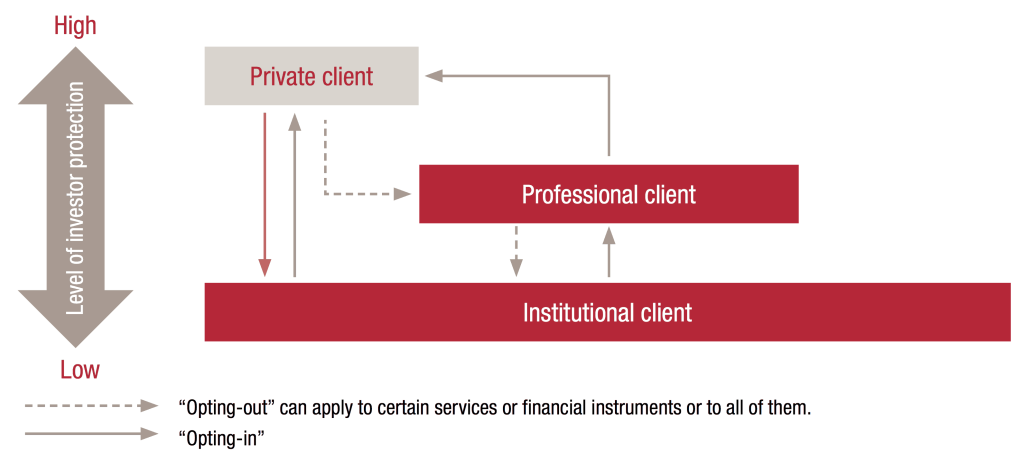

Solution 4: Be a professional investor

You may have noticed that in this post, I have talked especially about retail investors. It is because both the European laws and Swiss laws are considering different professional investors and retail investors.

They only apply to retail investors. So, if you are a professional investor, you can still use the good old U.S. funds! I am not a professional investor, and I doubt that you are either. However, there is a kind of loophole in the Swiss version of the law. It states that certain high net worth individuals may choose to opt-out of the law and be treated as professional investors. There is also this loophole in the European version of the law. But the conditions are slightly different.

In the law, a high net worth individual is described as one that:

- Either declare that they understand the risks of the investment under their qualification and have at least 500’000 CHF.

- Or dispose of at least two million CHF.

We can see that there is a loophole for the rich. The European Union does not want to hurt the rich that are in the European Union. Another stupid part of this law. I am far from filling these conditions yet. But it is not rare in the personal finance community to see people with more than 500’000 CHF. They could apply to opt-out and be considered professionals investors.

Now, I do not know how difficult it will be to opt-out. And I do not know if this will make you qualified as a professional investor for taxes as well. In which case, capital gains will be taxed. That is something to consider. But it could be a very good option for people who already have a high net worth. It is something I may do in a few years.

FAQ

Why can't European invest in U.S. Funds anymore?

Since 2018, PRIIPS regulations disallow European investors to invest in U.S. Funds. These regulations only allow investment in funds with a Key Investor Document (KID). And U.S. funds do not provide this KID.

What are the PRIIPS regulations?

Packaged Retail and Insurance-based Investment Products is a regular to protect European investors. It prevents them from investing in funds without a Key Investor Document (KID). In practice, this practice European investors to invest in U.S. Funds. The need of KID is part of the biggest set of law called Markets in Financial Instruments Directive (MiFID).

What are the FinIA/FinSA laws?

The Financial Services Acct (FinSA) and the Financial Institutions Act (FinIA) are the Swiss laws equivalent of the MiFID laws from the European Union. These laws will enter into effect in January 2020. And effectively, they should prevent Swiss investors to invest in U.S. funds.

Conclusion

Interactive Brokers is an outstanding broker, with extremely affordable fees! Trade U.S. security for as little as 0.5 USD!

The possible future loss of the U.S. ETFs is sad news for European and Swiss investors. The best alternative is to invest in European funds. But they are more expensive. And there is also less choice.

I think that the people who crafted this law did not care about Swiss investors at all but only about European fund providers. There is no doubt that this will profit European funds. Maybe in the future, it will increase their quality and price. But I am not very confident about that. It is a local lockdown of the market. Instead of protecting the customer, they are locking him into inferior choices.

Because of the poor handling of this law by DEGIRO, DEGIRO users already lost access to U.S. ETFs, several years in advance. I lost confidence in DEGIRO. It is why I switched to Interactive Brokers.

With this, I can still invest in good funds until at least 2022. After January 2022, I will still be able to hold these funds and invest in the European equivalents for the future.

If you are still using DEGIRO and want access to U.S. ETFs as a Swiss Investor, I recommend switching to Interactive Brokers.

To see an ETF Portfolio without any U.S. ETF, take a look at my European ETF Portfolio.

If you are considering U.S. ETFs, you may want to read about the U.S. estate tax.

What about you? What your strategy be when we will not have access to U.S. funds anymore?