USD/CHF has met a confluence of support as the US Dollar extends higher.

Latest positioning data shows that CHF net shorts had been climbing for a third week.

FOMC minutes at the top of the hour is next major risk.

USD/CHF has met a confluence of support as the US Dollar extends higher on Wednesday ahead of the Federal Open Market Committee’s Minutes today and US consumer Price Index tomorrow.

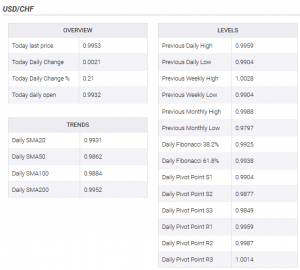

Currently, USD/CHF is trading at 0.9952 having travelled between 0.9915 and 0.9963, +0.23%. The DXY is trading on the 99 handle still, supported by the 21-day moving average with eyes set on the recent YTD highs and highest levels since 2017 of 99.67.

However, the Swiss franc may still have some fight left due to the current state of affairs with respect to geopolitical

Articles by Ross J Burland

AUD/CHF Technical Analysis: Bears seeking a break to channel bottoms, below 61.8 percent Fibo

October 4, 2019Bulls target risk back to the top of the channel and recent highs of 0.6750.

Bears seek a break of trendline support and a resumption of the downside within the bearish channel.

AUD/CHF has been resilient against the odds, considering the risk-off tone in markets were otherwise, the CHF usually performs.

The Swiss Nation Bank has evidently been intervening in recent weeks, protecting its currency against strength vs the euro, although, on a technical basis, vs the Aussie dollar, the breach of the 50% Fibonacci level within a descending channel and below the 21-day moving average exposes risk of a run to the 61.8% target.

Bears are in pursuit of a break of the trend-line support. On the other hand, should the bulls advance, a break of the 50-DMA will open the

AUD/CHF technical analysis: Bears looking for a run to a 50 percent mean reversion

September 21, 2019AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement for a 50% reversion.

A subsequent pull-back, however, to the resistance and another sell-off will likely make for a high probability set up.

AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement of the August lows to September highs, located at 0.6715, and target the 50% retracement at 0.6674 (meeting the 2019 lows) should the markets continue to unravel AUD longs coupled with uncertainties surrounding the health of the global economy.

The price broke below the late June lows and the 23.6% Fibo and in doing so is looking to extend the 2019 downtrend with the price now back below the descending trendline resistance. A subsequent pull-back, however, to

CHF/JPY: Eyes on central banks and geopolitics

September 17, 2019This week the BoJ will hold its regular policy meeting.

Global uncertainty, linked to the trade war and Brexit, has strengthened the value of the Swiss franc and Yen.

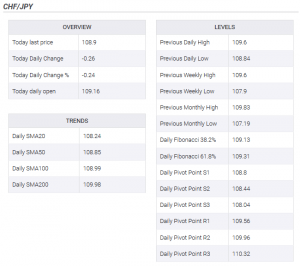

CHF/JPY is struggling to maintain the upside as the Yen picks up a safe haven bid, anchored on geopolitical developments following a textbook risk-off response in global financial markets following the strike on Saudi Arabia’s oil facilities over the weekend.

Both the CHF and Yen picked up a bid as equities dipping while treasuries and precious metals lifted. However, the Dollar came through in the end and did damage across, multiple crosses, including both USD/JPY and USD/CHF, both crosses respecting the rising channel’s support.

BoJ and SNB in focus

This week the BoJ will hold its regular policy

EUR/JPY rallies the hardest vs EUR/CHF as CHF/JPY spikes following ECB

September 15, 2019EUR/JPY rallies hard following hawkish ECB cut and trade war optimism.

EUR/JPY tracking positive sentiment in financial and commodity markets.

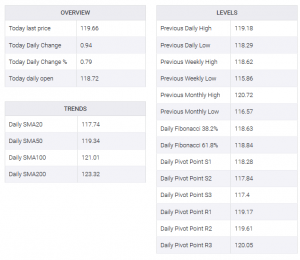

While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today.

EUR/JPY is currently trading at 119.65 having ranged between a low of 117.55 and 119.82, whipsawed over the ECB announcements before gaining bullish traction towards the 2nd August spike high at 119.87.

ECB QA is likely to be with us for a considerably long time

The main take away from today’s ECB policy announcements is that QA is

EUR/CHF technical analysis: Break out or fake out?

September 11, 2019The cross needs to hold above the 1.0970s and beyond the 25th July swing lows.

To the downside, a break back below the prior descending resistance will spell bad news for the bulls.

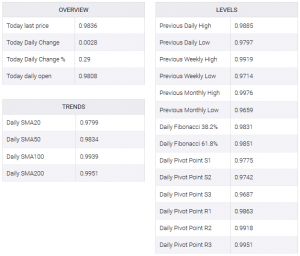

EUR/CHF has been running higher of late, despite the onset of the European Central Bank – a possible buy the rumour sell the fact scenario as the less committed euro shorts are squeezed.

Nevertheless, the price action is all the counts from a technical analysis perspective. EUR/CHF has made for a compelling long, and if it was not for the ECB and risk of SNB intervention, would be a high probability set up considering the breakout fro trend line resistance has pulled back around a 50% mean reversion and printed a decent-sized bullish pin bar and has subsequently closed overnight at the

USD/CHF bounces from trend-line support on trade news

September 6, 2019US/Sino trade teams will consult in mid-September with a view for a meeting in Washington in early October.

USD/CHF is currently trading 0.26% higher and bouning of trend-line support.

The announcement that trade talks are back on track as given the markets the extra fuel needed to recover with respect to risk appetite. Currencies, such as the Yn and CHF, would otherwise benefit from investment, but in such a case that a trade deal could eventually emerge from the protracted negotiations is pressuring them in Asia today. USD/CHF is currently trading 0.26% higher and bouning of trend-line support.

Vice Premier Liu He who is the head Chinese trade negotiator has been reported to have spoken with Mnuchin and Lighthizer on Wednesday on a phone call and trade teams

SNB’s Maechler: Reaffirms Pledges on FX and Intervention, Negative Rates

August 29, 2019SNB jawboning CHF lower as concerns mount over global growth fears and a flight to safety.

EUR/CHF is already trading close to the lows of the year.

The Swiss National Bank’s Andréa M Maechler, Member of the Governing Board, has crossed the wires saying that ‘any intervention’ requires an analysis of cost/benefits – plenty of jawboning going on here.

Key comments:

Negative rates are working, still, have plenty of room for fx intervention.

The attractiveness of CHF has ‘enormously increased’.

Expansive monetary policy remains necessary.

Reaffirms pledges on FX intervention, negative rates.

Swiss inflation pressures remain weak.

Negative rate is important because it helps reduce the attractiveness of the Franc.

FX implications

This will likely become a major