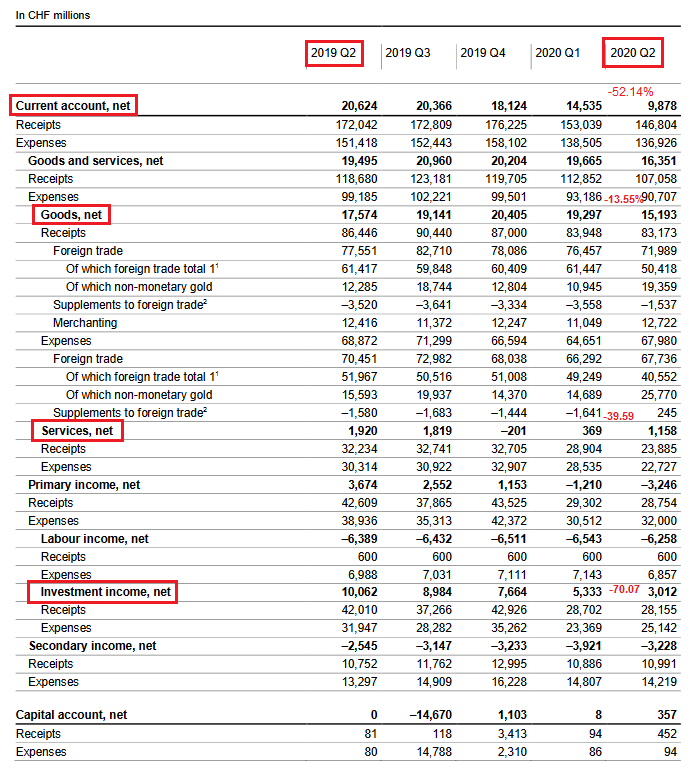

Current Account Key figures: Current Account: Down 52.14% against Q2/2019 to 9.878 bn. CHF of which Goods Trade Balance: Minus 13.55% against Q2/2019 to 15.193 bn. of which the Services Balance: Minus 39.69% to 1.158 bn. of which Investment Income: Minus 70.07% to 3.012 bn. CHF. Current Account Switzerland Q2 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge In the second quarter of 2020, the current account surplus amounted to CHF 10 billion; in the same quarter of 2019 it was CHF 21 billion. This decline was principally due to lower receipts from direct investment abroad. While the goods trade balance and the services trade

Topics:

George Dorgan considers the following as important: 1) SNB and CHF, 1.) SNB Press Releases, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Current AccountKey figures:Current Account: Down 52.14% against Q2/2019 to 9.878 bn. CHF

|

Current Account Switzerland Q2 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

| In the second quarter of 2020, the current account surplus amounted to CHF 10 billion; in the same quarter of 2019 it was CHF 21 billion. This decline was principally due to lower receipts from direct investment abroad. While the goods trade balance and the services trade balance changed only marginally, there was a significant decrease in receipts and expenses. In the case of the goods trade, the decline was curbed by the increased exports and imports of non-monetary gold (i.e. gold not held as reserve assets).

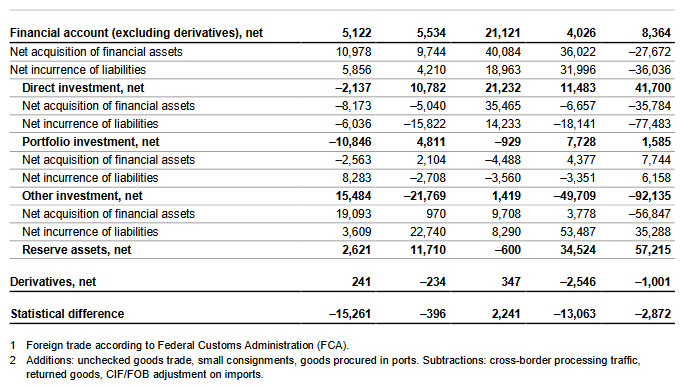

Transactions reported in the financial account showed a net reduction in both assets (down by CHF 28 billion) and liabilities (down by CHF 36 billion) in the second quarter of 2020. Transactions conducted by foreign-controlled finance and holding companies were a decisive factor here; these companies shortened their balance sheets. As regards assets, they reduced intragroup lending (other investment) and participations abroad (direct investment), while on the liabilities side non-resident parent companies withdrew equit y capital fro m their resident subsidiaries. On the assets side, this reduction was partly offset by purchases of foreign currency by the SNB (reserve assets). Transactions by resident commercial banks (other investment) had the same effect on the liabilities side, where they recorded an increase against both non-resident banks and non-resident customers. Including derivatives, the financial account balance came to CHF 7 billion. |

Switzerland Financial Account, Q2 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

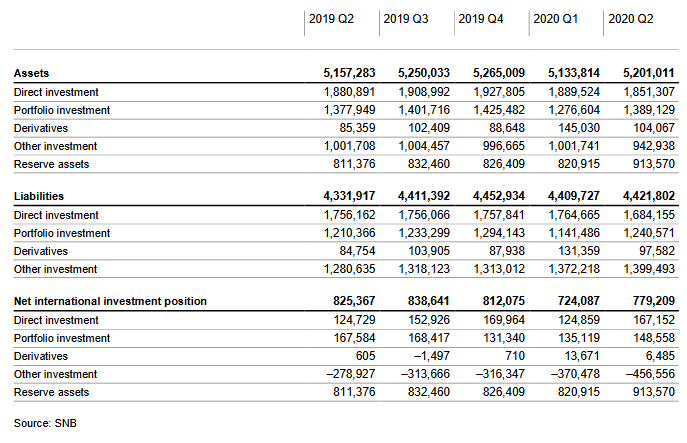

The net international investment position rose by CHF 55 billion quarter-on-quarter to CHF 779 billion in the second quarter of 2020. Stocks of assets were up by CHF 67 billion to CHF 5,201 billion, and stocks of liabilities were CHF 12 billion higher at CHF 4,422 billion.On both sides, the increase was largely attributable to price rises on the stock exchanges in Switzerland and abroad. These valuation gains were higher on the assets side than on the liabilities side, and were partly offset in both cases by the transactions from the financial account.

Backcasting of the breakdown of changes in stocks in the international investment position to 2000The data on the breakdown of changes in stocks in the international investment position will now be shown from 2000 onwards; previously they were only available from 2015. The extended tables and additional charts are now available on the SNB’s data portal (data.snb.ch, Table selection, International economic affairs, Switzerland’s foreign economic affairs, Switzerland’s international investment position), alongside other comprehensive tables on the balance of payments and Switzerland’s international investment position. |

Switzerland International Investment Position, Q2 2020(see more posts on Switzerland International Investment Position, ) |

Data revisions

The data on the balance of payments and international investment position take into account revisions, some of which extend over the entire period.

These revisions have arisen as a result of closing data gaps, corrections to the methodology used, and newly available information fro m reporting inst itutions.

Tags: Featured,newsletter