What happens when these monstrous speculative bubbles pop? Let’s start by stipulating that if I’d taken a gummit job right out of college, I could have retired 19 years ago. Instead, I’ve been self-employed for most of the 49 years I’ve been working, and I’m still grinding it out at 65. By the standards of the FIRE movement (financial independence, retire early), I’ve blown it. The basic idea of FIRE is to live frugally and save up a hefty nestegg to fund an early comfortable retirement. As near as I can make out, the nestegg should be around .6 million–or if inflation kicks in, maybe it’ll be million. Let’s just say it’s a lot. You’ve probably seen articles discussing how much money you’ll need to “retire comfortably.” The trick of course is the definition

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| What happens when these monstrous speculative bubbles pop?

Let’s start by stipulating that if I’d taken a gummit job right out of college, I could have retired 19 years ago. Instead, I’ve been self-employed for most of the 49 years I’ve been working, and I’m still grinding it out at 65. By the standards of the FIRE movement (financial independence, retire early), I’ve blown it. The basic idea of FIRE is to live frugally and save up a hefty nestegg to fund an early comfortable retirement. As near as I can make out, the nestegg should be around $2.6 million–or if inflation kicks in, maybe it’ll be $26 million. Let’s just say it’s a lot. You’ve probably seen articles discussing how much money you’ll need to “retire comfortably.” The trick of course is the definition of comfortable. |

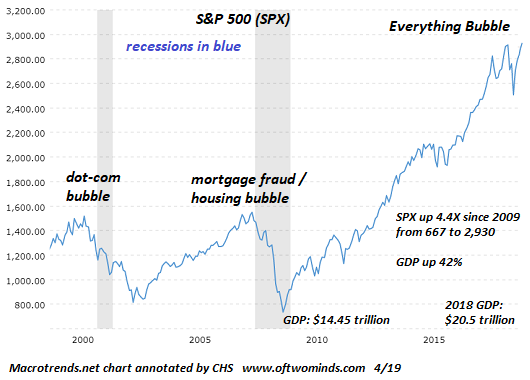

SPX Everything Bubble, 2000 - 2019 |

| The conventional idea of comfortable (as I understand it) appears to be an income which enables the retiree to enjoy leisurely vacations on cruise ships, own a boat and well-appointed RV for tooling around the countryside, and spend as much time golfing or boating as he/she might want.

FIRE retirees might opt for socially aware volunteer work or hiking trips in remote regions. Whatever the activities, the basic idea here is: retirement = no work = enough cash to do whatever I please. Needless to say, Social Security isn’t going to fund a comfortable retirement, unless the definition is watching TV with an box of kibble to snack on. Where do you put your expanding nestegg so it earns a positive yield? In the good old days, regular savings accounts earned 5.25% annually by federal law. Buying a house was not a way to get rich quick, it was more like a forced savings plan, as over time real estate earned about 1% above the core inflation rate. But all the safe ways of securing a return have been eradicated by the Federal Reserve. The Fed’s “fix” for economic stagnation was to financialize the U.S. economy, effectively eliminating low-risk returns and forcing everyone to become a speculator in high-risk financial casinos. As a result, the saver seeking a yield above zero is gambling that all the asset bubbles don’t all pop before he/she cashes out. If the bubbles keep inflating steadily for another decade, making assets ever-more overvalued and unaffordable, then maybe the saver can exit the asset bubbles with the desired nestegg. But what if the bubbles in stocks, bonds, real estate, etc. pop? What are the chances that monumental bubbles in stocks, bonds and real estate will continue inflating for another decade? Most gigantic asset bubbles pop after five years of expansion. The current bubbles are in Year Ten of their speculative expansion, and it seems highly unlikely that they will be the only bubbles in the history of humanity to never pop. If the current bubbles follow the pattern of all other speculative credit-driven bubbles, they will pop, without much warning and with devastating consequences for all those who believed the bubbles couldn’t possibly pop. Which leads to another strategy entirely: focus not on retiring comfortably, but on working comfortably. Line up work you enjoy that can be performed in old age. That’s a much safer bet than counting on the bubble-blowing machinery of the Fed to keep inflating speculative bubbles that magically never pop. Although nobody wants to talk about it, state and local government pensioners are dependent on bubbles never popping, too–not just asset bubbles like stocks but bubbles in the sales, income and property taxes that fund their pension plans. What happens when these monstrous speculative bubbles pop? Trillions in phantom wealth vanish, pension funds go broke, states, cities and counties are insolvent, and nesteggs invested in speculative assets dry up and blow away. |

|

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency

Tags: Featured,newsletter