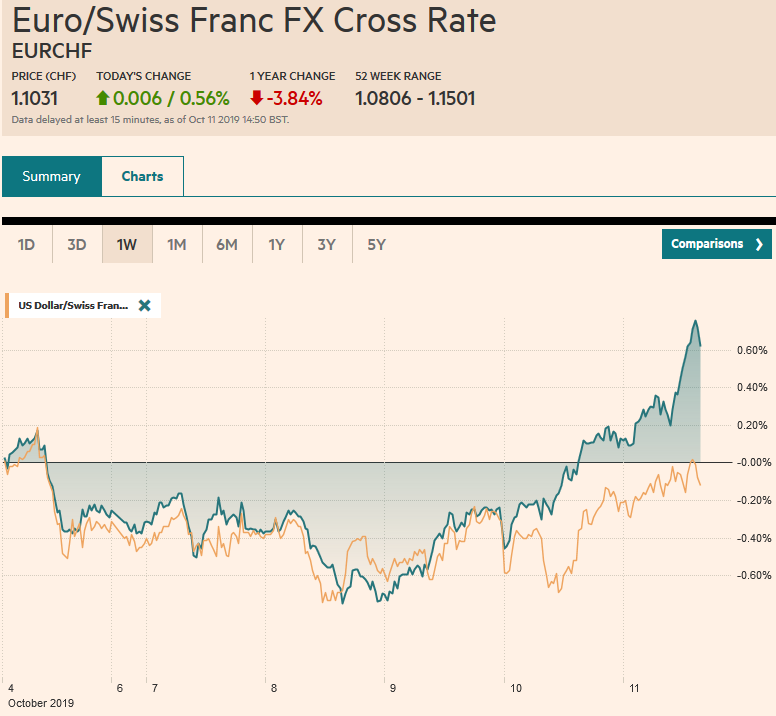

Swiss Franc The Euro has risen by 0.56% to 1.1031 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the edge of the abyss is approached in three distinct areas, there is hope that victory can be snatched from the jaws of defeat. US-China trade talks continue today, and there is hope of a small deal that could lead to the US not hiking tariffs next week. A shift in the UK toward a free-trade agreement with the EU seems to have opened fertile ground in negotiations that could still avoid a no-deal Brexit. Reports suggest the demonstrators in Hong Kong are considering ending their vandalism ahead of this weekend’s protests. Hong Kong stocks posted their biggest gains since June.

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Brexit, EUR/CHF, Featured, FX Daily, Germany Consumer Price Index, Hong Kong, newsletter, trade, U.S. Michigan Consumer Sentiment, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.56% to 1.1031 |

EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

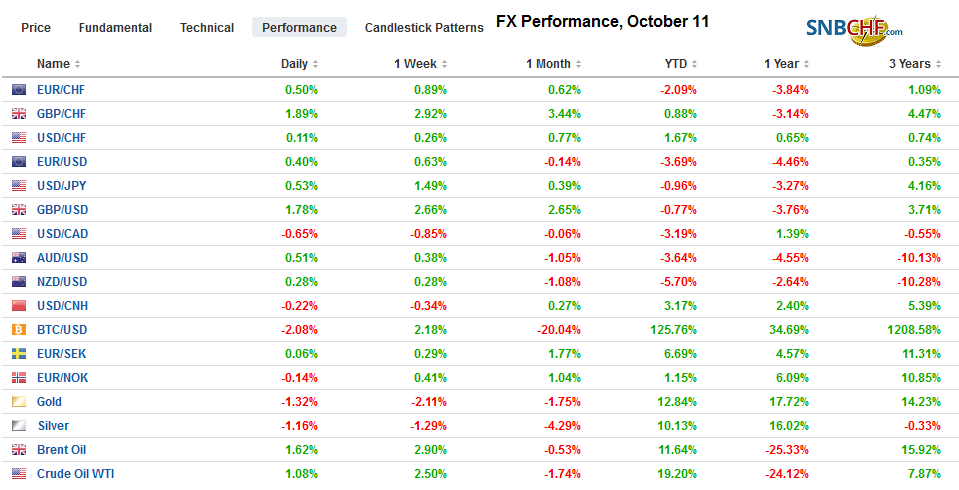

FX RatesOverview: As the edge of the abyss is approached in three distinct areas, there is hope that victory can be snatched from the jaws of defeat. US-China trade talks continue today, and there is hope of a small deal that could lead to the US not hiking tariffs next week. A shift in the UK toward a free-trade agreement with the EU seems to have opened fertile ground in negotiations that could still avoid a no-deal Brexit. Reports suggest the demonstrators in Hong Kong are considering ending their vandalism ahead of this weekend’s protests. Hong Kong stocks posted their biggest gains since June. The 2%+ rally led the region. Today’s rally in the MSCI Asia Pacific Index lifted the benchmark for the week and ends a three-week slide. Europe’s Dow Jones Stoxx 600 gapped higher to extend this week’s gain and is also ending a two-week slide. US shares are firmer, and the S&P 500 needs to gain about 0.5% today to turn it favorable for the week, for the first time since the week ending September13. The eight basis point jump in US 10-year yields yesterday dragged Asia Pacific yields higher, but European benchmark yields are paring yesterday’s increase and are mostly a couple of basis points lower. The US 10-year yield is slipping back below 1.65% in Europe. The dollar is soft, but mostly little changed. The creeping optimism is allowing the dollar-bloc and Scandis to extend yesterday’s gains. Emerging market currencies are also firm, with the Turkish lira consolidating yesterday’s gains after the US joined Russia in the UN Security Council to reject the resolution proposed by several European countries to condemn its invasion of Syria. Oil prices and gold jumped in response to news that an Iranian oil tanker appears to have been hit by rockets in the Red Sea near a Saudi port. |

FX Performance, October 11 |

Asia Pacific

US-China trade talks will continue today, and President Trump will meet with China’s Vice Premier Liu. As we suggested, a key metric to determine the success of the talks is whether the US goes ahead with the planned tariff hike on October 15 on around $250 bln of goods from 25% to 30%. We argue that that increase is more symbolic than substantive. Imagine that the 25% tariff made a Chinese-produced good uncompetitive in the US market, making it even more uncompetitive has little impact. Once the threshold of competitiveness is crossed, does it really matter how much? The importance of getting the US to refrain may look sufficiently like a concession so that Chinese purchases of US agriculture goods do not appear to be a unilateral gesture. China reports CPI figures next week, and the food inflation shows the desperate straits the PRC finds itself.

Talk that a currency pact could be part of an agreement between the US and China has spurred speculation of a strong yuan. We are skeptical of the merits of such an agreement. First, China is already managing its currency to resist downside pressure, not wholly or but clearly. It is doing so for the only reason that can be relied on, self-interest. Moreover, it appears to be doing this will little if any direct intervention. Second, it is the Trump Administration that has repeatedly tried talking the dollar down. A stable yuan against the dollar means that the US cannot resort to its time-test tactics, like the ones used against Europe and Japan, and seek the devaluation of the dollar against the yuan. Chinese officials have been concerned that the US can secure a strategic advantage by devaluing the dollar. That said, another tariff truce could see the yuan strengthen, and apparently, others think so too, and reports suggest there was a large purchase (~$650 mln) of dollar puts/yuan calls at CNY6.95 for two-month tenors.

The dollar has been confined to about a 15 tick range on either side of JPY108.00 today. Typhoon Hagibis is poised to hit Japan, and this has shuttered airports, delayed flights, etc. Ideas that insurers may be forced to sell some overseas assets to repatriate funds for claims could be a consideration deterring continued yen selling today despite the risk-on mood. The yen is the poorest performer of the major currencies this week, losing almost 1% against the greenback. The Australian dollar is leading the move against the US dollar today, gaining nearly 0.4% (near $0.6790). It is at its best level in about two and a half weeks. It can finish above its 20-day moving average (~$0.6770) for the first time since September 18. A move above the $0.6800-$0.6810 area would set the stage for more gains next week. The US dollar briefly traded below CNY7.10 for the first time since September 20. The dollar’s four-day downdraft is the longest in six months.

EuropeThe first inkling of good news in a while on Brexit was jumped on by fx players who fueled the biggest single-day rally in six months. A joint statement by the UK’s Johnson and Ireland’s Varadker said that constructive talks were held and that they “see a pathway to a possible deal.” Precisely what this means is not clear, though the Irish Times reported a significant concession by the UK Prime Minister. It appears that Johnson may be proposing a free-trade agreement with the EU as a way to avoid the backstop. No breakthrough was announced. The next step is the UK Brexit Secretary will meet with the EU’s chief negotiator today. The crucial EU summit will be held on October 16-17. At one point yesterday, sterling had gained 2.6 cents and is extending those gains today. Although Johnson has famously said he would rather be “dead in a ditch” than ask for an extension, real progress could see the EU grant an extension “to work out the final details.” |

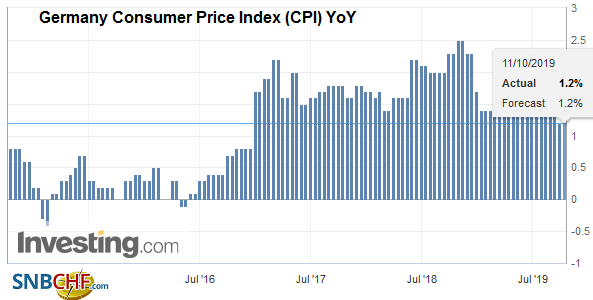

Germany Consumer Price Index (CPI) YoY, September 2019(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

The OECD is proposing a new approach to corporate taxes that would allow countries the right to tax sales carried out in their territories, even if the company does not have a physical presence. The tax base would be the sales of the global company within the country. However, Italy may be joining France in setting its own tax on the large digital companies starting in January. The importance of this is not merely about taxes, but that it throws another spanner in the works that may goad the US into retaliation, or at least aggravates the rising tensions.

The market was short sterling, and a short-covering squeeze and new buying have lifted through $1.25 today, encouraged by the guarded optimism of EU President Tusk. September’s high, which was a three-month high, was near $1.2580. The next target is in the $1.2715-$1.2720 area, which corresponds to a retracement objective and the 200-day moving average. There also has been keen interest in the options market for sterling calls. In fact, the demand for one-month calls has lifted the skew (i.e., one-month risk reversal) to its highest level (favoring calls over puts) since the referendum in 2016. This may also reflect the market’s short exposure as well as new bulls joining the fray. The euro has been unable to extend yesterday’s gains so far today, and perhaps it is being deterred by pressure on the cross against sterling. A weekly close above $1.10 is constructive, and the next target, assuming the $1.1035 is overcome, is near $1.1085. There are options for about 740 mln euros struck at GBP0.8830 and GBP0.8835, which corresponds with the 200-day moving average. The option may not be in play as the euro tests support near GBP0.8800 to test last month’s low near GBP0.8785.

AmericaThe US Treasury sold $16 bln of 30-year bonds yesterday. The record low yield of 2.17% did not deter interest. The bid-cover ratio was slightly higher than the previous auction that went off with yields about 10 bp higher (2.25x vs. 2.22x). Moreover, the auction took place amid sell-off in US Treasuries that saw the US two and 10-year yields rose by 5-7 bp. The sale followed the US September CPI report. The headline and core rate were slightly softer than expected. The year-over-year rates were unchanged at 1.7% and 2.4% respectively. Of note, shelter and ownership-equivalent rent rose 0.3%. Medical costs rose by 0.2%, but prescription drug prices fell by 0.5%, according to the report. Energy prices (-1.4%) were down for the fourth in the past five months, while food prices edged higher (0.1%), snapping a three-month decline. |

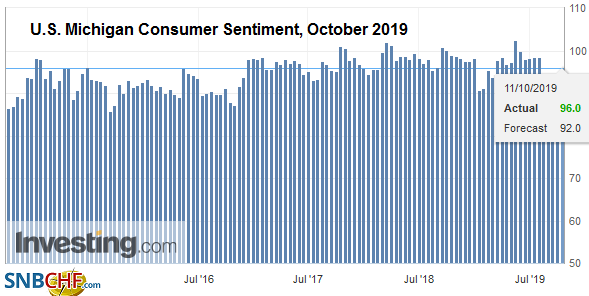

U.S. Michigan Consumer Sentiment, October 2019(see more posts on U.S. Michigan Consumer Sentiment, ) Source: investing.com - Click to enlarge |

The US reports import and export prices, which tend not to be market movers. The preliminary October University of Michigan consumer confidence report may show the current optimism remains strong, but future expectations may soften. The future expectations component has been in a saw-tooth pattern for the past six-months, alternating between gains and declines. It ticked up n September. The 5-10 year inflation outlook is often worth noting even though it has been in a 2.3%-2.6% range for a little more than three years. Three regional Fed presidents speak today, Kashkari, Kaplan, and Rosengren. The first two seem inclined to cut, though neither votes and Rosengren remains reluctant and has dissented (alongside George) against the two rate cuts that have been delivered this year.

Canada’s September jobs report is due. Full-time positions are expected to have grown by almost 21k, which is about a third smaller than this year’s average. August’s 81.1k employment gain had been flattered by more than 57k part-time positions. Mexico reports industrial output figures. A flat report is hoped for after a 0.4% decline in July. A soft report, coupled with the decline in the CPI reported earlier this week, appears to give the central bank scope to cut rates again here in Q4.

The US dollar is at its week’s lows against the Canadian dollar near CAD1.3270. A measuring objective of a potential double top (~CAD1.3350) and the trendline drawn off the September and early October lows are found near CAD1.3220. The US dollar posted an outside down day against the Mexican peso yesterday, and follow-through selling today has seen the peso test our target near MXN19.40. The next objective is last month’s low around MXN19.32. The 200-day moving average is near MXN19.26. The Dollar Index peaked on October 1, near 99.67. The month’s low was set today near 98.50. A trendline off the June and August lows comes in near 99.20, which is also the (38.2%) retracement objective of the rally from those June lows (~95.85).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,EUR/CHF,Featured,FX Daily,Germany Consumer Price Index,Hong Kong,newsletter,Trade,U.S. Michigan Consumer Sentiment,USD/CHF