It has been a long time since I read anything by Paul Krugman, and seeing his most recent column simply reminds me why I’ve not missed anything. As both an extreme Keynesian and political partisan, he long ago abandoned economic analysis for something economists should recognize as nothing less than what Mises called metaphysics. Nonetheless, my curiosity got the best of me when he wrote that reopening the economy and allowing people to go to work almost surely will cause a depression. He writes: Last week the Bureau of Labor Statistics officially validated what we already knew: Just a few months into the Covid-19 crisis, America already has a Great Depression level of unemployment. But that’s not the same thing as saying that we’re in a depression. We won’t

Topics:

William L. Anderson considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Michael Njoku writes Totalitarianism Begins With A Denial of Economics

Nachrichten Ticker - www.finanzen.ch writes US-Wahl treibt Bitcoin über 90’000 US-Dollar – wie Anleger vom neuen Krypto-Hype profitieren können

Jim Fedako writes Subjectivity and Demonstrated Preference: A Possible Paradox

Connor O'Keeffe writes The Context Behind Donald Trump’s “Takeover” of the American Right

It has been a long time since I read anything by Paul Krugman, and seeing his most recent column simply reminds me why I’ve not missed anything. As both an extreme Keynesian and political partisan, he long ago abandoned economic analysis for something economists should recognize as nothing less than what Mises called metaphysics.

It has been a long time since I read anything by Paul Krugman, and seeing his most recent column simply reminds me why I’ve not missed anything. As both an extreme Keynesian and political partisan, he long ago abandoned economic analysis for something economists should recognize as nothing less than what Mises called metaphysics.

Nonetheless, my curiosity got the best of me when he wrote that reopening the economy and allowing people to go to work almost surely will cause a depression. He writes:

Last week the Bureau of Labor Statistics officially validated what we already knew: Just a few months into the Covid-19 crisis, America already has a Great Depression level of unemployment. But that’s not the same thing as saying that we’re in a depression. We won’t know whether that’s true until we see whether extremely high unemployment lasts for a long time, say a year or more.

Unfortunately, the Trump administration and its allies are doing all they can to make a full-scale depression more likely.

Now, many of us believe that the massive monetary and “fiscal” interventions into the US economy from both federal and state governments are likely to create a depression and make the current rates of unemployment grow even more. That, however, is not Krugman’s point. In fact, Krugman seems to believe that there isn’t enough government intervention, which is a regular theme in his writings. Instead, Krugman is alleging that reopening the economy is what will usher in the next depression.

We have been there before. Who can forget Krugman’s 2011 clarion call to form real defenses against an imaginary invasion by space aliens in order to revitalize the economy? Anyone who has read (or taught) Keynesian economics knows that according to Keynesians, the economy always is a slip away from going into massive unemployment unless government (a) cuts interest rates until they cannot be cut anymore, and (b) engages in massive new spending to increase “aggregate demand” because “full employment” only can be reached when government intervenes, period.

But even I will admit that this column took me by surprise, although he has his usual partisan snipes. To the question of how we avoid an out-and-out depression, Krugman replies that we need to “stay the course” (in his words) and keep everyone locked up even longer. His reasoning is that if Americans are let out of home confinement now, all of the so-called gains that this country supposedly has made against the ravages of COVID-19 will be lost and then the rock will roll back down to the bottom of the hill. Krugman writes:

If we could get the coronavirus under control, recovery could indeed be very rapid. True, recovery from the 2008 financial crisis took a long time, but this had a lot to do with problems that had accumulated during the housing bubble, notably an unprecedented level of household debt. There don’t seem to be comparable problems now.

But getting the virus under control doesn’t mean “flattening the curve,” which, by the way, we did—we managed to slow the spread of Covid-19 enough that our hospitals weren’t overwhelmed. It means crushing the curve: getting the number of infected Americans way down, then maintaining a high level of testing to quickly spot new cases, combined with contact tracing so that we can quarantine those who may have been exposed.

To get to that point, however, we would need, first, to maintain a rigorous regime of social distancing for however long it takes to reduce new infections to a low level. And then we would have to protect all Americans with the kind of testing and tracing that is already available to people who work directly for Donald Trump, but almost nobody else.

The closest thing to this kind of thinking is AP correspondent Peter Arnett’s infamous quote after American air strikes decimated the village of Ben Tre: “It became necessary to destroy the town to save it.” In modern parlance, it means that in order to “save” the US economy, the government must enact and enforce policies that will severely hamper economic activity. However, Krugman, being Krugman, believes that there is an easy interim “solution” to enabling the economy to work just fine—without working, of course. He writes:

At the same time, the administration and its allies are apparently dead set against providing the financial aid that would let us sustain social distancing without extreme financial hardship. Extend enhanced unemployment benefits, which will expire July 31? “Over our dead bodies,” says Senator Lindsey Graham. Aid to state and local governments, which have already laid off a million workers? That, says, Mitch McConnell, would be a “blue-state bailout.” (Emphasis mine)

This statement truly exposes the extreme Keynesian mentality: printing money is the near-direct equivalent of actually producing something. Like all Keynesians, Krugman commits the fallacy of composition, believing that what might be good for one person (or a few persons) thus is good for everyone.

For example, we already have seen that thanks to current government policies, many workers are receiving unemployment benefits that are more than the wages they would receive if they returned to work, so, not surprisingly, they are staying off the job. According to the Keynesian-supporting journalists at CNBC, that is a “good thing.”

No, that is a disaster in the making. Although it might be good for me if the government gave me a million dollars a week not to work, it would be effective only if I’m the only one receiving the benefit. Although the rest of society actually would be worse off under such a policy—since it would be nothing but a naked wealth transfer from everyone else to me—I could claim that it really is a “good thing,” because, in Keynesian-speak, it would increase “aggregate demand.”

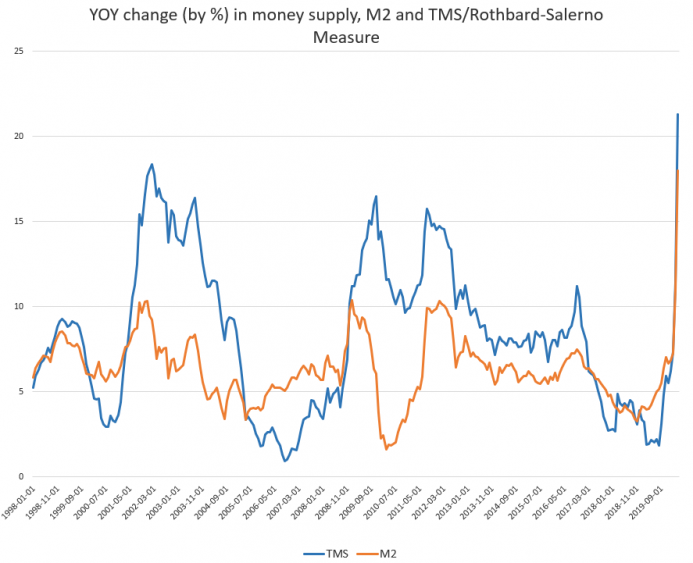

Think of this on a very large scale, and one has an idea of what Krugman is advocating in the name of preventing a depression. Although it is clear that the Trump administration has engaged in one policy disaster after another by flooding the economy with new money in hopes (vain hopes) that it can “replace” the permanent economic losses due to mandatory business shutdowns, one senses that Krugman believes that these so-called stimulus packages are not enough. Indeed, one can interpret his attack on Trump and Senate Republicans as saying that they are refusing to go as far as Krugman apparently wants: to put nearly the entire workforce on the dole.

One is reminded of J.M. Keyne’s quote that credit expansion from thin air “turns stones into bread.” Krugman essentially is saying the same thing; government via massive monetary injections into the economy magically is substituting money for the real thing: production of actual and consumable goods and services. Unfortunately, too many people in authority believe this nonsense and believe it to our demise.

Like so many others on the left, Krugman believes that we are faced with a stark choice: lock down everyone and defeat the coronavirus or allow people to live their lives without government interference and so get sick and die. As Michael Accad recently wrote, this is not about that kind of tradeoff. Given that the original policies which Krugman has endorsed came about because of an outright fraudulent epidemiological model by Neil Ferguson of Imperial College of London, which predicted a whopping 2.2 million American deaths unless government acted immediately to quarantine the whole country, it is just as hard to take Krugman the epidemiologist seriously as it is to take Krugman the economist with anything but a huge block of salt.

To sum up Krugman’s latest outburst, we have the following progression: (a) shutting down businesses across the country has resulted in massive layoffs and depression-level rates of unemployment; (b) letting people go back to work will result in even greater levels of illness than before, which will really spur unemployment; (c) therefore, print lots of money and keep people inside and everything will be fine.

The logical fallacies here are overwhelming. If governments continue to keep businesses shuttered and people locked up, unemployment rates soon will skyrocket to unprecedented levels and we will be in an even worse depression. However, Krugman adds that if governments vastly expand credit that is now beyond already unrecognizable levels, then the glorified money printing will keep everything in check.

This is logic worthy of not just Keynes, but of cranks like Silvio Gesell and the gaggle of modern monetary theory (MMT) advocates. To be honest, the only thing missing from Krugman’s latest fantasy is the beginning line, “Once upon a time….”

Tags: Featured,newsletter