Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic continues to exert a strong influence on economic developments. The SNB is therefore maintaining its expansionary monetary policy. In so doing, it aims to cushion the negative impact of the pandemic on economic activity and inflation. The SNB is keepingthe SNB policy rate and interest on sight deposits at the SNB at −0.75%.In view of the fact that the Swiss franc is still highly valued, the SNB remains willing to intervene more strongly in the foreign exchange market, while taking the overall exchange rate situation into consideration. The SNB continues to supply the banking system with generous amounts of liquidity via the SNB COVID-19 refinancing facility (CRF). It is also active

Topics:

Swiss National Bank considers the following as important: 1) SNB and CHF, 1.) SNB Press Releases, Featured, newsletter

This could be interesting, too:

Frank Shostak writes Assumptions in Economics and in the Real World

Conor Sanderson writes The Betrayal of Free Speech: Elon Musk Buckles to Government Censorship, Again

Nachrichten Ticker - www.finanzen.ch writes Bitcoin erstmals über 80.000 US-Dollar

Nachrichten Ticker - www.finanzen.ch writes Kraken kündigt eigene Blockchain ‘Ink’ an – Neue Ära für den Krypto-Markt?

Swiss National Bank maintains expansionary monetary policy

The coronavirus pandemic continues to exert a strong influence on economic developments. The SNB is therefore maintaining its expansionary monetary policy. In so doing, it aims to cushion the negative impact of the pandemic on economic activity and inflation.

The SNB is keepingthe SNB policy rate and interest on sight deposits at the SNB at −0.75%.In view of the fact that the Swiss franc is still highly valued, the SNB remains willing to intervene more strongly in the foreign exchange market, while taking the overall exchange rate situation into consideration. The SNB continues to supply the banking system with generous amounts of liquidity via the SNB COVID-19 refinancing facility (CRF). It is also active on the repo market as needed.

The SNB’s expansionary monetary policy is necessary to ensure appropriate monetary conditions in Switzerland and to stabilise economic activity and price developments. The low interest rates provide favourable financing conditions and, coupled with the SNB’s willingness to intervene, counter upward pressure on the Swiss franc. The CRF and the loans guaranteed by the federal government have together contributed significantly towardsensuring the supply of credit and liquidity to the economy.

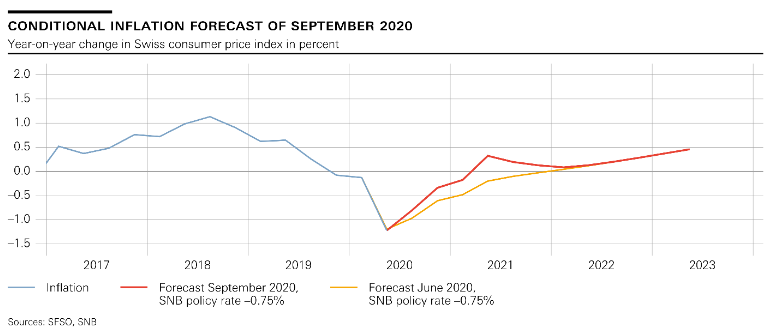

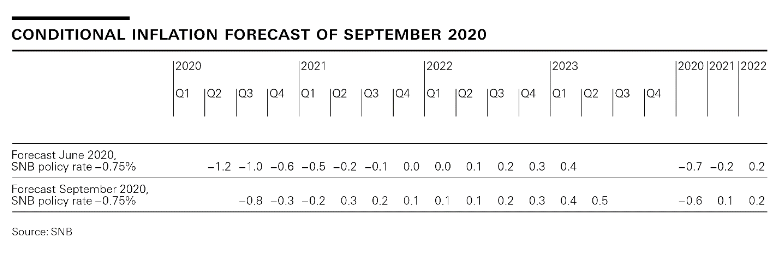

| In the current situation, the inflation outlook is subject to unusually high uncertainty. In the short term, the new conditional inflation forecast is higher than in June, mainly due to a rise in oil prices. The longer-term inflation forecast is unchanged. However, the forecast for the current year remains negative(−0.6%). The inflation rate is likely to edge back into positive territory in 2021 (0.1%) and increase slightly further in 2022 (0.2%). The conditional inflation forecast is based on the assumption that the SNB policy rate remains at –0.75% over the entire forecast horizon.

The coronavirus pandemic and the measures implemented to contain it have led to a historic downturn in the global economy. In the second quarter of 2020, gross domestic product (GDP) was approximately 10–20% below its end-2019 level in most countries. Unemployment has increased around the world, although short-time work schemes in various countries have so far prevented a stronger rise. Following the easing of containment measures by numerous states, there has been asignificant pick-up in economic activity in recent months. The global economy is expected to experience a robust recovery in the third quarter. Global GDP is nonetheless likely to remain below its pre-crisis level. In its baseline scenario for the global economy, the SNB anticipates that it will be possible to keep the pandemic under control without a renewed serious impairment of economic activity. The economic recovery should thus continue. The monetary and fiscal policy measures adopted worldwide are providing important support for the economy. However, it is likely that global production capacity will be underutilised for some time to come and inflation will remain modest in most countries. |

SNB Switzerland Conditional Inflation Forecast, September 2020(see more posts on Switzerland inflation, ) Source: snb.ch - Click to enlarge |

| This baseline scenario is subject to a high degree of uncertainty. On the one hand, a rapid increase in infections could necessitate renewed containment measures, which would once again weigh heavily on the economy. Trade tensions could also hamper economic activity. On the other hand, the economic policy measures introduced in many countries could support the recovery more strongly than expected.

Switzerland too experienced a sharp recession as a result of the coronavirus pandemic. In the second quarter, GDP was more than 10% below its pre-crisis level. In contrast to previous recessions, many service industries in particular were hit hard by the downturn. Economic activity in Switzerland has picked up significantly since May due to the relaxation of health policy measures and to fiscal and monetary policy support. This should be reflected in a strong rise in GDP in the third quarter. The positive development is likely to continue in 2021. |

Conditonal Inflation Forecast of September 2020 Source: snb.ch - Click to enlarge |

However, the SNB anticipates that, as abroad, the recovery will only be partial for the time being. Production capacity will probably remain underutilised for an extended period of time and unemployment is likely to increase further.

This year, GDP is set to shrink by around 5%. This would be the strongest decline since the crisis in the mid-1970s. At its last monetary policy assessment, the SNB had expected an even stronger decline. The forecast revision is mainly due to the fact that the downturn in the first half of the year was somewhat less strong than feared. The forecast for Switzerland, as for the global economy, is subject to high uncertainty.

While GDP declined strongly in the second quarter, mortgage lending and residential property prices continued to rise. Imbalances thus persist on these markets and continue to present risks for financial stability.

Tags: Featured,newsletter