(Disclosure: Some of the links below may be affiliate links) Many people use a home bias in their investing portfolio. These investors are allocating a large portion of their portfolio to domestic stocks. And this portion is not based on the size of their local stock market. But not every investor agrees on that strategy. And some people do not know what a home bias is. So, in this article, I want to answer the question of whether investors should have a home bias in their portfolio. We are also going to look at existing research on the subject. Home Bias in investing So, let’s start at the beginning: what is a home bias in investing? You have a home bias when you dedicate a large portion of your portfolio to stocks of your home country. For instance, you could say that you are

Topics:

Mr. The Poor Swiss considers the following as important: Investing

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

(Disclosure: Some of the links below may be affiliate links)

Many people use a home bias in their investing portfolio. These investors are allocating a large portion of their portfolio to domestic stocks. And this portion is not based on the size of their local stock market. But not every investor agrees on that strategy. And some people do not know what a home bias is.

So, in this article, I want to answer the question of whether investors should have a home bias in their portfolio. We are also going to look at existing research on the subject.

Home Bias in investing

So, let’s start at the beginning: what is a home bias in investing?

You have a home bias when you dedicate a large portion of your portfolio to stocks of your home country. For instance, you could say that you are allocating 25% of your portfolio to Swiss Stocks if you are living in Switzerland.

One important thing is that your home bias does not have to be in the country you are living in right now. If you are planning to retire in another country, your preference should be toward this other country. For instance, if you are living in Switzerland now but want to retire in England, you may want to have English stocks as your home bias.

In general, people should invest in a diversified way. If you believe in the efficiency of the market, you want to invest according to stock market valuations. So if your country represents 10% of the entire stock market, you should invest 10% of your portfolio in your country’s stocks.

So, if you are investing more than this 10% in your country stocks, you have a bias (sometimes called a tilt) towards this county. This country bias is your home bias.

Let’s take the example of Switzerland. Switzerland is about 3% of the world’s stock market. I allocate 20% of my portfolio to Swiss Stocks. So, I have a strong home bias towards Switzerland.

Benefits of Home Bias

There are two benefits of adding a home bias to your portfolio.

The first advantage is that if something gets bad in other parts of the world, it could reduce the volatility in your portfolio. A home country bias could greatly help you if you need the money at this time of trouble.

This first advantage also helps with currencies. If your bias is in CHF and the USD loses a lot of value, your shares in CHF will be safe from this devaluation. Again, this protection could help you in case you need to sell at the wrong time.

Research showed that a reasonable home bias (lower than 40%) could decrease volatility in local currency. If you want to retire by withdrawing your portfolio, it is essential to consider volatility.

The second advantage is that you know more about what you invest in. Investors will likely know a lot more about companies in their own countries. And investors are more likely to invest in what they know. So, if you need a home bias to start investing, then you should have one, by all means.

Home Bias hurt your diversification

Now, an investing Home Bias also has some disadvantages.

Since it is a bias, it will hurt your diversification, and potentially your returns. Now, this will highly depend on how biased you are. Diversification is critical for reducing volatility by spreading your investment over multiple countries and different kinds of companies. With a good diversification, you will have fewer risks of something happening in a country ruining your portfolio.

How much such a bias will hurt your diversification will depend on its size. For instance, if your home bias is 80% of your portfolio, you are losing on a lot of diversification. On the other hand, if it is only 20%, it may help you in times of need, and the impact on diversification may not be that high.

While diversification is excellent, it also suffers from diminishing returns. When you have 60% of foreign stocks in your portfolio, the benefits of more diversification gets lower. So going from 60% to 70% of diversification has less impact than going from 10% to 20%. Research from Vanguard confirmed these results.

Therefore, if you keep your home bias at a reasonable level, you will not pay a higher price in diversification.

Home Bias can be achieved with currencies

In practice, it is unlikely that a global event does not impact your home stocks. On the other hand, a large currency event in some countries could spare your home currency if it is strong.

So, in some cases, it does not have to be in the same country as your home bias, but it needs to be in the same currency. If you plan to retire in France, you could have a home bias with European stocks, in Euro. Of course, if you plan to retire in Switzerland, you will be limited to Swiss stocks, which are the only ones in Swiss Francs.

But, you do not have to invest in Swiss stocks to get Swiss Francs in the stock market. You could get some cash, but then it would lose value to inflation.

Something that would work instead is to have foreign stocks hedged in your local currency. With this technique, you would not lose on foreign diversification. And you would still get the benefits of having stocks protected from variations in other currencies.

Now, there are some disadvantages to currency hedging. It could be more expensive in the long-term. And no conclusive data is showing that currency hedging will yield better performance. And, currency hedging will reduce your currency diversification.

Nevertheless, using currency hedging instead of a pure home bias could be a good solution for many investors if they are more worried about currency fluctuations than local events.

Home Bias ETF may be cheaper

In some cases, an investor may save money by adding home bias ETF in his portfolio.

In some countries, it is more efficient to invest in domestic stocks than in foreign stocks. In that case, having a home bias will reduce your overall fees. And since we saw that investing fees were very important, doing so may help your overall returns.

It is not the case in every country. For instance, in Switzerland, you do not have lower taxes for Swiss Stocks than for foreign stocks. On the other hand, ETFs for Swiss Stocks generally have higher Total Expense Ratios (TERs) than foreign stocks ETFs. And the Swiss Stock Exchange itself is much more expensive than American Stock Exchanges.

But there is one thing where they will differ: currency exchange fees. When you buy a U.S. ETF, you will need dollars. If the dollar is not your base currency, you will need to buy dollars with your local currency. Foreign exchange conversions are not free. If you have a good broker like Interactive Brokers, these transactions will not be expensive. But for many other brokers, like DEGIRO, currency conversion can be expensive. So, this adds a fee that buying Swiss Stocks will not have.

Consider the big picture

One problem with home bias is that many investors are bad at considering the entire picture.

If you have a home bias in your primary investing portfolio but have a lot of home stocks in your retirement accounts, you are likely to have too large of a bias. As we saw before, a home bias that is too large will hurt diversification. In turn, a lower diversification will reduce your returns and increase the volatility of your portfolio.

So, you should consider your entire net worth and decide how much home country bias you want int this net worth. You should not consider only your investing portfolio. It is always essential to have a good view of where you are standing and what your assets are.

For instance, in Switzerland, you should consider your second and third pillar as well. You probably have more Swiss Stocks than you think. It is always a good idea for your asset allocation to represents your total assets, not a small portion of them.

How much home bias people have?

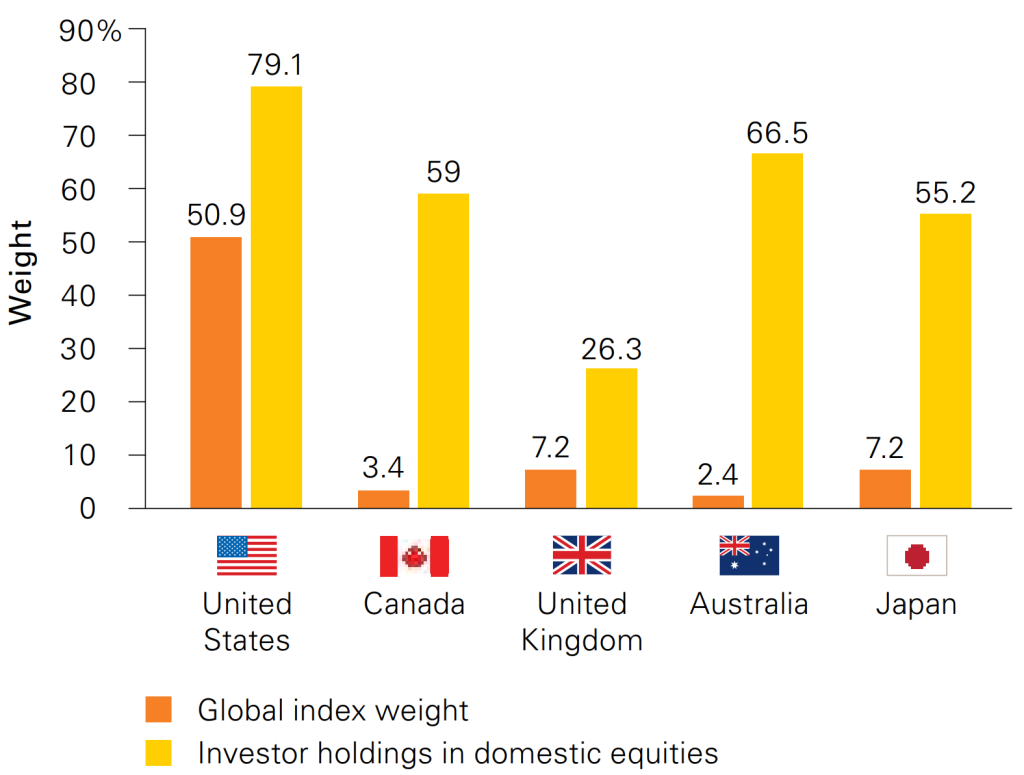

To get an idea of what investors are doing, we can look at how much home country bias investors from different countries have in their portfolio.

I have found the results for five countries in a research paper by Vanguard.

As we can see, most investors have a strong bias toward domestic stocks. The most extreme example is the one from Australia, where the domestic stock market is only 2.4% of the world, and Australian investors are allocated 66.5% to domestic stocks.

In the United States, investors have an extensive bias toward domestic stocks. On the other hand, the American stock market is half of the world’s stock market. So these investors are making themselves less of a disservice than Australian investors.

In the United Kingdom, the results are better. On average, English investors have 26.3% invested in domestic stocks. So, English investors are doing a better job at diversification than most.

I also found some interesting results from Vanguard for Switzerland. Here is what Swiss investors have in their portfolio:

- 43.79% of Swiss Stocks

- 36.97% of European Stocks

- 19.24% of Other Stocks

Two things are interesting in these results for Swiss investors. First, Swiss investors have a strong home country bias. They allocate more than 43% in domestic stocks. Also, Swiss investors have a second bias toward European Stocks.

Overall, Swiss investors are invested more than 80% in European and Swiss Stocks. However, these stocks only represent about 25% of the world stock market. It means that Swiss investors have an extreme European bias.

These results are fascinating. I did not think that Swiss investors had such a bias. I would not recommend such a high bias towards either Swiss or European Stocks. If you want to have both biases in your portfolio, you could do 20% in each and then keep 60% fully diversified in the world. But I prefer having only a Swiss home bias.

Conclusion

While it is a bias, I still believe that a home bias makes sense. However, it is not strictly necessary, and it should not be too large. Home bias in the range of 10-40% may help you invest and protect yourself against some foreign events. But a more considerable home bias will hurt your diversification.

I like having a home bias in my portfolio. I currently want to have at least 20% Swiss Stocks, in Swiss Francs in my portfolio. Since I consider my allocation on my entire net worth, my allocation in Swiss Stocks ETF may be lower than that. But overall, I try to stick to this 20%. I want to have such a bias in Swiss Francs to hedge against foreign currencies getting deflated.

If you do not know what to do with your home bias, I recommend adding a small home bias to your portfolio. Doing so will likely reduce the volatility of your portfolio. And it could help if you need to sell when it is the wrong time for foreign stocks.

Continue to learn more about portfolios by reading about currency hedging and whether you should use it in your portfolio.

What about you? Do you have a home bias in your portfolio?