USD/CHF has met a confluence of support as the US Dollar extends higher. Latest positioning data shows that CHF net shorts had been climbing for a third week. FOMC minutes at the top of the hour is next major risk. USD/CHF has met a confluence of support as the US Dollar extends higher on Wednesday ahead of the Federal Open Market Committee’s Minutes today and US consumer Price Index tomorrow. Currently, USD/CHF is trading at 0.9952 having travelled between 0.9915 and 0.9963, +0.23%. The DXY is trading on the 99 handle still, supported by the 21-day moving average with eyes set on the recent YTD highs and highest levels since 2017 of 99.67. However, the Swiss franc may still have some fight left due to the current state of affairs with respect to geopolitical

Topics:

Ross J Burland considers the following as important: 1) SNB and CHF, 1.) FXStreet on SNB&CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

- USD/CHF has met a confluence of support as the US Dollar extends higher.

- Latest positioning data shows that CHF net shorts had been climbing for a third week.

- FOMC minutes at the top of the hour is next major risk.

USD/CHF has met a confluence of support as the US Dollar extends higher on Wednesday ahead of the Federal Open Market Committee’s Minutes today and US consumer Price Index tomorrow.

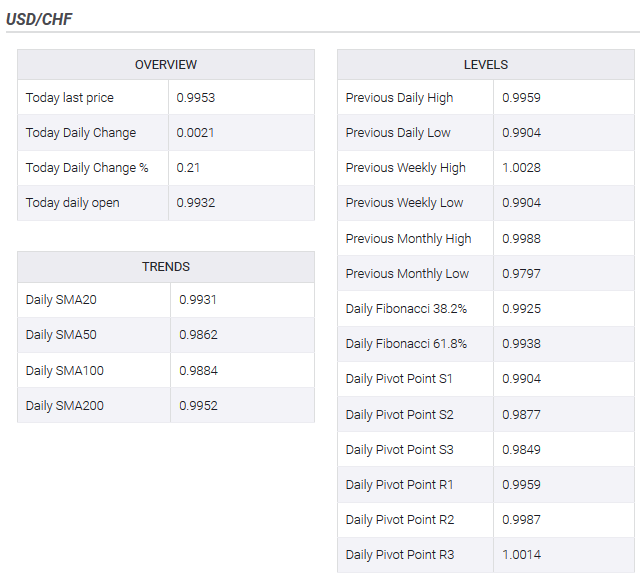

Currently, USD/CHF is trading at 0.9952 having travelled between 0.9915 and 0.9963, +0.23%. The DXY is trading on the 99 handle still, supported by the 21-day moving average with eyes set on the recent YTD highs and highest levels since 2017 of 99.67.

However, the Swiss franc may still have some fight left due to the current state of affairs with respect to geopolitical risks which tend to support the currency for its safe-haven appeal. However, the SNB has stated that it’s always ready to intervene in the foreign exchange market when it is deemed necessary.

SNB has stated that it’s always ready to intervene

The latest positioning data shows that CHF net shorts had been climbing for a third week, despite its safe-haven status, which likely means that the SNB has been recently intervening in the FX market which have distorted demand for the CHF, but equally, means that there is the potential of a buy-in should geopolitics continue to deteriorate and the scales are balanced in this respect firmly towards an escalation of risk-off themes, supportive of the CHF.

“We believe that the SNB will continue to intervene in the foreign exchange market when it is deemed necessary. It will also use the exemption threshold, now subject to possible revision every month, as a monetary policy tool to influence money market conditions,”

analysts at ING Bank argued.

Meanwhile, the next risks for the pair in the very immediate future ar the FOMC minutes at the top of the hour.

FOMC minutes on the cards

The minutes from the September FOMC will be in focus today and scrutinized by the markets seeking some clarity on the Fed’s thinking for the way forward following the Fed’s decision to ease rates again at that meeting.

“More importantly, the minutes are also likely to shed light on the Fed’s thinking about the recent surges in repo market rates. However, this has been partly addressed by Chair Powell, who stated on Tuesday that the Fed “will soon announce measures to add to the supply of reserves over time,””

analysts at TD Securities explained.

USD/CHF levelsThe rising channel support meets the 50-day moving average and the price has bounced room there, currently rising through the 21-DMA and has sights on the top of the rising channel’s resistance up at the 104 handle. |

USD/CHF levels(see more posts on USD/CHF, ) |

Tags: Featured,newsletter,USD/CHF